Facebook’s Fall: Why Considering ESG is Important in the Investing Process

August 3, 2018 By Sage Advisory

Long before Facebook revealed that 87 million users’ data may have been breached (April 2018), and even before it was revealed that Ted Cruz’s presidential campaign retrieved Facebook users’ data without their permission (December 2015), Facebook had a Sustainalytics Controversy Score of 3 (on a 1-5 scale) because of data privacy issues. While Facebook’s stock has had some jolts and recoveries, which is typical in the days surrounding company “incidents,” it was, until very recently, up by triple digits since mid-2014. Until the stock fell 19% last week, it might have been difficult to make a case against investing in Facebook given the stock’s ascent. To be sure, those who made bets against Facebook have seen a pay-off.

Facebook’s Stock Price

Source: Yahoo Finance

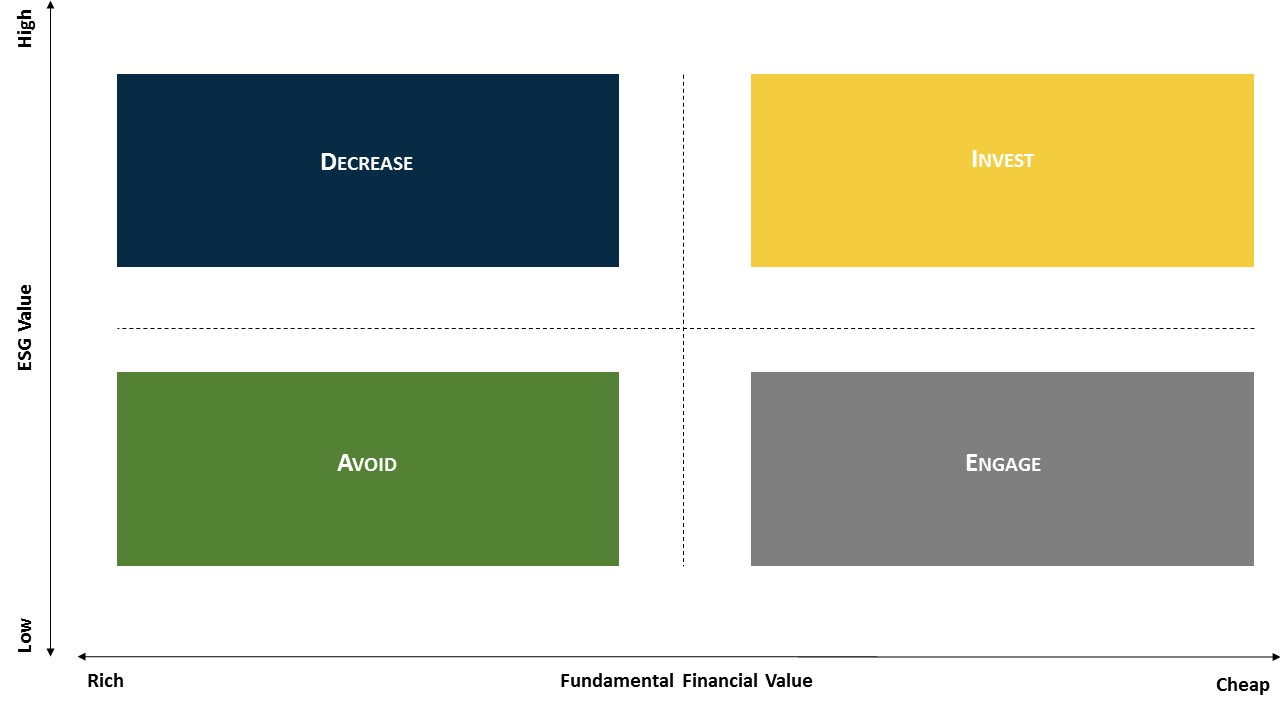

For as long as it’s been controversial, the company has been screened out of Sage’s Environmental, Social, and Governance (ESG) security selection process because of its controversy score alone; we don’t invest in companies with a controversy score higher than 3 (Facebook’s current Controversy Score is 4). The consideration of Controversy Scores is just one factor Sage considers when analyzing securities through our ESG Framework. We also analyze each E, S, and G factor, as well as impact and impact intensity. We believe companies that have high standards for ESG – in Facebook’s case, there’s a lack of Social integrity – build sustainable business models and create sound investment opportunities. That being said, Facebook could be an opportunity worth looking at if it’s valuation becomes attractive, and it has a positive controversy outlook. As of now, it has neither.

Sage ESG Investment Approach

Source: Sage Advisory

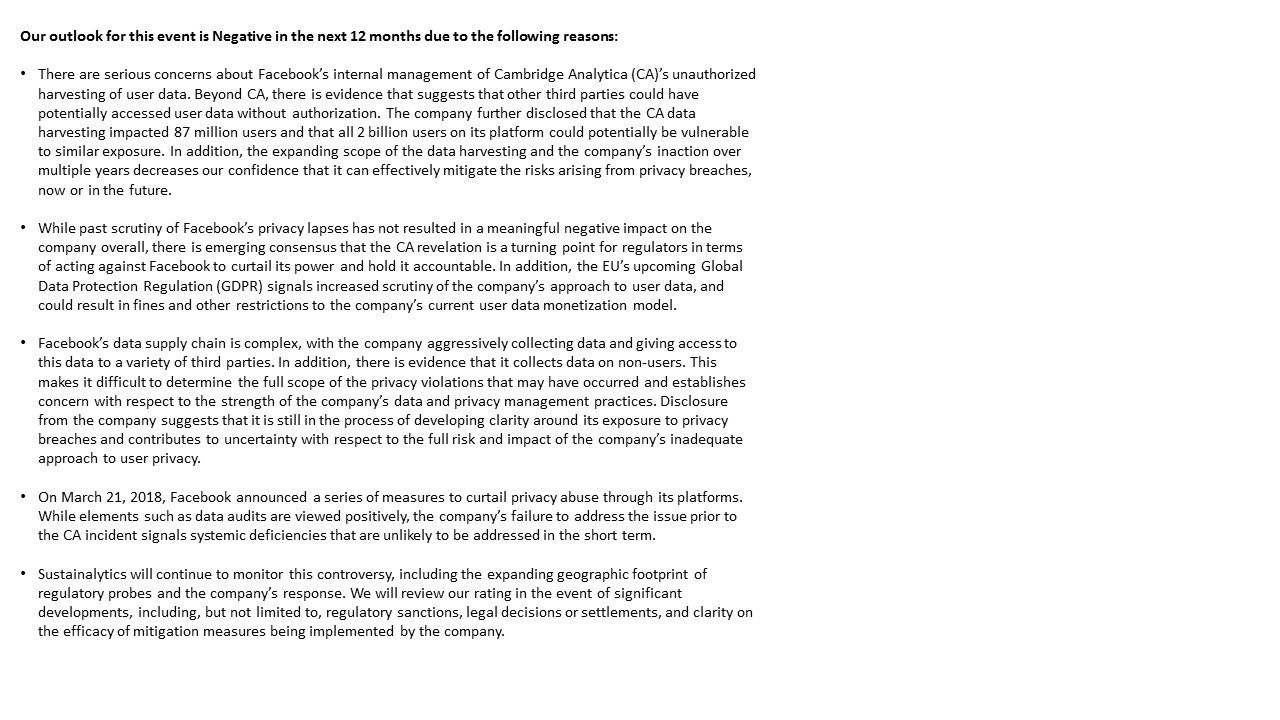

Facebook Controversy Outlook

Source: Sustainalytics

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.