Markets Shrug Off Fed Drama and Focus on Macro Tailwinds

July 21, 2025 By Sage Advisory

Recent rhetoric from the White House has drawn attention to Federal Reserve Chair Jerome Powell, particularly regarding scrutiny of the central bank’s $2.5 billion headquarters renovation. While legal experts generally agree that a president cannot fire a Fed chair without cause, reports that the administration explored such an option — however unlikely — were enough to momentarily induce market volatility last week. Treasury Secretary Scott Bessent reportedly advised against any action, citing potential market instability and legal uncertainty.

The independence of the Federal Reserve is a cornerstone of US monetary credibility. Any hint of political interference tends to raise risk premiums, particularly around inflation and the integrity of long-term policymaking. A disorderly leadership change at the Fed would theoretically drive Treasury yields higher, weaken the dollar, and introduce volatility across asset classes.

The immediate market reaction reflected that dynamic. Equity indices dipped and credit spreads widened on reports of a potential removal, but both recovered quickly as subsequent comments downplayed the likelihood of action. Treasury yields moved modestly higher, consistent with a rise in term premium, but not dramatically so. This suggests that investors view the removal of the Fed chair as a headline risk rather than a near-term base case, and given the legal protection for Fed leadership and an institutional precedent, the probability of such an event is low.

More telling is the market’s resilience: credit spreads remain historically tight, and equities are grinding higher due to the growing confidence of a continued economic expansion. Financial conditions have actually eased over the past few months, driven by a weaker dollar and falling short-term interest rates.

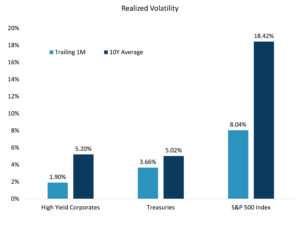

Additionally, volatility across asset classes has remained relatively subdued compared to historical norms. The chart below illustrates the annualized one-month volatility for high-yield corporate bonds, Treasuries, and US equities — all of which are currently exhibiting lower levels of volatility than their respective 10-year averages.

Source: Sage, Bloomberg

Meanwhile, tariffs remain a politically charged issue, but markets have shown far less sensitivity to each successive headline. That could be due to several factors: services and commodity-driven disinflation continue to drive aggregate inflation readings, imports make up a relatively small share of US GDP, and many importers preemptively frontloaded supply in the first quarter in anticipation of tariff escalation. The result is a market that increasingly sees trade policy as background noise rather than a primary macro driver.

Rather than fixating on the politics of central bank governance or trade disputes, markets appear focused on fundamentals: a backdrop of front-loaded fiscal stimulus, falling inflation, and the growing expectation that rate cuts are a matter of “when,” not “if.”

In many ways, the current environment resembles a “Goldilocks” economy — not too hot to reignite inflation fears, and not too cold to threaten growth. While risks remain, recent price action reflects a market narrative driven by the interplay between fiscal policy, disinflation, and Fed easing, with investors leaning into the idea that the macro backdrop still supports strength across the real economy and asset markets.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.