US banks delivered robust earnings this quarter, driven by continued expansion in net interest income and strong fee revenues. Although isolated events — such as fraud cases and the First Brands bankruptcy — introduced some market volatility, their impact was limited. Overall, consumer resilience and the soundness of the banking sector remained intact.

The largest banks — “the Big 6” — posted standout results in capital markets and investment banking, fueled by a surge in corporate activity. Credit trends remain broadly healthy, with net charge-offs, nonperforming assets, and reserves holding steady.

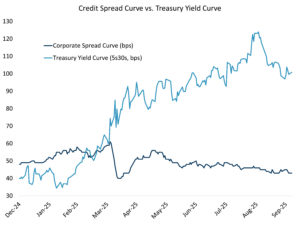

Many institutions, including Fifth Third, Truist, U.S. Bank, PNC, First Horizon, and Synchrony, noted lighter provisions for credit losses, reflecting stronger-than-expected credit performance. Ally Financial highlighted a significant year-over-year decline in auto net charge-offs and delinquencies and now expects results at or below prior guidance. Huntington and KeyCorp reported stable-to-improving asset quality, with modest increases in net charge-offs remaining within forecasted ranges. Wells Fargo, Morgan Stanley, and Goldman Sachs posted notably low or even zero provisions, underscoring confidence in their credit books. Concerns arose as Zions disclosed a $50 million write-off due to borrower irregularities, but our assessment is that this is an isolated event rather than a systemic concern. Despite outsized equity volatility in bank stocks, banking credits remained remarkably stable. Overall, the sector is benefiting from resilient consumer and commercial credit trends. Profitability is further supported by reserve releases and a decline in criticized loans.

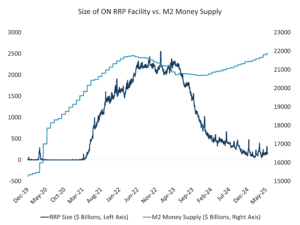

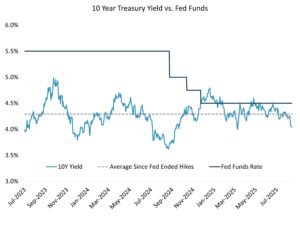

Source: Sage, Bloomberg

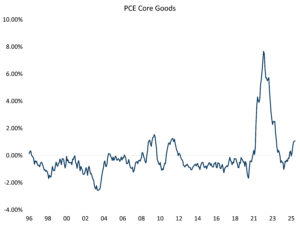

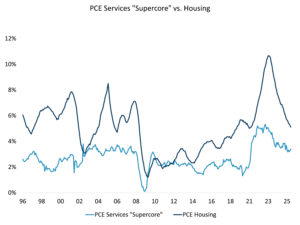

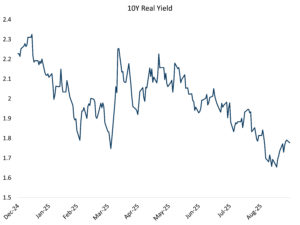

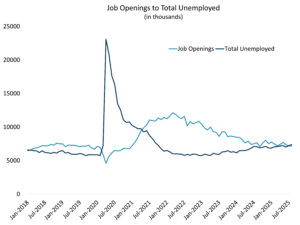

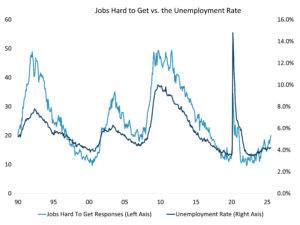

This quarter’s bank earnings provided a clear view into the resilience of the real economy. Household and private sector consumption remained strong, even amid ongoing policy and macroeconomic uncertainty. The data reinforced the strength of consumer credit, with most prime and near-prime borrowers maintaining financial stability — supported by low unemployment and the wealth effect from buoyant financial markets.

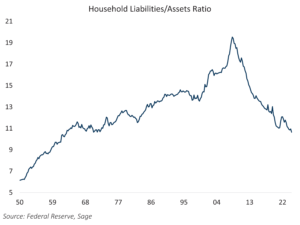

Looking at the broader picture, households have been in a long-term deleveraging trend since the Global Financial Crisis. According to the Federal Reserve’s flow of funds data, household liabilities relative to assets are now at their lowest level in over 50 years, making consumers less vulnerable to economic shocks.

Source: Federal Reserve, Sage

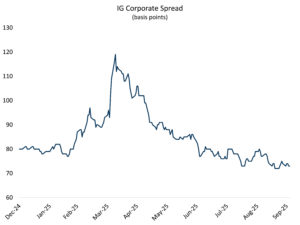

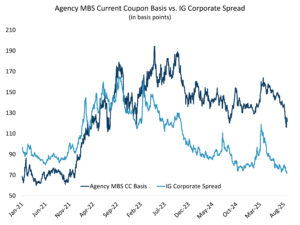

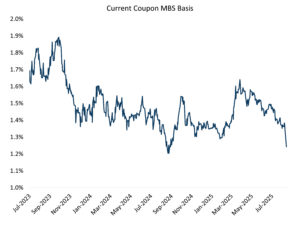

With another strong earnings season behind them, banks are in a much stronger position than they were entering the regional banking crisis of 2023. They have built excess loan loss reserves and capital, enhancing their ability to weather unexpected economic shifts. Corporate bond investors have expressed increased confidence in the health and transparency of bank loan portfolios, as reflected in the limited sell-off in bank bond spreads. Much of the risk associated with overleveraged borrowers has shifted to private markets, which should help mitigate potential damage in a future credit cycle. Banks are also benefiting from a more measured regulatory environment under the Trump presidency, which is expected to support sector growth and spur further bank M&A activity as the need for scale continues to rise.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.