Cracks in the Consensus: Testing the Fed’s Unity

July 28, 2025 By Sage Advisory

The Federal Reserve is often perceived as a monolith. Policy decisions are usually described in collective terms — “the Fed raised rates,” “the Fed is watching inflation” — as if the institution speaks with a single voice. But that perception may soon be tested with attention shifting to the Fed’s future composition.

While President Trump recently ruled out firing Chair Powell — reducing the likelihood of a near-term leadership shake-up — the Fed’s evolving makeup and internal dynamics will be important to watch. What’s at stake isn’t just the direction of monetary policy, but how markets respond to a potentially more divided and politically influenced Fed. Leadership changes could have profound implications for interest rates, inflation expectations, and asset prices.

The FOMC’s structure reflects a balance between centralized authority and regional input. Twelve members vote on policy decisions: seven governors appointed by the President and confirmed by the Senate, the New York Fed president (a permanent voter), and four rotating regional Fed bank presidents. While all 19 participants contribute to policy discussions, only the designated 12 cast formal votes.

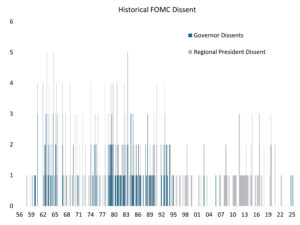

Since the mid-1990s, FOMC votes have been marked by an extraordinary degree of unanimity, with most decisions passing 12-0 or with only a lone dissent. This consensus-oriented approach became a hallmark of the Greenspan era and has largely continued under subsequent Fed chairs.

But it wasn’t always this way. During the 1980s, dissent was more common — particularly among the Board of Governors. At the time, the Fed was grappling with double-digit inflation, volatile interest rates, and a credibility crisis. Governors frequently broke with the chair over the pace and severity of tightening measures, with some worried about recession risks and others pushing for even more aggressive action to tame inflation. The stakes were existential, and the ideological divides within the Committee were sharper. The shift toward near-unanimity in the 1990s reflected not only a calmer macroeconomic environment but also a deliberate cultural shift to manage expectations and reduce market noise.

Source: Federal Reserve, Sage

Today, navigating the Fed’s dual mandate — maximum employment and price stability — is increasingly complex. While the labor market remains healthy, it is showing signs of slowing. At the same time, potential inflationary pressures from tariffs are expected but not having a major effect on inflation readings.

Market expectations suggest that Trump would favor a Fed chair who is explicitly dovish and aligned with his pro-growth agenda. This could mean faster and deeper rate cuts, marking a sharp departure from Powell’s focus on restoring price stability through restrictive policy. Such a shift would raise questions about the Fed’s independence and internal cohesion. While a more accommodative FOMC might boost equities and credit in the short term, it could also trigger a bear steepening, greater inflation volatility, and rising risk premiums if markets begin to doubt the Fed’s long-term commitment to price stability

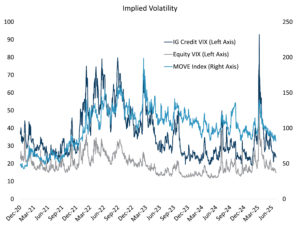

Source: Sage, Bloomberg

So far, markets have largely discounted this risk. Implied volatilities for rates, credit, and equities remain near multi-year lows. But dissent signals more than disagreement — it signals uncertainty. A 9-3 or 8-4 vote, especially with dissent from governors, suggests diverging views on the economy, the policy path, or the influence of politics. That could lead to increased volatility around FOMC meetings, greater market sensitivity to economic data, and a wider range of scenarios for rates, the dollar, and risk assets.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.