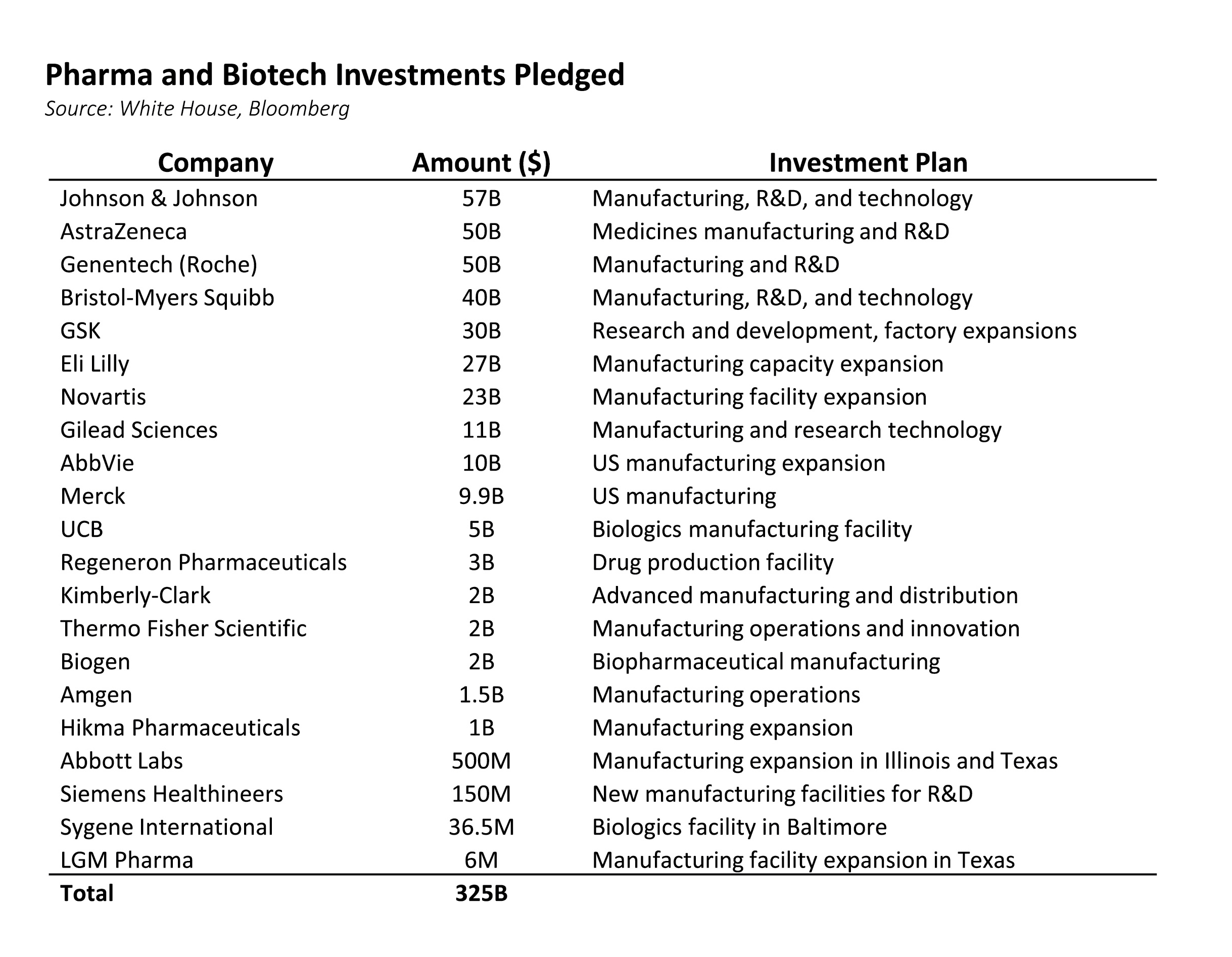

Pharmaceutical tariffs were among the final major trade actions anticipated after Liberation Day in April. The White House had delayed implementation to give drugmakers time to adjust manufacturing plans. On September 25th, President Trump announced a 100% tariff on branded or patented drugs from companies not building manufacturing facilities in the US, effective October 1st. While details remain limited, firms that have broken ground or are actively constructing US plants are expected to be exempt. As a result, most large US pharmaceutical companies are likely to see minimal impact, as the policy has already driven significant investment — industry commitments now total $325 billion.

The tariffs’ impact will depend heavily on whether they apply to individual drugs or to a company’s overall manufacturing footprint – details that remain unclear. International pharmaceutical firms without US investments, such as Novo Nordisk, could face greater disruption. Notably, generic drug makers were excluded from the announcement, which was a positive development for companies like Viatris, Teva, and Amneal Pharmaceuticals.

Announced investments have varied widely depending on the company, with Johnson & Johnson’s investment currently the largest at $57B, followed by AstraZeneca and Roche at $50B each. The tariff announcement also preceded a further $650M investment announced by AMGN on the morning of September 26th. While details could change the ultimate impact, we view this announcement as better than feared as it removes a longstanding overhang for the sector.