MBS Opportunities Amid Quiet Housing Market

June 2, 2025 By Sage Advisory

The US housing market remains in a state of inertia. Despite the arrival of the spring selling season, both new and existing home sales continue to underwhelm. In April, existing home sales fell to an annualized pace of 4 million units — down 2% from a year earlier and well below the pre-pandemic average of over 5 million. New home sales, while slightly more resilient, have also plateaued as affordability pressures mount.

Source: Sage, National Association of Realtors

Mortgage rates are a key factor. As of late May, the average 30-year fixed mortgage rate remains near 6.84%, a level that has persisted for months. These elevated rates have created a lock-in effect: homeowners with sub-4% mortgages are reluctant to sell, while buyers face higher monthly payments and tighter credit conditions.

Source: Sage, Bankrate.com

The result is a market with limited inventory and muted activity. Even though active listings have increased year-over-year, total inventory remains 16% below pre-pandemic levels. Home prices, meanwhile, are showing signs of softening. Zillow now expects national home values to decline by 1.4% in 2025 — a modest but notable shift after years of rapid appreciation.

Sentiment reflects this cooling. A Q1 2025 Realtor.com survey found that nearly two-thirds of prospective buyers expect a recession within the next year. While some see that as a potential buying opportunity, many remain cautious — concerned about job stability, credit access, and the risk of overpaying in a market that feels increasingly uncertain.

Even as the housing market remains subdued, agency mortgage-backed securities (MBS) have emerged as a bright spot, drawing investor attention due to their evolving risk profile and attractive valuations.

Agency MBS are bonds backed by pools of residential mortgages and issued by government-sponsored enterprises (GSEs) such as Fannie Mae, Freddie Mac, and Ginnie Mae. These securities are considered to carry minimal credit risk due to their implicit or explicit government backing. However, they are still subject to other forms of risk — primarily interest rate risk and prepayment risk.

In a typical environment, prepayment risk is a major consideration. When interest rates decline, homeowners often refinance at lower rates, causing MBS to prepay earlier than expected. As a result, investors receive their principal sooner and are typically forced to reinvest at lower yields. But in today’s high-rate environment, refinancing activity has slowed dramatically. This has reduced prepayment volatility and made the cash flows from agency MBS more predictable.

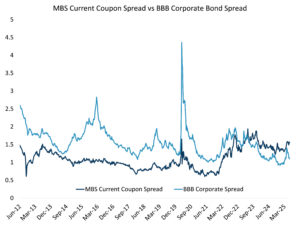

At the same time, spreads on agency MBS remain elevated. This is partly due to a shift in demand dynamics. The Federal Reserve, once a major buyer of MBS during its quantitative easing programs, has been reducing its balance sheet. Commercial banks — another traditional source of demand — have also pulled back following the regional banking stress of 2023. With fewer natural buyers in the market, spreads have widened relative to historical norms, and are even considered cheap relative to corporate bonds in an environment of higher earnings uncertainty.

Adding another layer of complexity is the renewed discussion around the potential privatization of government-sponsored enterprises (GSEs) under the Trump administration. President Trump has recently stated that he is giving “very serious consideration” to taking Fannie Mae and Freddie Mac public. While this idea has surfaced before, past efforts to privatize the GSEs have faced significant legal, political, and logistical hurdles. The conservatorship structure, in place since 2008, has proven difficult to unwind, and many in the housing and financial sectors remain skeptical that a full privatization can be executed without disrupting the mortgage market.

Nonetheless, President Trump has emphasized that any move toward privatization would retain the implicit government guarantee that underpins the stability of agency MBS. That assurance may help temper market volatility, but the path forward remains uncertain.

Source: Sage, Bloomberg

In a fixed income landscape where high-quality yield is increasingly scarce, agency MBS stand out for their relative value. Despite carrying no credit risk, current coupon MBS are trading at spreads well above historical averages — offering a meaningful pickup over comparable-duration Treasuries. Importantly, these elevated spreads are not being driven by deteriorating fundamentals. Prepayment risk has diminished in the current rate environment, and the underlying credit quality remains strong due to the government-sponsored nature of the issuers. In a market starved for high-quality yield, agency MBS offer a rare combination of stability, attractive spreads, and reduced volatility — making them a compelling option for income-focused investors navigating today’s uncertain environment.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.