Hiring Hits a Wall: Private Labor Data Flags Economic Softness

October 13, 2025 By Sage Advisory

In a world that clings to every labor data release for clues about potential shifts in monetary policy, the absence of official data adds a fresh layer of uncertainty for market participants. Since the government shutdown began on October 1st, only a handful of reports from private and non-governmental sources have offered glimpses into labor market conditions — and they continue to point toward a gradual deceleration.

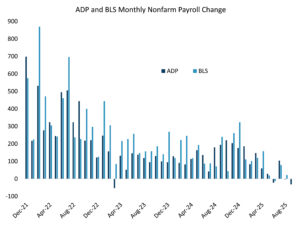

The ADP National Employment Report is a monthly estimate of private-sector payroll employment, based on actual payroll data from millions of workers. Its measure of nonfarm employment change serves as a counterpart to the Bureau of Labor Statistics’ (BLS) nonfarm payroll figures. For September, ADP reported a decline of 32,000 jobs — one of the weakest readings since the pandemic — signaling a continued slowdown in hiring. The report was released on October 1st, just as the government shutdown began.

Source: Sage, ADP, BLS

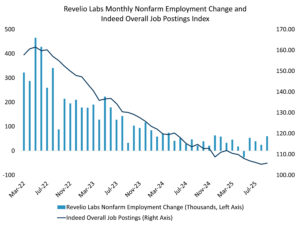

In the absence of official data, private sources have become increasingly important for gauging labor market conditions. One such source is Revelio Labs’ Public Labor Statistics (RPLS), a monthly dataset that tracks employment, hiring rates, and job openings using over 100 million public professional profiles. Its September report, released on October 2nd, showed a modest gain of 60,000 nonfarm jobs. Similarly, Indeed’s US job postings, updated on October 8th, continue to show a sharp decline throughout the year. Together, these private indicators reinforce the narrative of a gradually cooling labor market over the past 12 months.

Source: Revelio, Indeed, Sage

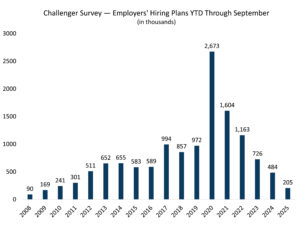

Complementing these private employment indicators is the Challenger Job Cuts Report, which tracks layoffs across both corporate and private sectors using publicly available data, press releases, and company disclosures. The latest report, released on October 2nd, did little to shift the narrative of a stagnant labor market. So far this year, 948,000 job cuts have been announced — the highest year-to-date total since 2020 — with 299,000 of those coming from the government sector, largely driven by earlier Department of Governmental Efficiency (DOGE) reductions. Additionally, employers have announced plans to hire just 205,000 workers this year, marking the lowest year-to-date hiring figure since 2009.

Source: Challenger, Sage

Taken together, these non-governmental data sources continue to point to a weakening labor market, with hiring activity at some of the lowest levels seen since 2009. For an FOMC intent on staying “ahead of the curve” in supporting employment, these figures — viewed in isolation — provide continued justification for further rate cuts. However, that stance could shift if inflation unexpectedly accelerates in the near term.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.