Cooling on the Surface, Steady at the Core: Retail Sales Tell a Mixed Tale

June 24, 2025 By Sage Advisory

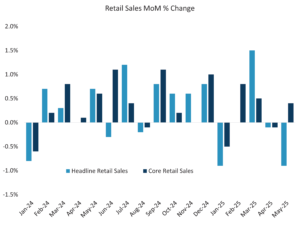

The US Census Bureau’s May retail sales report came in weaker than expected, with the headline measure — total nominal sales — down 0.9% on the month. It’s the largest drop in nearly two years and reflects broad-based softness across categories like autos, gas stations, and restaurants. April was also revised down to a mild decline, which on the surface could indicate that the US consumer may be catching its breath.

But the headline overstates the weakness. When you strip out the volatile categories — autos, gas, building materials, and food services — the so-called control group, which feeds into GDP, was actually up 0.4% on the month and 5% year-over-year. That’s the healthiest monthly gain in this core category since January. On a monthly basis, core retail sales have been relatively stable and positive over the past year.

Source: Sage, US Census Bureau

E-commerce and general merchandise stores continue to show momentum, and the stability in control group spending suggests consumers are still spending on staples and discretionary items alike. The weakness in auto sales and gas station receipts may be more about normalization than retrenchment — especially after a pull-forward in April ahead of potential tariffs.

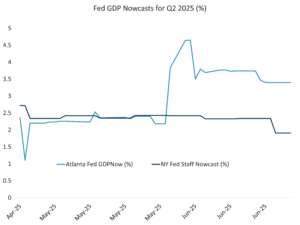

On the surface, the retail sales report is another data point in a string of softer-than-expected prints, reinforcing the idea that the economy is cooling. But the internals indicate that the consumer hasn’t rolled over — they’re just getting more selective. Control group strength points to real consumption still running at a solid clip, which lines up with GDP tracking estimates in the 2% to 3% range for Q2 based on current Fed Nowcasting estimates.

Source: NY Fed, Atlanta Fed, Sage

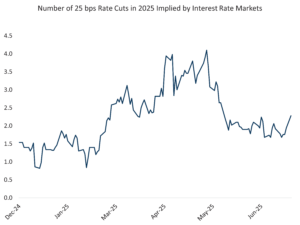

Data like the retail sales figures continue to point to a cooling economy that remains in expansion. The FOMC’s summary of economic projections, released last week alongside its policy statement, showed a slowing growth forecast through 2027 compared to the March release, while inflation is forecasted to run higher than was forecasted in March. Yet, the median path for the Fed funds rate for 2025 remains at two cuts.

Source: Sage, Bloomberg

To us, the current policy stance in light of the forecast revisions from the FOMC reflects the committee’s continued asymmetric focus on preventing a slowdown via lowering interest rates rather than fighting inflation through rate hikes.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.