Market Outlook

- The fourth quarter was not an easy one for markets but ended up being a productive one with all major asset classes finishing in positive territory (S&P 500, +2.7% and Aggregate Bond Index, +1.1%). Risk appetites faced multiple setbacks during the quarter, including a record-breaking government shutdown, weak job data, and rising AI valuation concerns. Ultimately, markets recovered and investors gained policy clarity on a few fronts, including Fed cuts, and economic data showed resilience with a robust 4Q GDP number. For 2025, the S&P 500 gained nearly 18% but lagged even stronger global markets with the ACWI ex-US index returning 32% in 2025, its best year since 2009. Bond markets had strong returns also with the Aggregate Bond Index gaining 7.3%, driven by yield carry and Fed easing. Three Fed cuts in the second half translated into lower yields across the curve and curve steepening (2yr yields, -77bps and 10yr, -37bps).

- The setup for fixed income in 2026 appears positive and similar to 2025 with decent yield carry and expected Fed cuts – just maybe a little less of both. Yields are 50-70 bps lower for most core fixed income indices, but they are still attractive at above 4% and will generate meaningful carry. Current Fed pricing implies three cuts, which is where we landed in 2025. Our view on rates is that three currently looks aggressive given growth and inflation momentum, but two is likely. And the Fed tone may get a dovish boost into mid-year on the FOMC makeover, with a new chair. This suggests fixed income investors stay positioned for lower rates overall but more neutral early in the year. Midterm election years often see rates rise in the first half before declining after mid‑year. At the same time, the economy has remained resilient, with 4.3% GDP growth in Q3 and Q4 tracking above consensus expectations.

- Macro drivers remain supportive for global equities heading into 2026, with strong earnings expectations and a favorable balance between policy and growth. Added to this is receding trade uncertainties and improving outlooks abroad (China growth, eurozone fiscal spending). US market breath also improved with value and small caps matching growth returns in the second half. That said, valuations and concentration risk are still elevated and warrant caution. Returns are likely to come from earnings growth rather than multiple expansion in 2026, making tactical shifts and a focus on diversification and valuation opportunities essential. Positioning into 2026 across multi-asset strategies includes an overweight to equities and a full equity beta vs benchmarks to capture upside related to medium-term tailwinds. Within equities, we balance our risk position with lower average valuation multiples than the broad market and an allocation to small caps to increase diversification and reduce concentration risk.

Equities vs. Fixed Income

We carry a small overweight in equities vs. fixed income. Given our base case that the US will avoid a recession and benefit from supportive monetary and fiscal policy into 2026, we see relative upside potential in equities compared to bonds.

| Equity | View | Reasoning |

|---|---|---|

| US Equities | Neutral | We hold a neutral weight in US equities relative to international markets given economic resilience and a supportive fiscal and monetary policy backdrop. Valuations are higher than many other regions, and earnings and economic momentum are less dominant domestically, so we shifted toward neutral from an overweight in 4Q. |

| Developed International | Positive | Despite international market outperformance in 2025, the valuation gap remains attractive vs. the US. With improving economic outlooks in the EU and cooling AI enthusiasm, there is increased potential for continued strong relative performance. As such, we increased our overall developed market exposure going into 2026. |

| Emerging Markets | Neutral | We maintain a neutral allocation to EM as valuations are attractive and there is growth upside in India and parts of Asia and LATAM. This is countered by structural weakness in China and elevated macro and geopolitical risks globally. |

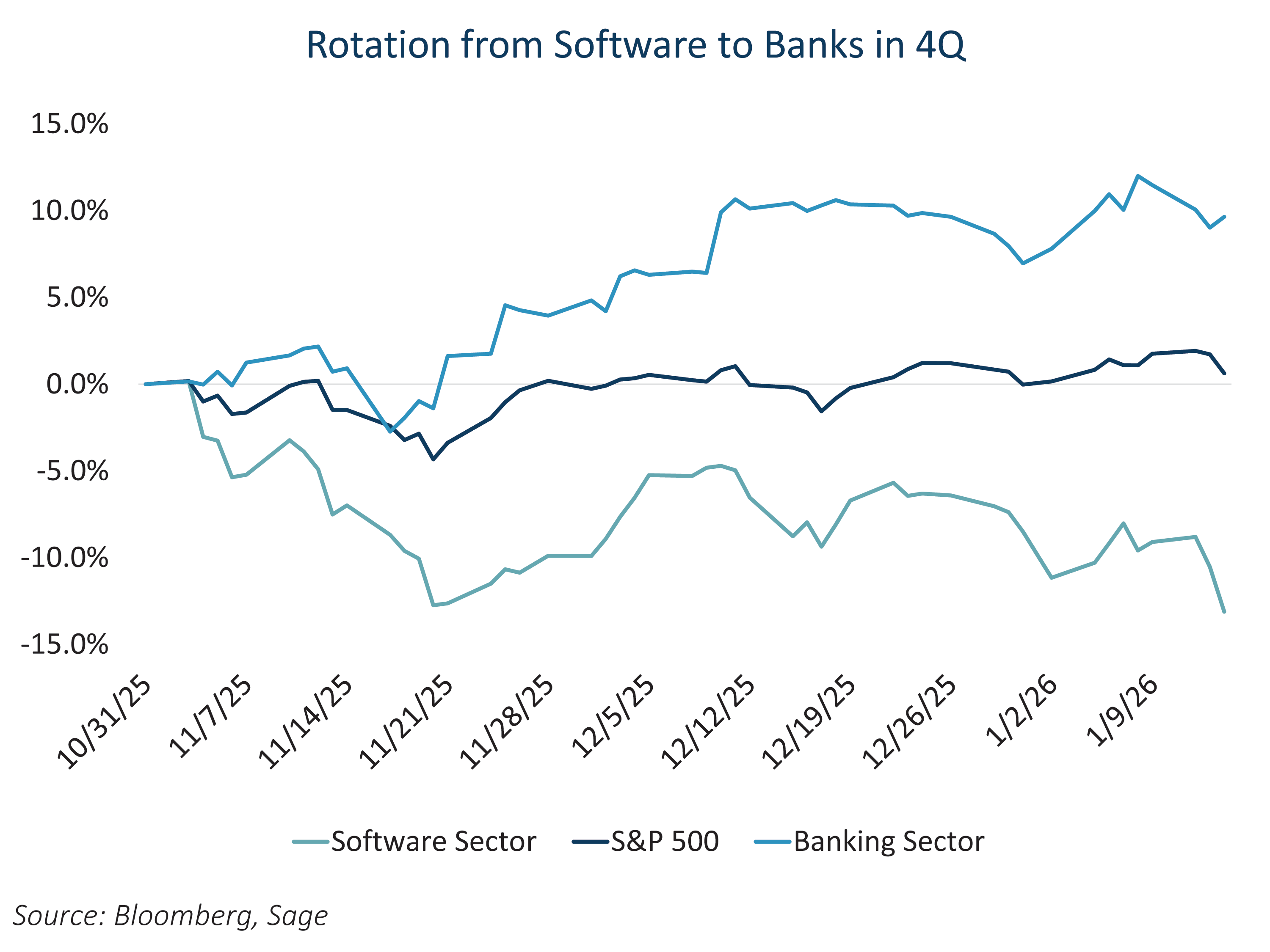

| Style/Sector/Factor | Quality | We enter 2026 with a quality bias, and an overweight to banking, retail, and healthcare sectors. Key changes in 4Q include exiting the software sector based on stretched valuations and positioning ahead of mid-November volatility. At the same time, we added direct exposure to banks and retail, as well as to our small-cap overweight. |

| Fixed Income | View | Reasoning |

|---|---|---|

| US Treasuries | Underweight | We are underweight Treasuries overall but biased toward longer-duration exposure. This is balanced with a credit allocation biased toward the front-end, to tamp down overall spread volatility. This positioning also allows us to keep modestly longer-than-benchmark duration at the portfolio level to balance our non-core risk and increased securitized exposure. |

| Investment Grade Credit | Market Weight | Market weight-type exposure still makes sense in IG credit given strong fundamentals and demand for yield but full valuations. We continue to have a tilt toward short-dated credit to enhance quality and liquidity, and we continue to diversify our overall spread risk with increased MBS exposure. |

| Securitized | Positive | We continue to like the agency mortgage sector from both a relative value and macroeconomic standpoint. Mortgages offer attractive yields to Treasuries and IG credit without the credit risk and should benefit from lower rate volatility. We have increasingly skewed exposure toward actively managed ETFs as issuer and structure selection are an important excess return driver within securitized markets. |

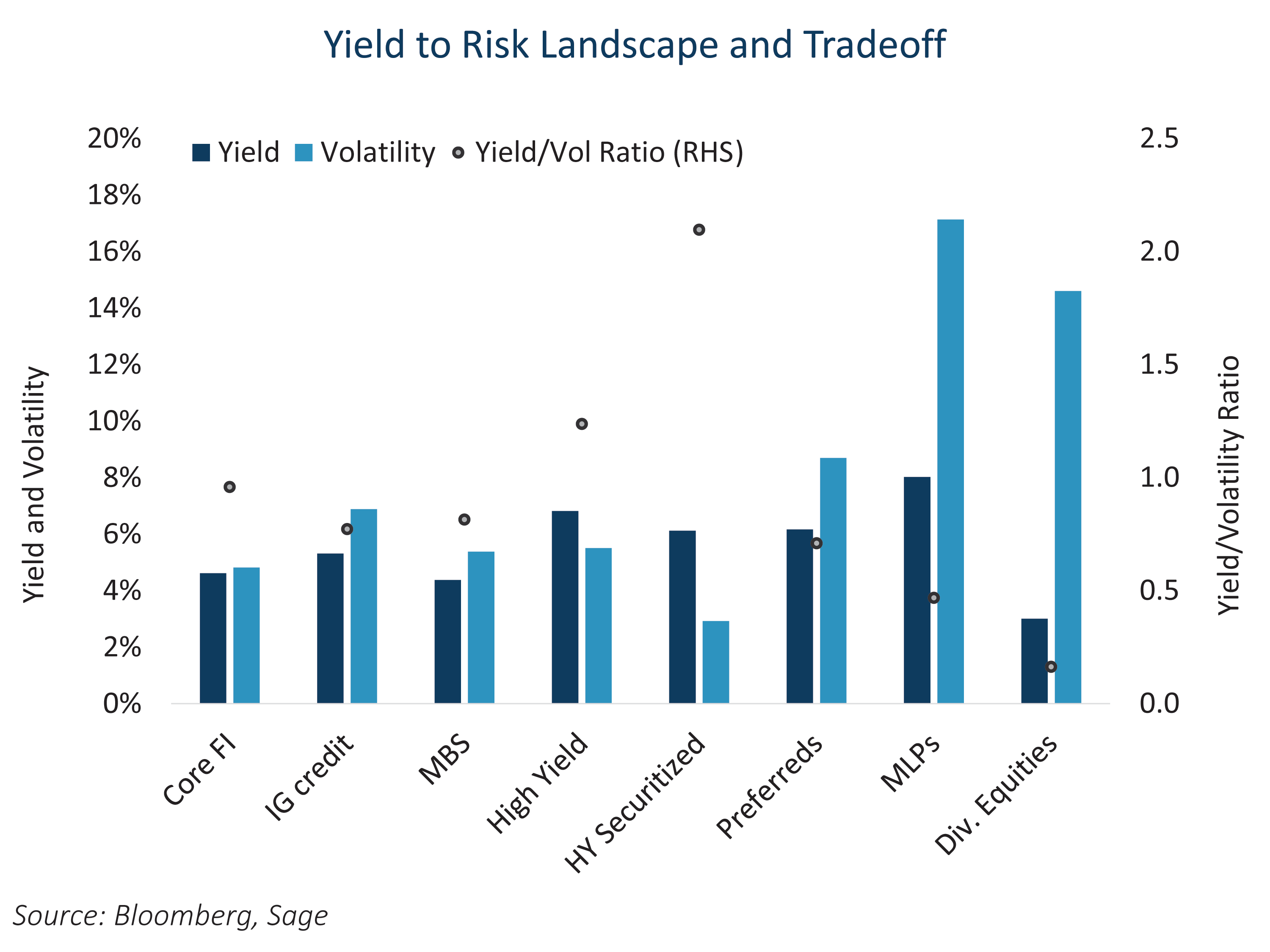

| Non-Core Fixed Income | Moderate | We believe a moderate allocation to non-core assets is appropriate to diversify sources of yield and return. Given tight US credit spreads and an easing Fed, we have lowered high yield and loan allocations in favor of increased preferred stock and high-income securitized exposure. |

Illustration of Themes – Things That Will Matter in 2026

Managing Income to Risk Will Be More Important

Income generation will be a key driver of returns in 2026, but it requires careful management given historically tight spreads, thinner liquidity, and the potential for policy‑ or geopolitical‑driven rate volatility. With fixed income offering higher absolute yields, relying on equity‑oriented income for extra carry is no longer compelling. A balanced multi‑asset approach that diversifies income sources offers a more effective mix of yield and volatility control.

Valuations Will Matter More

Equity valuations like credit spreads begin the year at historically expensive and unforgiving levels. Investors began to question valuations in certain sectors in the back half of 2025, and we believe this will continue in 2026. Staying invested in equities still makes sense given the medium‑term upside, but allocations should emphasize stability and be more mindful of stretched valuations. Going into 4Q, for example, we trimmed software, as valuations became more extreme, and added to banks, where valuations were far less demanding and earnings stability remained high, in our view.