Following the tariff disruptions in April, improving financial conditions have supported asset markets and spurred corporate interest in public debt financing. Investment grade corporate bond issuance reached $1.27 trillion through September — marking the highest volume since the post-pandemic surge in 2020.

An increase in bond supply would typically pressure corporate bond markets, as investors demand higher spreads and lower prices to absorb the new debt. Yet, since April, corporate spreads have tightened to levels not seen since the mid-1990s.

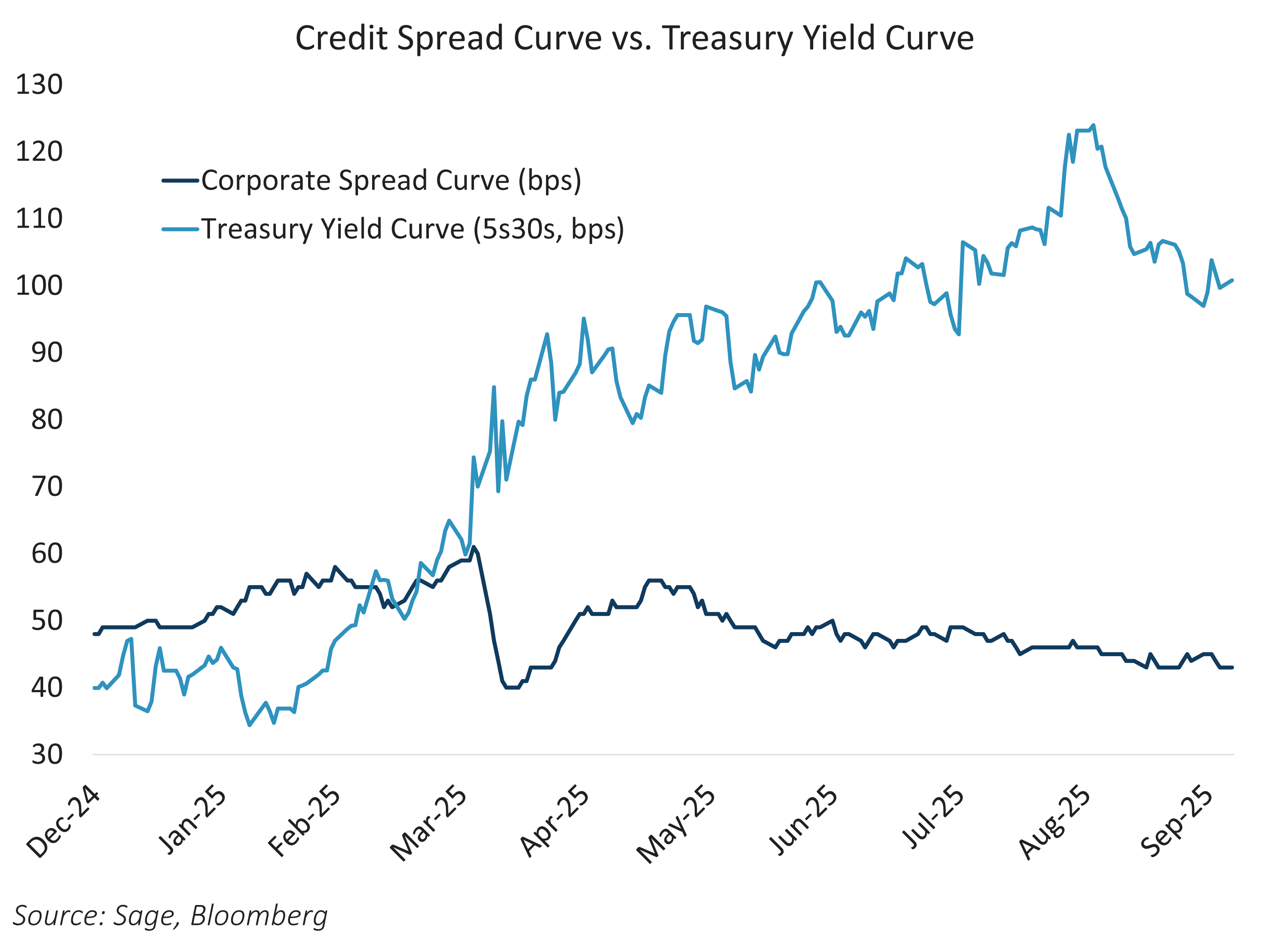

There’s a key nuance to the rise in bond supply: corporations are favoring shorter-maturity debt to benefit from lower interest rates at the front end of the yield curve and preserve flexibility to refinance if long-term rates decline. As a result, most investment grade issuance has maturities of 10 years or less, leading to a scarcity of longer-dated bonds. This trend is reflected in the spread curve, which has flattened significantly — even as the yield curve has steepened — reaching its lowest point of the year outside of the Liberation Day shock.

Although this year’s corporate bond issuance is the largest since 2020 in dollar terms, the overall spread duration is lower due to the shorter maturities of the new debt. This has created a mixed impact on the corporate bond market, with effects varying by maturity segment. As long as issuance remains concentrated in short and intermediate maturities, investors may continue to overlook elevated supply, focusing instead on supportive monetary policy and a resilient economy as the key drivers of spread performance.