The August PCE inflation report confirmed that price pressures remain stuck in a holding pattern. Headline PCE rose 0.26% month-over-month and 2.74% year-over-year, while core PCE increased 0.23% MoM and held steady at 2.91% YoY. Inflation is not accelerating, but it is not falling quickly enough to reassure the Fed that the path back to 2% is secure.

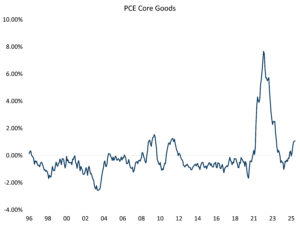

The impact of tariffs on inflation remains modest. The current pace of price growth is similar to July, holding near the upper end of its historical range (excluding the COVID period). Within the PCE basket, goods excluding food and energy are rising at 1% year-over-year, which means that tariffs are having an effect, but firms seem to still be relying on inventories and absorbing cost pressures to maintain sales.

Source: Bureau of Economic Analysis, Sage

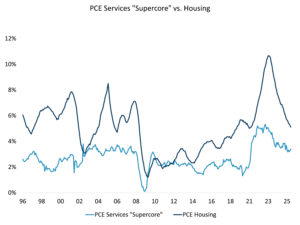

Meanwhile, housing and core services continue to be the largest contributors to prices, and both continue to show a clear downtrend, which should help keep overall inflation subdued. Consumer activity remains resilient, with spending up 0.6% in August, surpassing consensus expectations.

Source: Bureau of Economic Analysis, Sage

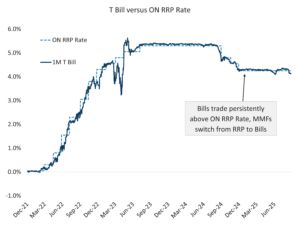

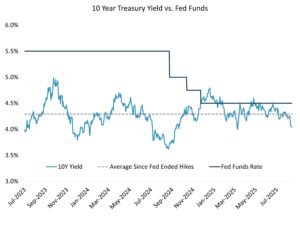

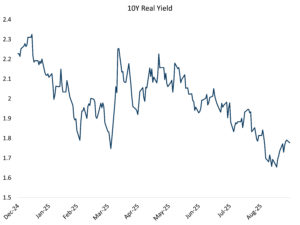

Last week Fed officials pushed back on the notion of imminent rate cuts in a barrage of speeches. Fed Chair Powell described policy as “modestly restrictive” and noted that tariffs have pushed some goods prices higher, but he also stressed that the pass-through remains small. He emphasized there is “no risk-free path” forward, a phrase that highlights the Fed’s balancing act. Cleveland Fed President Beth Hammack argued caution is still warranted given that inflation is above target, while Chicago’s Austan Goolsbee suggested there is room to cut if disinflation resumes, though not before the data confirm it. Richmond Fed President Tom Barkin emphasized the dilemma facing the FOMC, while Atlanta’s Raphael Bostic stated outright that he was hesitant to support a rate cut in October.

Source: Bloomberg, Sage

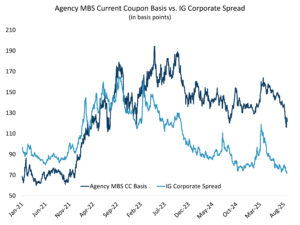

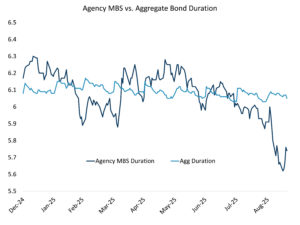

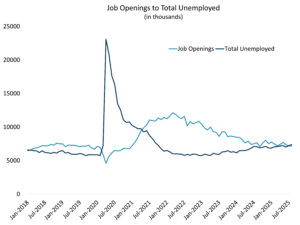

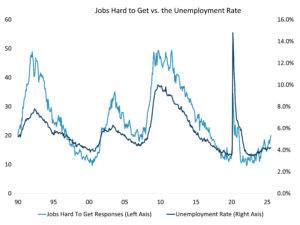

Real yields jumped 20 bps after the FOMC meeting, injecting some uncertainty into the Fed’s path. Still, the broader trend points to lower rates. The next key data arrives this week with the upcoming labor market reports. An upside surprise to employment and wages would reinforce the Fed’s two-sided mandate risk, while weaker data could boost confidence that inflation will continue to ease. Job openings are likely to show declines in both demand and supply – a historically unusual dynamic. Additionally, new downside risk has emerged: a potential government shutdown. While past shutdowns have been temporary, they still hurt the real economy and would delay the release of labor data, adding uncertainty to the outlook.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.