There’s a new twist developing between President Donald Trump and Federal Reserve Chair Jerome Powell. What began as a difference in economic philosophy has evolved into a full-blown policy tug-of-war, complete with social media jabs, press conference poker faces, and enough market speculation to move yields.

The Core of the Conflict

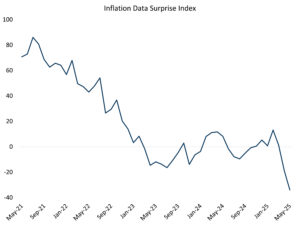

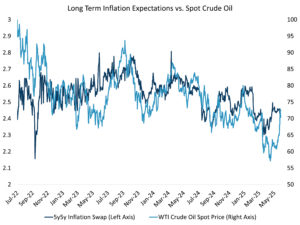

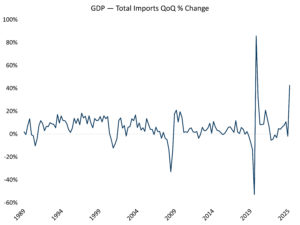

President Trump has been vocal—especially on social media—about his dissatisfaction with the Fed’s current monetary policy stance. Following multiple rate cuts last fall, Powell has since adopted a more cautious tone, citing concerns over tariff-driven inflation and maintaining that the current policy rate is “mildly restrictive.” Trump, on the other hand, is pushing for further rate cuts to stimulate economic growth and reduce the federal government’s ballooning interest expense.

From a bond investor’s standpoint, this divergence is more than political theater—it’s a signal of potential volatility in rate expectations and market pricing.

The Trump Card: A New Fed Chair?

While Powell holds significant sway over the FOMC, his term ends in May 2026. Recent reports suggest that President Trump is considering announcing his pick for the next Fed Chair as early as this summer or fall—well ahead of the traditional transition timeline. This move, while unconventional, could be strategic.

An early announcement would allow the chair-in-waiting to shape market expectations, potentially nudging the Fed toward a more dovish stance even before Powell’s term concludes. For bond investors, this introduces a new variable: the possibility of a “shadow pivot” in policy direction, driven not by data but by political signaling.

Market Reaction: Reading the SOFR Tea Leaves

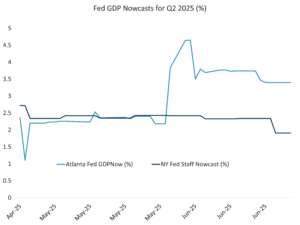

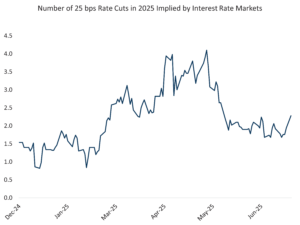

Despite Powell’s reaffirmation of a “wait and see” approach at the June FOMC meeting and in recent congressional testimony, the market appears to be pricing in a different outcome. The yield on March 2026 SOFR futures has fallen over the past few days, suggesting that investors are anticipating additional rate cuts in the coming quarters.

This divergence between Fed guidance and market pricing is a classic setup for volatility. If Powell holds firm and inflation remains sticky, yields could snap back upward. However, if political pressure or economic data forces the Fed’s hand, we could see a rally in the front end of the curve.

Strategic Implications for Bond Investors

The tension between President Trump and Chair Powell is more than a political spat—it’s a fundamental tug-of-war over the direction of U.S. monetary policy. Navigating this landscape will require vigilance, flexibility, and a keen eye on both Washington and the Fed’s next move.

In this environment, bond investors should consider the following:

- Duration Management: With uncertainty around the Fed’s path, maintaining a balanced duration profile is key. Overcommitting to either short or long duration could expose portfolios to unnecessary risk.

- Inflation Hedging: Tariff-driven inflation remains a wildcard. TIPS and other inflation-protected instruments may offer valuable diversification.

- Fed Communication Monitoring: Pay close attention to speeches, minutes, and any signals from potential Fed Chair nominees. These could offer early clues about future policy shifts.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.