Black Swans of the Same Feather – Sage Commentary on Recent Market Volatility

March 10, 2020 By Sage Advisory

The market moves in recent weeks have been nothing short of unprecedented. We seem to be experiencing multiple rare and unpredictable events simultaneously. The following is a recap of key events and our observations thus far.

A recap of last week through Monday, March 9:

- COVID-19 concerns have grown given its spread to an increasing number of countries. The disease has now reached more than half of the countries in the world, including the U.S. This has been a major concern, and markets have priced in a hit to economic growth both from private sector demand and more uniquely, supply-side shock, as supply-chain disruptions in Asia and now the U.S. will result in a further hit to global growth. In its most recent report, the OECD revised its 2020 global growth rate assumption down to 2.4% from an already low 3% given concerns around COVID-19. The rate could fall as low as 1.5%, according to the OECD’s outlook.

- A strong policy stimulus response was expected, and the Fed made the first move, with an emergency 50 bps rate cut on March 3. However, given that the current situation largely involves an unpredictable viral outbreak that is truly an external shock, lowering the cost of money did not have the same effect as in prior slowdowns since the 2008 crisis. In the coming weeks, the world’s major central banks and governments are expected to inject additional monetary and fiscal stimulus into the economy to combat any potential slowdown. The ECB is expected to ease policy further, either by cutting rates and/or making asset purchases on March 12, and the Fed is expected to follow suit with further rate cuts on March 18. On the fiscal side, affected countries could provide fiscal stimulus to their respective private sectors through the form of tax cuts or direct relief to affected industries – similar to what China has done over the past month for its domestic business sector.

- In addition to the COVID-19 shock, tensions between Russia and Saudi Arabia have escalated into an all-out oil price war. In response to a breakdown in OPEC/Russia talks last week, on Saturday, Saudi Arabia announced massive discounts to its official oil selling prices and indicated that it was increasing production above the typical 10 million barrels per day. The fear of an oil price war resulted in a 25% selloff in crude oil during yesterday’s trading session – the second worst day for WTI crude on record. The selloff sent shockwaves through global markets, as any commodity-linked asset class or sector priced in an additional hit to growth on top of slowing activity from COVID-19.

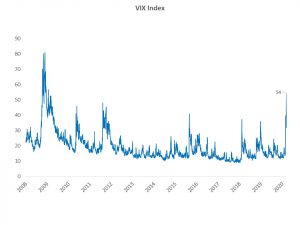

- These events occurred in the context of a market with extremely thin liquidity. Wider bid-ask spreads across all asset classes have amplified market volatility with several extreme +3% up and down days. Currently, the VIX index is trading at 55, the highest at any time since the 2007/2008 crisis.

Observations:

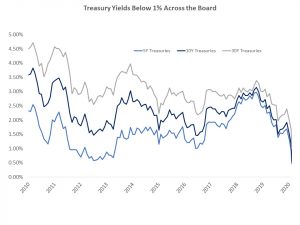

- The collapse of Treasury yields – Treasury yields have collapsed to all-time lows as investors continue to flock to safe havens. U.S. Treasury markets are not just pricing in further Fed action, they are pricing in a total “Japanification” of the U.S. economy with long-duration yields trading well below 1% at the start of this week.

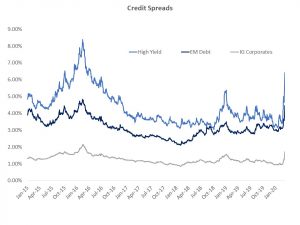

- Widening credit spreads – Credit spreads have widened past 4Q 2018 to near 2016 levels, with the speed of the move catching investors off guard. U.S. credit markets, which before March had been resilient against virus fears, have repriced to reflect a significant economic slowdown over the balance of 2020. Currently, the U.S. high yield sector offers an all-in yield at near 8%, which could prove to be an interesting opportunity if market volatility begins to settle down as a result of positive Covid-19 breakthroughs, government policy actions, and increased investor confidence.

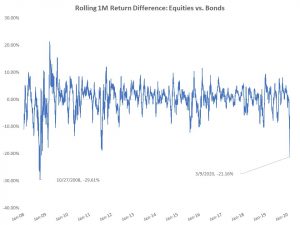

- Equity performance vs. bonds – The recent relative return of global equities versus bonds has no precedent outside of the financial crisis, since right after the collapse of Lehman Brothers and AIG. The chart below shows the 1-month relative return of the MSCI ACWI vs. the Bloomberg Global Aggregate Index, which stands at -21%.

The Market is Pricing in a Recession – The Question is: How Deep?

At Sage, we’ve maintained a relatively low level of risk across most of our strategies and remain opportunistic. A full-scale risk-off positioning often provides an opportunity in dislocated areas of the market, but we believe it’s too early to “buy the dip” here. Markets are in “no-man’s land” in some respect, driven by a tremendous amount of uncertainty and fear.

The scenario in which COVID-19 disruption devolves into a global recession is now reflected in market pricing. The question now is how deep is it expected to be? Policymakers will respond in the coming days and weeks with monetary and fiscal stimulus, but the nature of those policies will have to somehow address the threat to the economy that is now fourfold: COVID-19 demand/supply chain shock, an oil price war, credit stress, and a lack of trading liquidity. We await that response, along with any new details, and will continue to keep you updated as this unprecedented situation develops.

Going Forward: Heightened Market Surveillance & Identifying Value Across Asset Classes

- The Sage investment team is deeply experienced and has worked together through multiple cycles, including several periods of economic and market stress. During uncertain times, the structure and experience of our team has proven to be an advantage for our clients.

- We approach this environment with patience and diligence. Within our fixed income portfolios, our duration positioning has become more defensive in anticipation of more normalized levels of interest rates. Furthermore, a normalization of market risk has the potential to steepen the yield curve in concert with further rate cuts from the Fed. Within credit, we have maintained a relatively conservative posture, which has helped to mitigate downside risk during this correction. We continue to be selective in our credit exposure, avoiding issuers that we deem to be vulnerable to near-term downgrade pressures. In early February, we lowered equity sensitivities within our multi-asset class strategies, which allows us to be opportunistic in the case that conditions improve and/or attractive valuations present themselves.

- For more information about specific Sage strategies, please reach out to your client service team at 512-327-5530.

* Source on all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.