Notes from the Desk: Municipal Bonds — The Turtle That Keeps On Winning!

January 8, 2019 By Sage Advisory

Both classic and modern literature have countless stories of seemingly outmatched opponents finding a way to persevere and even prevail, despite the odds. One of our favorite examples, especially since we are talking about municipal bonds, is Aesop’s Fable “The Tortoise and the Hare” in which the slow and steady Turtle unexpectedly wins a race against the seemingly unbeatable Hare. Despite both literary and real-life examples of these events occurring time and time again, social influences, behavioral factors, and cognitive distortions cause many investors to keep betting, or in this case, investing in the proverbial “Hare.” Although adjectives like steady, stodgy, and plain-vanilla do not elicit a rousing response, municipal bonds continue to provide investors with positive returns, low volatility, and steady tax-free income.

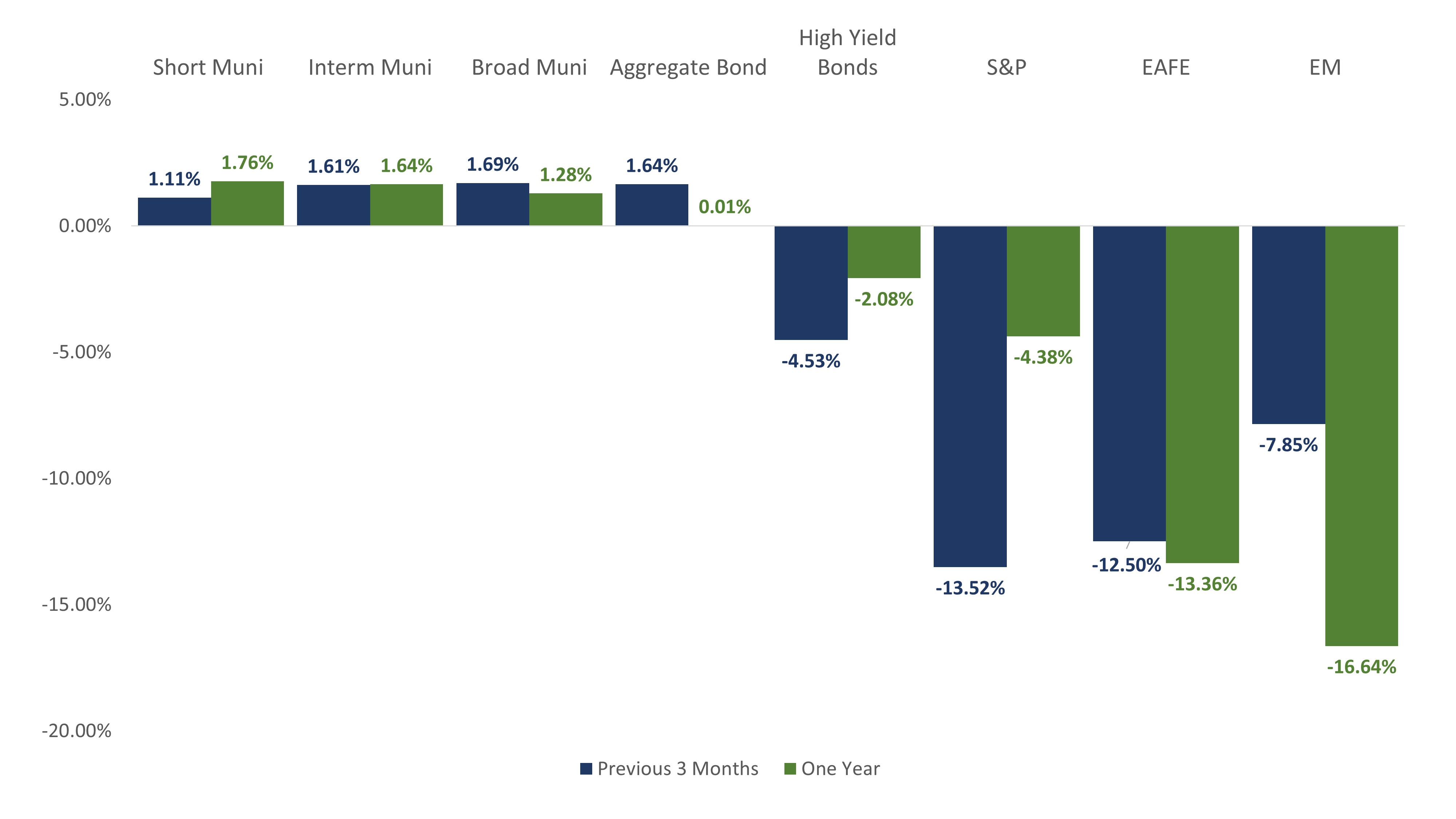

Once again in 2018, the municipal market showed its merit and provided investors with positive returns, low volatility, and ample liquidity during a time when it was needed most. Despite a quarter or two of low or negative returns earlier in the year, municipal bonds finished 2018 in positive territory as most other core asset classes experienced significant challenges, as shown below:

Market Environment

Source: BarclaysLive and Bloomberg as of 12/31/18

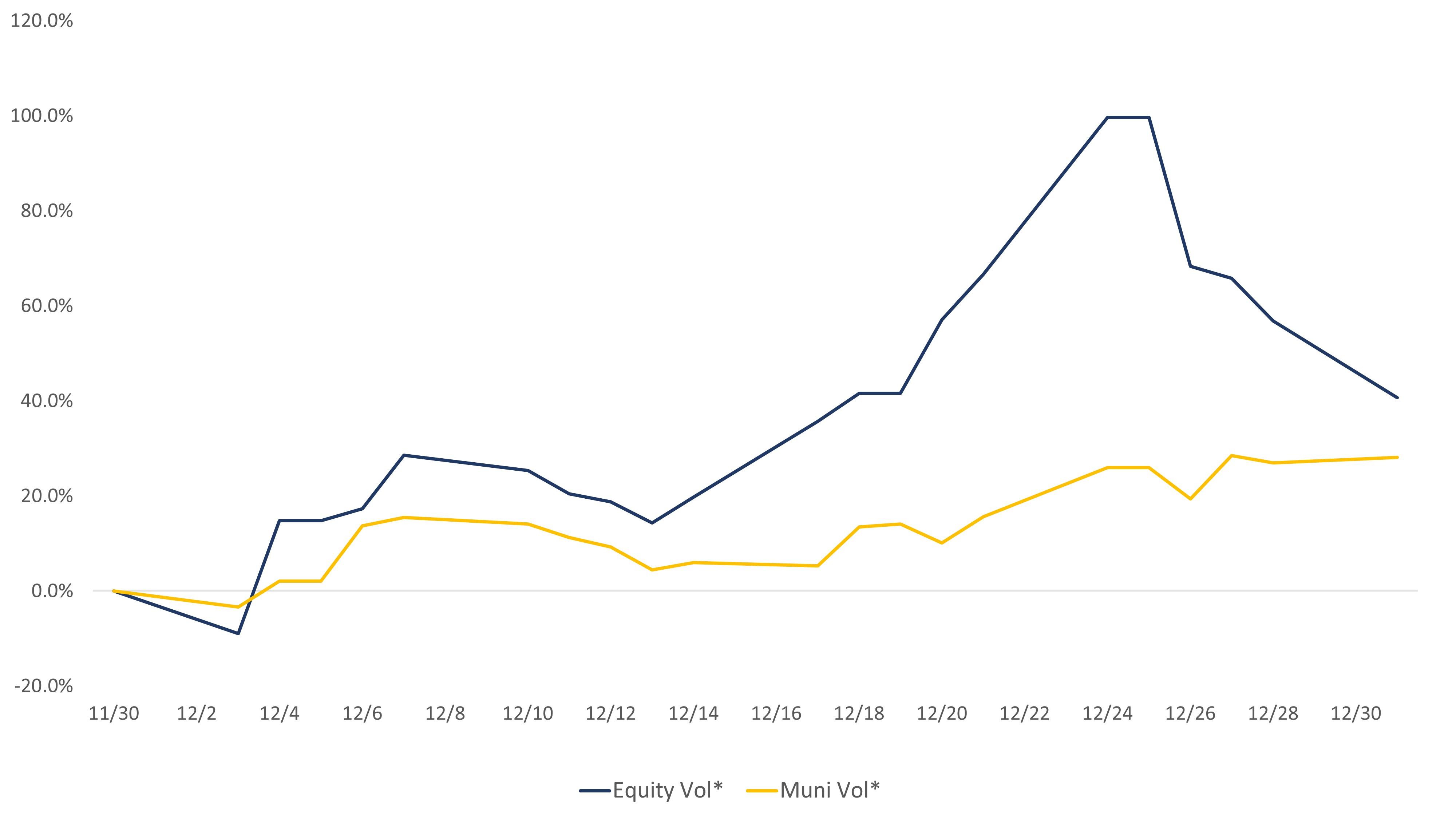

Despite the recent tumult of the global equity and corporate credit markets, municipal bond volatility was much more muted in comparison to the U.S. equity market, further validating municipal bonds’ role as a negatively correlated asset class that financial advisors and clients rely upon during times of market turmoil.

Market Volatility Comparsion (% Chg from 11/30/18 to 12/31/2018)

* VIX Index for Equity Vol, Move Index for Muni Vol, adjusted with daily M/T ratio

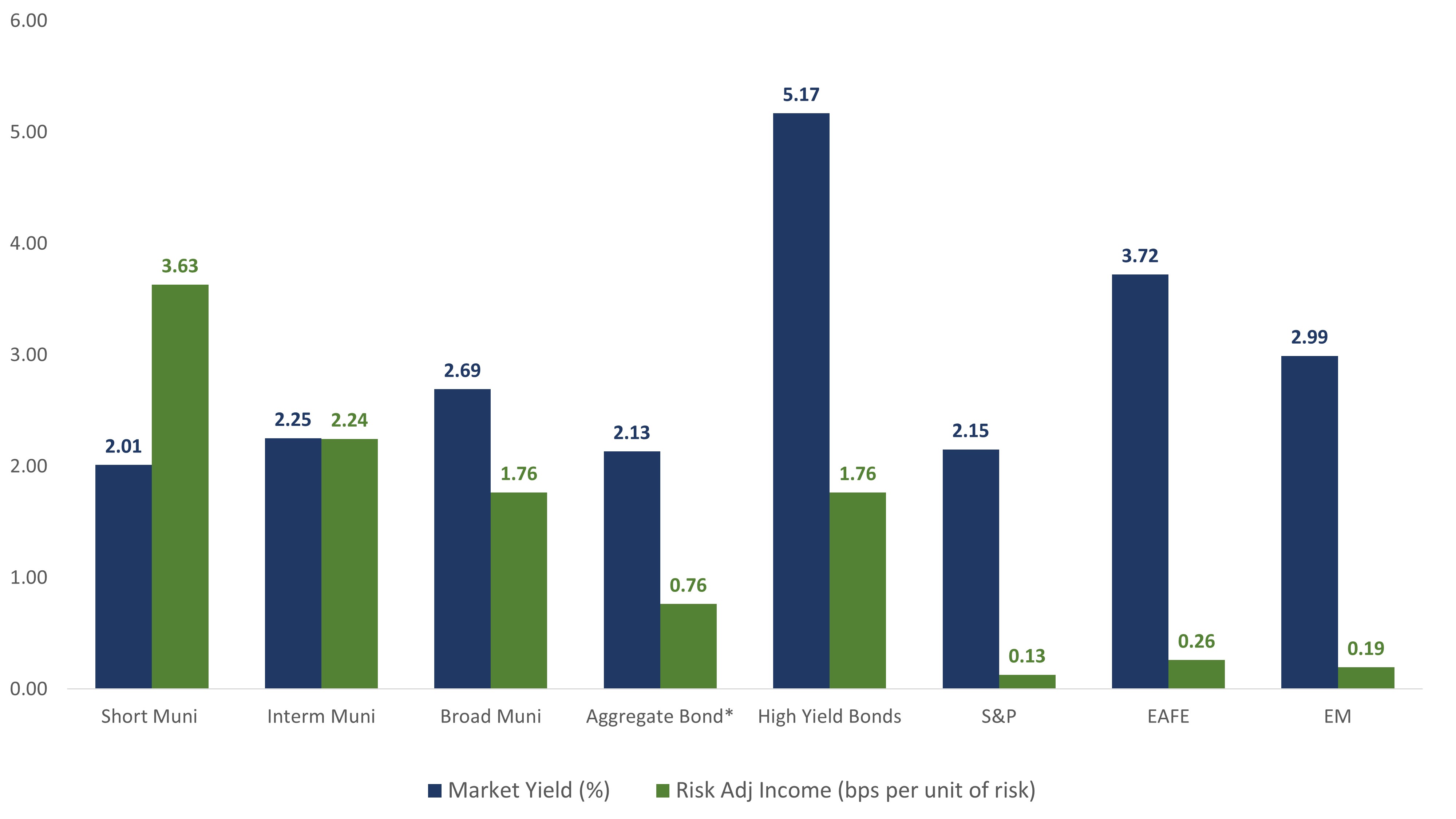

Furthermore, municipal bonds not only provide attractive income on a tax-free basis, but they also accomplish this objective with significantly less risk. An often-overlooked measure of income generation efficiency is risk-adjusted income. Relative to other income-producing asset classes, municipal bonds generate higher levels of income per unit of risk, particularly versus equities, which display pre-tax yields. This is illustrated in the chart below:

Market Yield and Risk-Adjusted Income

Source: BarclaysLive and Bloomberg as of 12/31/18, Agg & HY yield tax-adjusted at 35%

Despite the inherent benefits of municipal bonds, naysayers will continue to belittle the fixed income Tortoise and praise the equity Hare. For 2019, Sage is betting on the Tortoise.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.