Investor concern has been growing over the recent shift to debt financing for AI infrastructure build-out. In recent weeks, the investment grade (IG) market has seen a wave of issuance from hyperscalers as rising capital expenditures begin to influence credit markets. Year-to-date, hyperscaler supply has reached $121 billion, with the majority issued since September. This trend is expected to persist as the race to build AI infrastructure accelerates, creating ample opportunities for bond investors to gain exposure to some of the world’s most valuable companies — while technology continues to expand its share of the IG index.

Capital expenditures for hyperscalers are projected to climb to $600 billion by 2027, up from over $200 billion in 2024 and just under $400 billion in 2025, as estimates have been revised higher in recent quarters. While the scale of this spending cycle is significant in nominal terms, it is driven by companies that generate substantial free cash flow. Until early September, hyperscalers largely self-funded growth out of cash flow, with net issuance averaging only $28 billion annually over the past five years.

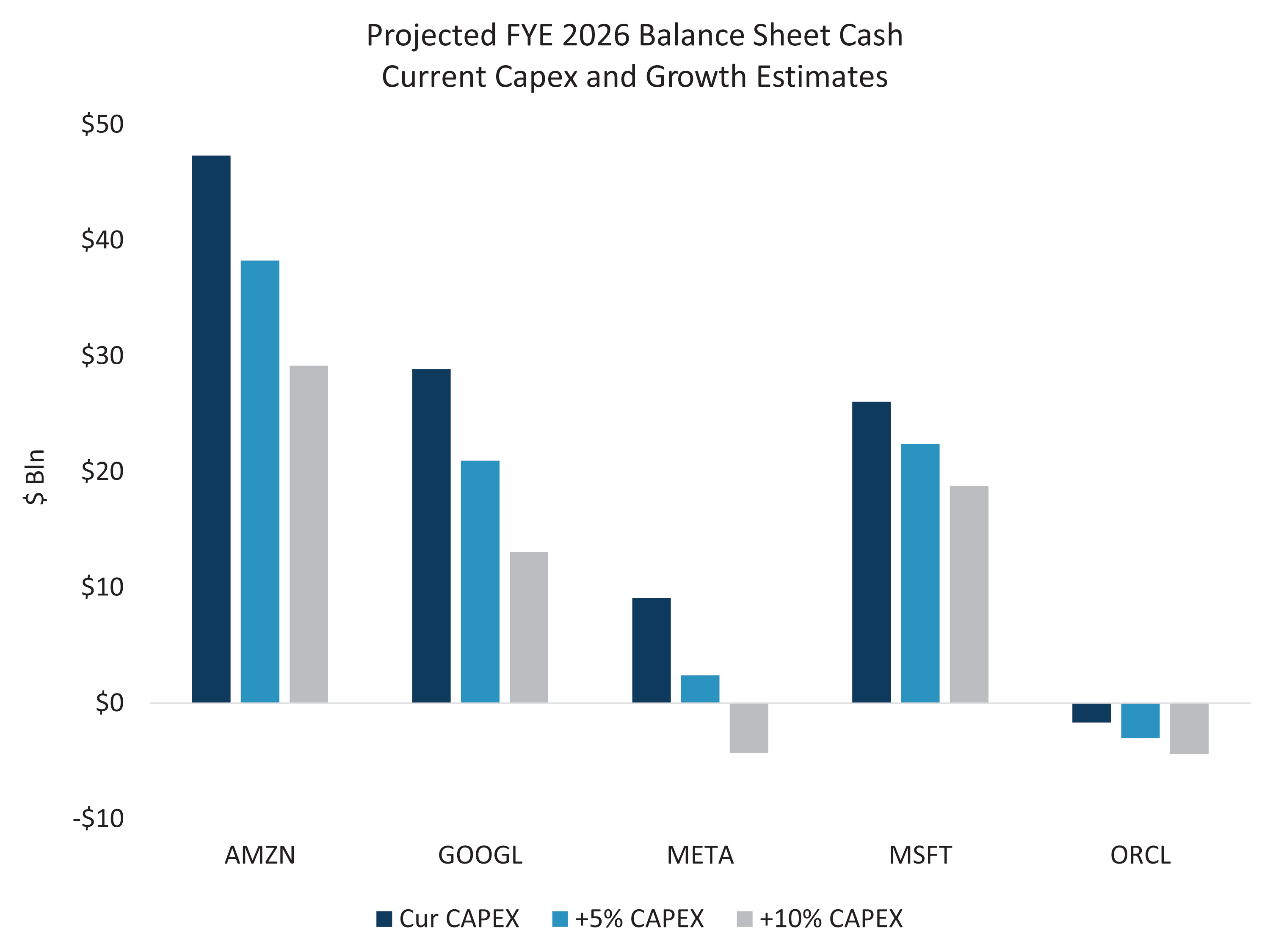

Looking ahead, net debt issuance is expected to reach $100 billion in 2026. Although historically elevated, this level remains manageable for hyperscaler balance sheets. Importantly, three of the five hyperscalers are projected to maintain positive free cash flow even after increased capex and shareholder returns, while four may not need to issue debt in 2026 — suggesting the recent surge could represent a local peak. Net leverage at the highest quality hyperscalers is expected to shift from ~negative to negligible, remaining below 1x even under aggressive spending scenarios.

While the IG market has priced in some underperformance for hyperscalers amid supply pressures, we believe their credit quality remains among the strongest globally. This environment presents a tactical opportunity for investors to capitalize on the AI-driven buildout.