Trust Accounts Benefit from Tax-Exempt Income

April 23, 2019 By Sage Advisory

by Jeffrey Timlin

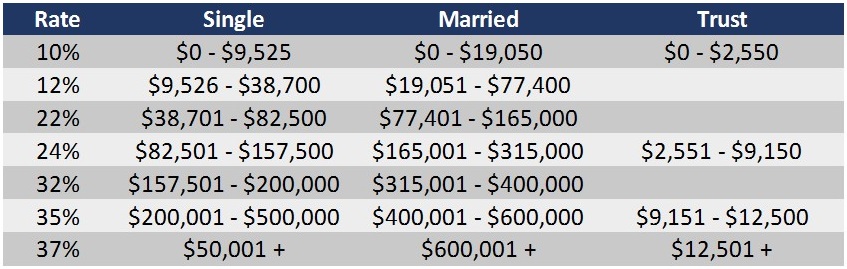

Unlike the graduated federal income tax brackets that max out at 37% with taxable income at $500k or more, trust accounts benefit from owning municipal bonds at a significantly lower tax bracket. As the political and economic environment becomes increasingly uncertain, many high-net-worth clients are turning to trusts to protect their assets as well as provide a tax-efficient way to transfer assets to family members. In 2012, the American Taxpayer Relief Act (ATRA) added new net investment income tax (NIIT) brackets for certain trusts as shown in the tax table below.

Source: IRS.gov

For clients in non-grantor trusts, the benefit of owning municipal bonds is realized almost immediately since the maximum income bracket tops out at only $12,500. As an added benefit, by utilizing tax-exempt municipal bonds to produce income, the trust’s beneficiary could also avoid paying the 3.8% investment income tax associated with the Affordable Care Act of 2010 for a maximum tax savings of 40.8%. Depending on the state of residence, an allocation to in-state municipal bonds may further enhance the tax-efficiency of the income generated within the trust.

Since the inception of municipal bonds, high-net-worth individuals have successfully utilized the benefits of tax-exempt income. Along with tax-free income, investors have benefited from a high degree of principle protection and low levels of price volatility. To ensure the proper use of municipal bonds within a trust, please review the trust agreement with your financial advisor, tax accountant, and trust attorney. Once approved, allocating to municipal bonds could significantly reduce your annual tax liability.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.