3 Questions for the Second Half

July 20, 2018 By Sage Advisory

What follows the volatile market environment we saw in the first half of 2018?

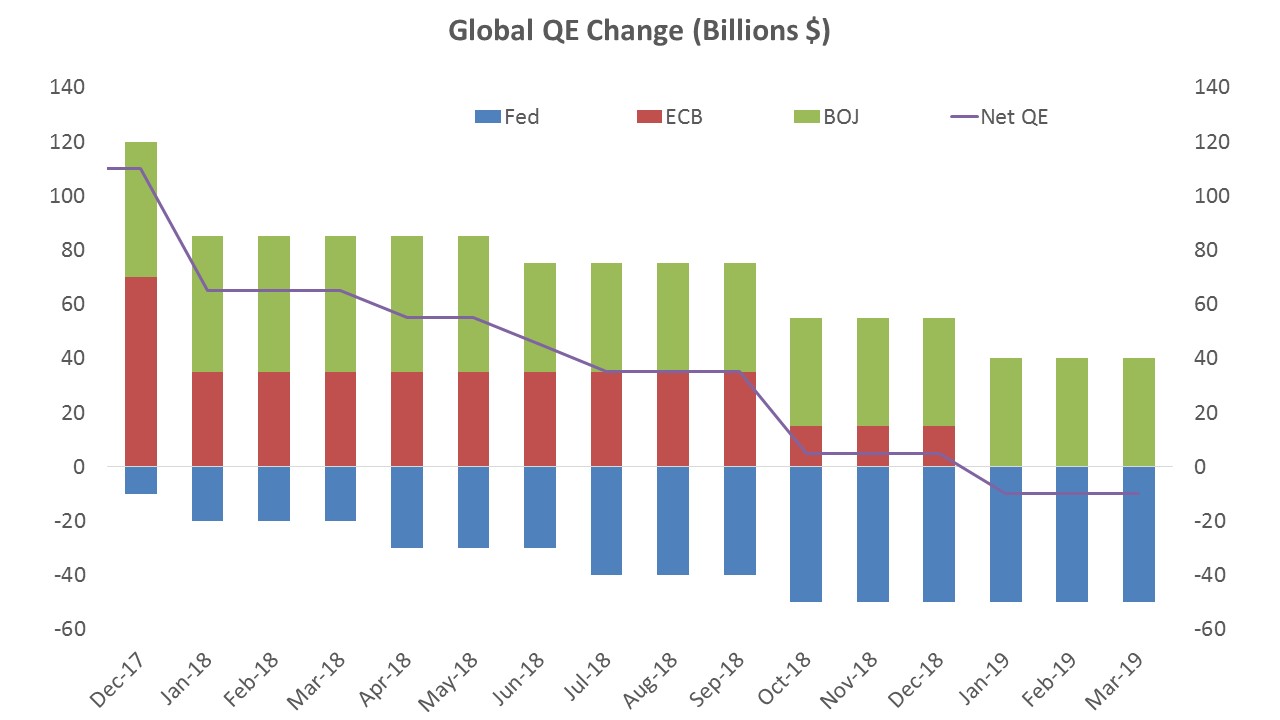

If the volatility during the first half of 2018 was caused by fears of reflation and higher rates negatively impacting equities, then the theme unfolding for the second half is looking like the opposite – a shock to growth due to trade issues or a slowdown abroad. In the first half, synchronous global growth gave way to U.S. growth leadership. After coming into the year with high expectations for private sector growth and corporate earnings, the U.S. economy has met or surpassed expectations while economies abroad have struggled to keep pace. European economic growth has not met the ECB’s expectations, and with inflation anchored in the region, the European Central Bank has responded by delaying any rate hikes until late 2019. Emerging market economies, while much stronger than they were in 2013, have shown vulnerability to tighter financial conditions caused by tighter Fed policy, rising short-term rates, and a stronger U.S. Dollar. These negative shocks have been exacerbated by political issues, such as those in Latin America, or trade issues in China. The big question in the second half will be the market’s reaction to continued shrinking of central bank balance sheets. By our estimation, aggregate QE purchases by the Fed, the European Central Bank, and the Bank of Japan will turn negative going into 2019. Will the volatility suppression dynamic of central bank purchases reverse along with the end of QE?

Source: Sage, Bloomberg

Is a trade war going to hinder growth?

As we’ve written in the past, a trade war caused by increasing tariffs raises prices for the private sector and acts as a tax on the economy, thereby lowering growth in the process. World trade activity has been decreasing since the global financial crisis; while this is not the first episode of restrictive trade policies in recent years, what makes the current episode significant is how it is occurring: between the world’s two largest economies on the most public stage — news headlines. While the tariffs don’t promote economic growth, they aren’t enough to turn the current economic expansion into a retraction. Our main concern are the indirect effects of tariffs – there could be a second order of effects in the form of negative “animal spirits” in the financial markets or an escalation that moves beyond trade.

Is it time to get defensive?

While we are in the late stages of the current economic expansion, we don’t yet think a recession is imminent. Real interest rates remain at historically low levels relative to economic growth, which we believe provides a solid foundation for economic activity to withstand any trade-driven shocks. However, we do think it’s important to remain diversified across stocks and high-quality fixed income. With the end of QE, the period of a low-volatility bull market is over. Higher-quality bonds should serve as shock absorbers in times of stress. Within fixed income, we favor mitigating risk by allocating to shorter-maturity corporate bonds (CSJ, FLOT), as well as agency MBS (MBB), as they provide a better risk-return profile when compared to longer-maturity spread sectors.

On the equity side, we see the U.S. economy continuing to lead in the second half, which should result in the continuation of U.S. equity outperformance versus international equities. Specifically, U.S. mid- and small-cap equities have done well, and we believe they will continue to do so. Cyclically-oriented segments of the market, such as tech (XLK), energy (XLE), and consumer discretionary (XLY), should continue to outperform. One segment to underweight is emerging markets, which continues to be plagued by political concerns, a strong dollar, and tightening global monetary policy.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.