Jackson Hole Marks Powell’s Readiness to Ease

August 25, 2025 By Sage Advisory

Fed Chair Jerome Powell’s speech at Jackson Hole last week marked a clear pivot from prior Fed communications, striking a more dovish tone than markets had expected. For much of this year, Powell emphasized patience and a cautious approach to easing. At Jackson Hole, he pivoted, acknowledging that the balance of risks has changed and that with inflation closer to target and policy already restrictive, “adjustments may soon be warranted.”

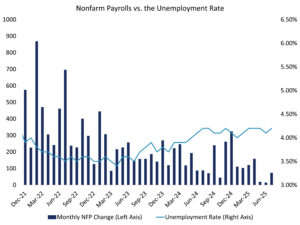

This shift did not come in a vacuum. Labor market data in recent months have been weaker than previously thought. Headline payroll gains have slowed sharply — from an average of over 200,000 per month in 2023 to just 35,000 in the most recent release — and downward revisions have erased much of the strength reported earlier in the year. The unemployment rate has edged up to 4.2%, and Powell described the current state as a “curious kind of balance,” one that results not from robust momentum but from a simultaneous slowing of both labor supply and labor demand. Such conditions, he warned, can tip quickly, raising the risk of a sharper deterioration.

Source: Sage, BLS

Overlaying these cyclical concerns was a structural change in the Fed’s policy framework that was scheduled for this year. Powell confirmed the Fed is abandoning the “average inflation targeting” approach it adopted in 2020. That framework — designed for a world of weak demand, low interest rates, and chronic undershooting of inflation — allowed inflation to run above 2% for a time to make up for earlier shortfalls. The aim was to lift long-term inflation expectations and prevent premature tightening. But the post-pandemic economy is different. Tariffs have reshaped global trade, immigration has slowed, and repeated supply shocks have altered the complexion of inflation. In this environment, tolerating overshoots risks embedding inflation rather than raising expectations. Powell announced a return to a more traditional 2% target — flexible enough to acknowledge real-world frictions, but without the asymmetric bias that tolerated prolonged overshooting.

The combination of a stricter-sounding framework and a dovish policy stance may seem contradictory, but it reflects the Fed’s evolving calculus. Inflation is moving toward the target faster than expected, while the costs of holding policy at restrictive levels are rising. The new framework restores credibility to the Fed’s inflation objective, even as Powell’s tone makes clear that the near-term priority is guarding against unnecessary damage to employment. The timing of the shift is telling. It signals that the Fed is ready to exit the “higher for longer” phase and transition toward gradual easing, with September now squarely in play.

Political pressure provides another important backdrop. The White House has been calling for rate cuts to support growth and jobs, placing the Fed in a delicate position. Powell avoided any explicit reference, but by emphasizing labor-market risks and pointing to the downside of waiting too long, he effectively acknowledged the broader context. Maintaining independence while responding to real economic weakness is a fine balance, and Jackson Hole was Powell’s attempt to walk that line.

Markets took him at his word. Treasury yields fell across the curve, led by the front end, as traders quickly priced in a near-certain September cut. The yield curve began to steepen, reflecting expectations of a lower policy path and a Fed that is more responsive to growth risks than previously assumed. Real yields rolled over, and credit markets tightened in anticipation of an easier stance.

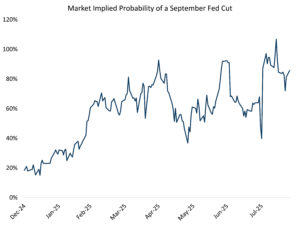

For fixed income investors, the debate is no longer about how long the restrictive policy will remain, but how fast the easing cycle will unfold and how far the Fed will ultimately go. The chart below shows the market implied probability of a Fed cut at the September meeting, which has hovered in a range since February. Following a steady decline after the latest weak labor data revisions, the market is now pricing in an 86% probability of a rate cut at the September FOMC meeting.

Source: Sage, Bloomberg

The message from Jackson Hole is clear: the Fed is pivoting from restraint to readiness. Inflation progress has given Powell room to maneuver, while weakening labor data and revisions have made the costs of inaction harder to ignore. September may well mark the start of a new phase in monetary policy — one where the focus shifts from fighting inflation at all costs to managing the risks of an economy that is already slowing.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.