Last Friday, the Fed published its October Survey of Consumer Expectations (SCE). With official economic data delayed by the US government shutdown, insights like these have become especially valuable as markets and policymakers focus on two key issues: the extent of the labor market slowdown and the persistence of inflation.

According to the survey, which polls roughly 1,300 households nationwide, expectations for inflation and labor market conditions showed mixed signals. Respondents anticipated slower inflation in the near term, while long-term expectations held steady. At the same time, views on the labor market deteriorated, reinforcing concerns about a slowdown that could keep pressure on the Federal Reserve to maintain its rate-cut trajectory.

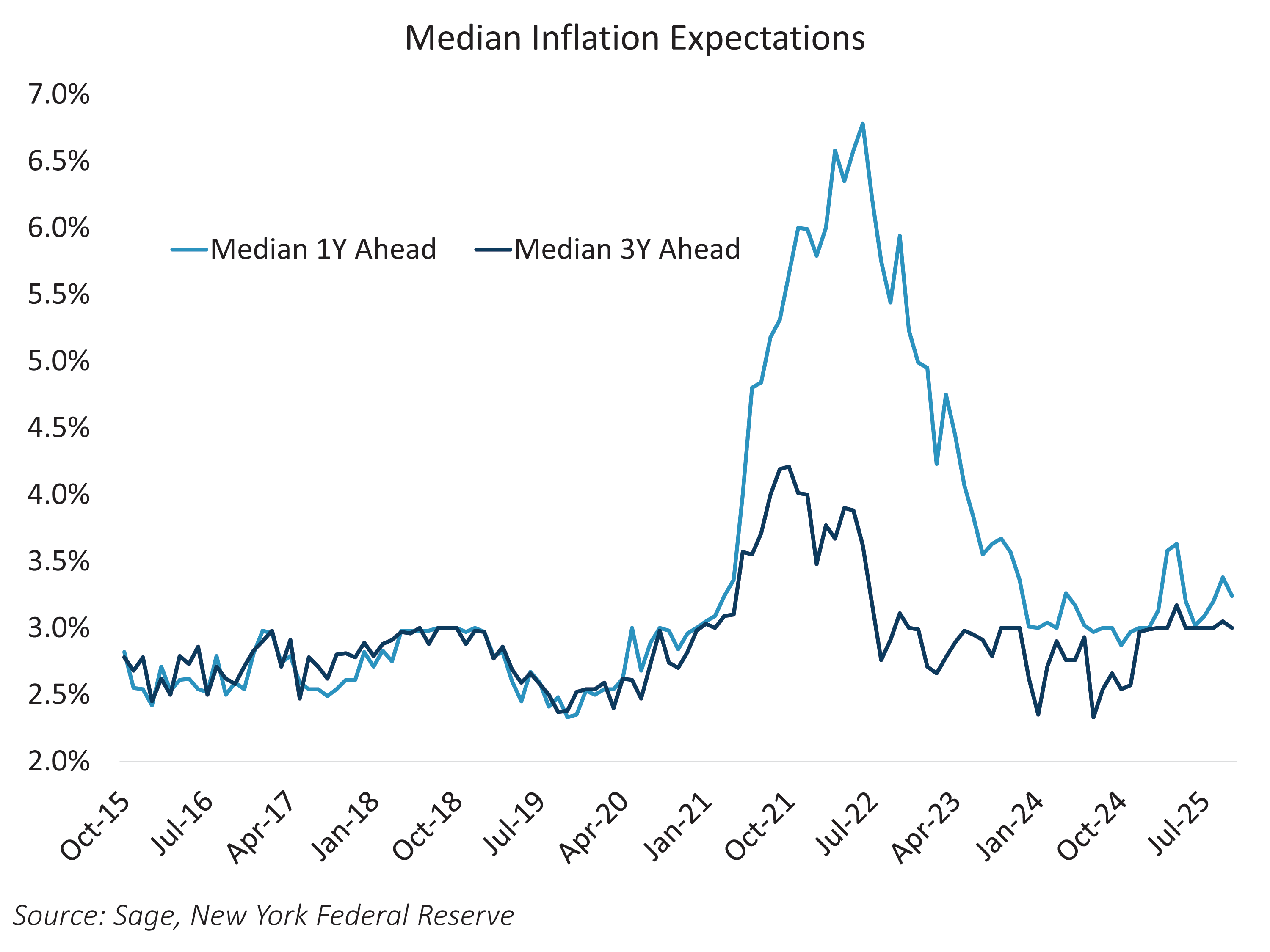

Digging deeper into inflation expectations, the median one-year outlook fell slightly by 0.2 percentage points to 3.2%, while three- and five-year expectations were unchanged. Encouragingly, long-term expectations remain anchored despite this year’s unprecedented trade developments.

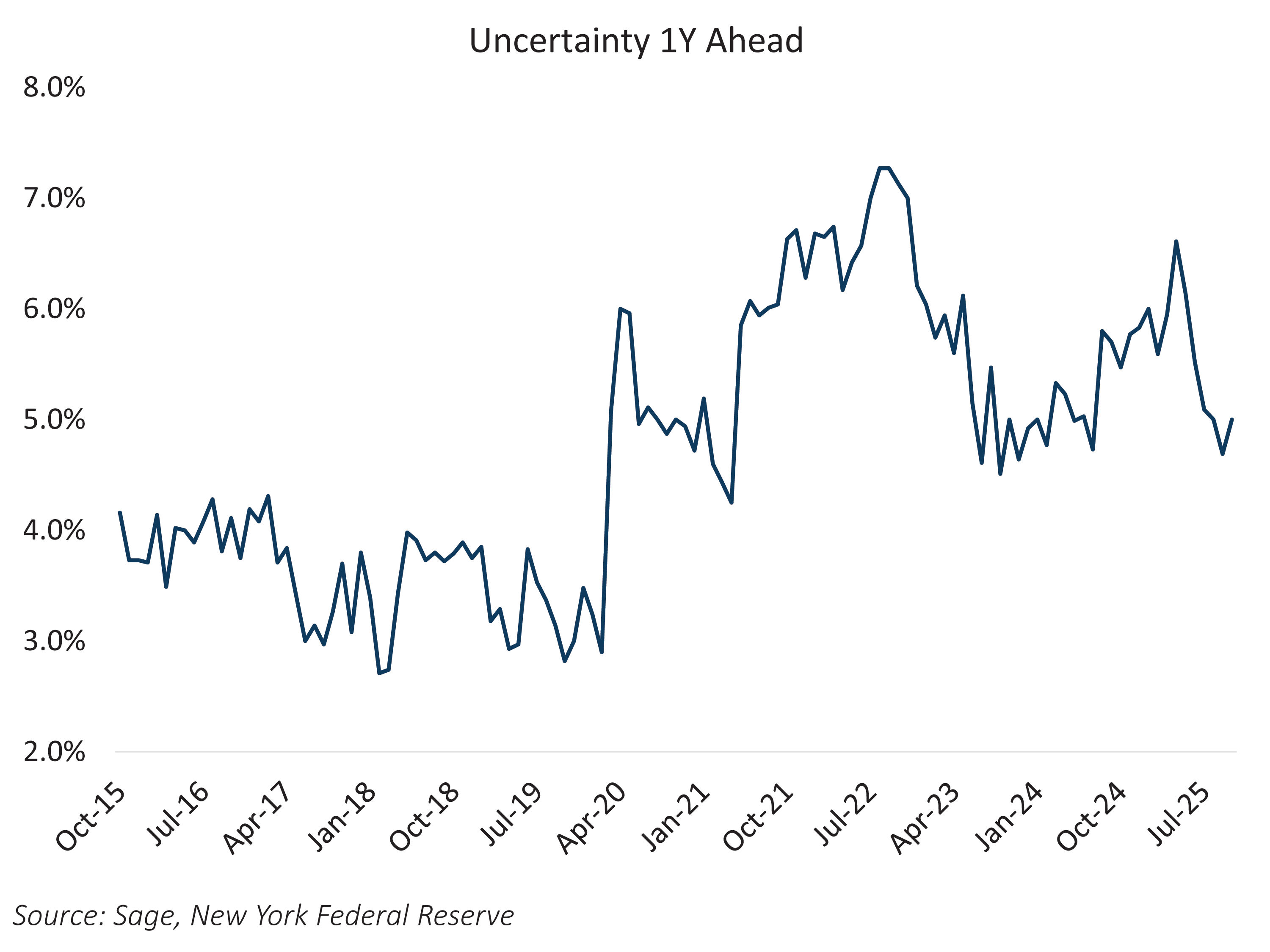

Inflation uncertainty also edged higher, measured by the gap between the 75th and 25th percentiles of responses, across all time horizons. Still, uncertainty remains near post-pandemic averages and far below the extremes seen during “liberation day.”

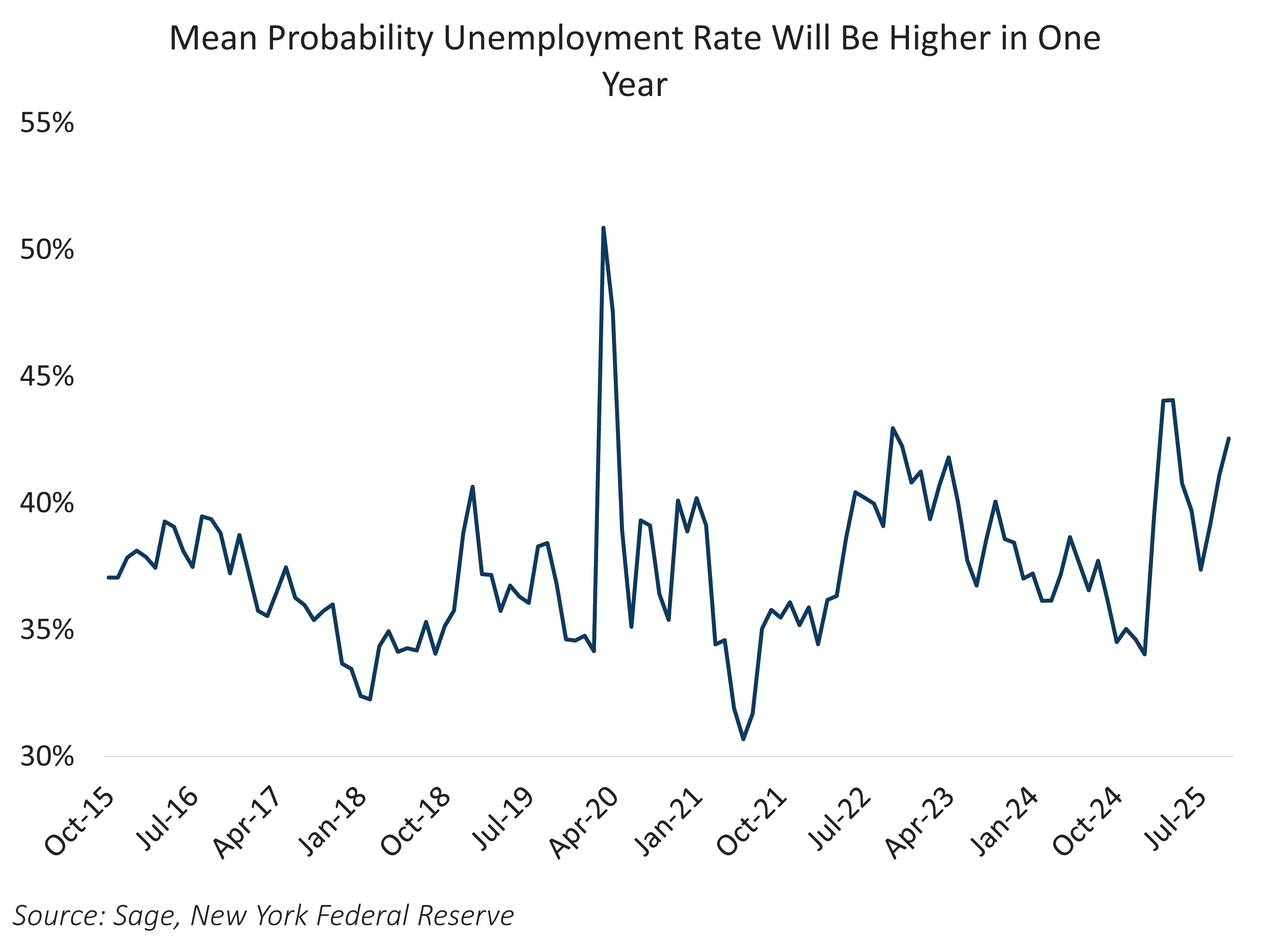

Meanwhile, labor market sentiment weakened further: the mean probability that unemployment will rise over the next year increased by 1.4%, marking the third consecutive monthly uptick.

Adding to the backdrop, the US Senate advanced a stopgap spending bill on Monday to end the government shutdown — a critical step toward restoring the normal flow of economic data. With the December FOMC meeting just six weeks away, policymakers face the challenge of interpreting limited official data alongside private-sector indicators. The question now is whether the Fed’s default stance will hold — or if the lack of government data will tip the decision toward a pause or another rate cut. Heading into October, expectations favored cuts in both September and October, but recent Fed rhetoric has cast doubt on that view. While we still anticipate the Fed ultimately lowering rates to a 3% terminal level sometime next year, the December meeting remains a coin toss.