All Hands on Deck – An Update on COVID-19, Its Effect on Markets, and Our Game Plan

February 28, 2020 By Sage Advisory

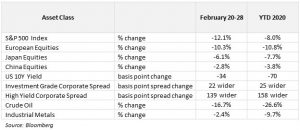

It’s been a long week for the markets. After a respite at the beginning of February, fears around the coronavirus (COVID-19) have devolved into a full-blown panic, resulting in the fastest equity selloff ever. Looking across markets reveals the extent of the turmoil:

A few observations from the last eight trading days:

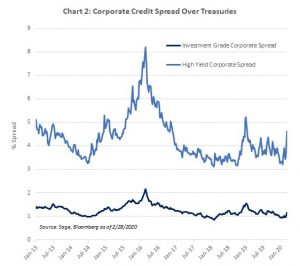

- U.S. risk assets are leading the down move. The S&P 500 fell into a corrective -10% drawdown in the shortest time period ever. In addition, investment grade corporate credit spreads, which were largely immune to the initial COVID-19 shock in January, widened by 23 basis points to 1.20% over Treasuries. High yield corporate spreads have widened by 112 bps to nearly 5% over Treasuries.

- Conversely, Chinese equities have outperformed handily during the recent drawdown. Whether it reflects improving conditions in China, or an under-owned region outperforming in a “sell-everything” market, de-risking remains to be seen.

- Treasury rates continue to make new all-time lows. As of this writing, the U.S. 10Y yield is hovering near 1.15% which is well through the low in yield established during the Brexit Referendum in 2016.

It’s all hands on deck for us at Sage. While we don’t know yet what medium to long-term effects the COVID-19 will have on markets, we do see some areas that could present an opportunity given the extreme fear in the market. Here’s our perspective on various asset classes and the game plan for investing in this environment.

Fixed Income: Interest Rates to Remain Low:

Treasury yields have retreated to make a new all-time low, reflecting COVID-19’s potential impact on the global economy. In January, market consensus treated the effects of the virus as having no more than a 1Q effect on GDP. As the virus continues to spread to more countries, the market has shifted to discounting a much deeper hit to the global economy.

The markets are expecting the Fed to act in response to the virus shock – the Fed Funds market is now anticipating nearly four rate cuts this year (Chart 1) after pricing in just one on February 20th. The Fed’s projection of its rate path, which hasn’t been updated since December, now looks far different than market pricing. Market participants will certainly pay close attention to future Fed communications.

Given the uncertainty in the market, continued flows into high quality fixed income, and potential policy easing, we expect yields to remain low, or even move lower from here. We are maintaining a longer duration across our fixed income strategies.

Credit spreads have widened in kind with the equity selloff, albeit its move isn’t as extreme when compared to recent history. The corporate bond markets are still adjusting to the risk to global growth from historically low spread levels (Chart 2). Conversely, at ultra-low Treasuries yields, corporate credit and other spread sectors now present an interesting yield advantage versus low Treasury yields. To that end, we are carrying a relatively low level of corporate credit risk across most strategies, leaving room to add to credit in the case that the narrative on COVID-19 changes for the better and/or take advantage of dislocations that occur during a panic sell-off.

Equities/Multi-Asset Strategies:

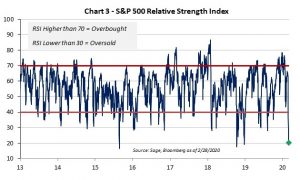

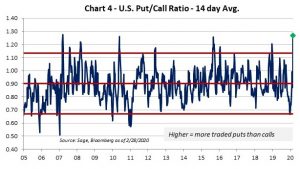

Ahead of the most recent selloff, we lowered equity exposure within the Multi-Asset Income strategies, and reduced beta in our equity allocations. Equity price action during the end of February reflected the public fear around the spread of the COVID-19. The S&P 500 rallied to an all-time high on February 20 then subsequently fell into a corrective 10% drawdown one week later – the fastest descent into a correction, ever. The magnitude of the down move was exacerbated by selling pressure from systematic strategies and retail investors. Two widely followed technical indicators – Relative Strength Index (Chart 3) and Put/Call Ratio (Chart 4) – are at extreme bearish levels which tells us that selling pressure should subside in the near term.

Going Forward: Heightened Market Surveillance & Identifying Value Across Asset Classes

So what now? While we think equity and credit selling pressure should subside in the near-term, uncertainty around the effect of the COVID-19 will remain, along with corresponding market volatility. However, a market environment driven by fear, speculation, and uncertainty could present opportunities to identify mispriced securities, sectors, or asset classes as more information comes to light. We approach this environment with patience and diligence. Within our fixed income portfolios, we remain slightly long duration and carry a relatively low level of credit risk. Within our multi-asset class strategies, we’ve recently lowered equity sensitivities, which allows us to be opportunistic in the case that conditions improve and/or attractive valuations present themselves.

We are closely monitoring the COVID-19 situation and will continue to update you on any changes in market conditions or our perspective.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.