Municipal Bonds That “Put” a Little Extra Income In Your Pocket

July 28, 2025 By Sage Advisory

Over the long-term, income is the dominant driver of returns for most fixed-income asset classes, and municipal bonds are no different. In order to further enhance the income component, investors can take on various types of risk premiums, including credit risk, duration, structural and liquidity, just to name a few. Over time and as markets evolve, the relative value of each of these risk premiums can shift, creating opportunities for investors.

Source: Bloomberg

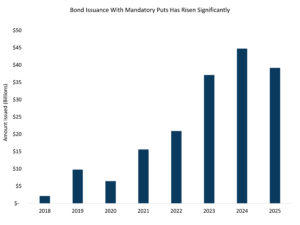

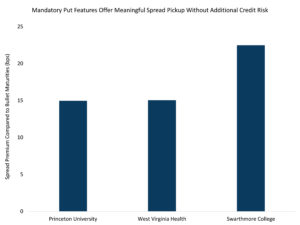

Within the last year or so, we have seen a significant rise in the issuance of bonds with mandatory put features. These bonds are typically issued with a 25-to-30-year maturity but are required to be tendered on the mandatory put date, which is typically within 10 years from the issuance date, thus making the put date the effective maturity date. These types of structures can offer an additional 15-30 basis points of spread over a similar security without the put feature. We view this additional income as highly attractive for the majority of puttable securities, given that any additional risk normally associated with the bonds can be contained with proper security selection.

Source: Bloomberg

Common Reasons Why Puttable Bonds Trade With Wider Spreads

Visual complexity — Municipal bonds with mandatory put features introduce an additional degree of complexity that certain investors may not feel comfortable with, thus causing them to avoid the securities altogether.

Market Liquidity — Historically these bonds have been less liquid than comparable callable or bullet maturities, however a recent rise in issuance and broader investor participation has significantly increased the liquidity pool. In fact, the larger issuance size for these types of structures can even enhance their market liquidity.

Tender Date Liquidity — The issuer is required to repurchase the bonds at a predetermined price on the tender date. However, if they lack sufficient funds to do so or are unable to access the capital markets, they could default on this obligation. Investors can protect against this risk by only purchasing bonds with mandatory puts from issuers who benefit from sufficient liquidity to repurchase the bonds outright if they are unable to access the capital markets to reoffer the bonds at the tender date.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.