Inflation Expectations Hold Firm Amid Tariff Noise

May 13, 2025 By Sage Advisory

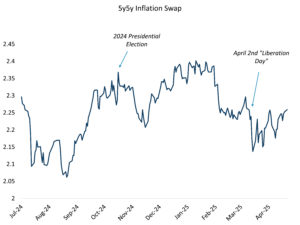

Despite the announcement of new tariffs, long-term inflation expectations—as measured by the 5y5y inflation rate—have remained stable. This rate, which reflects expected average inflation over a five-year period starting five years from now, is a key indicator of market sentiment on long-term inflation and is typically derived from TIPS or inflation swap markets.

From April 2 to May 12, the 5y5y rate stayed flat, even though tariffs are expected to raise costs. Since the November election, the rate has actually declined by 10 basis points to 2.26%.

Source: Sage, Bloomberg

Several factors help explain why long-term inflation expectations have remained stable despite the announcement of new tariffs. First, market uncertainty around the implementation of tariffs likely played a role. Investors may have anticipated that the proposed tariffs would be delayed or softened, a view that was validated when the US and China agreed to a 90-day postponement following in-person negotiations. This delay signaled a potential de-escalation in trade tensions, mitigating the perceived inflationary risk.

Moreover, the nature of tariffs themselves may limit their impact on long-term inflation expectations. Tariffs are generally seen as a one-time shock to prices, influencing short-term inflation more than the long-term trajectory. As such, markets may have discounted their relevance to the broader inflation outlook.

Additionally, concerns about the broader economic impact of tariffs may have further dampened inflation expectations. Tariffs can compress corporate profit margins and weaken aggregate demand, both of which are deflationary forces. Rather than fueling inflation, these effects could signal slower economic growth, which tends to suppress price pressures over time.

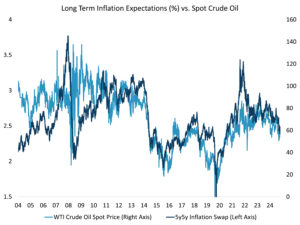

Another important factor is the behavior of energy markets, which are closely tied to inflation expectations. Oil prices have declined amid increased supply from OPEC+, contributing to a more subdued inflation outlook. Since energy is a key input cost across the economy, falling oil and gasoline prices can exert downward pressure on inflation expectations.

Source: Sage, Variant Perception, Bloomberg

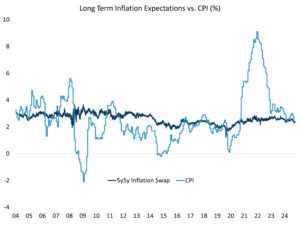

Finally, confidence in the Federal Reserve’s credibility appears to be anchoring long-term inflation expectations. Despite recent economic volatility, the 5y5y inflation rate has remained close to the Fed’s 2% target. This suggests that markets still trust the Fed’s ability to maintain price stability over the long run, even in the face of fiscal and geopolitical uncertainty.

Source: Sage, Bloomberg

While tariffs typically signal upward pressure on prices, markets appear unconvinced that recent trade developments will meaningfully alter the long-term inflation landscape. The resilience of the 5y5y inflation rate underscores investor confidence in the Federal Reserve’s ability to anchor inflation expectations and reflects broader forces — like global energy prices and demand outlooks — that continue to exert a stronger influence on long-term inflation sentiment than short-term policy shifts.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.