One Big Beautiful Bill

July 8, 2025 By Sage Advisory

On July 3rd, Congress approved the sweeping One Big Beautiful Bill Act, which was signed into law on Independence Day, meeting the deadline for the bill set out at the beginning of the year. The legislation pairs the extension of the 2017 TCJA tax cuts with delayed spending reductions, delivering immediate fiscal stimulus while deferring much of the budgetary pain.

While the tax relief takes effect immediately, the bill also expands funding for defense, border security, and immigration enforcement by hundreds of billions of dollars over the next decade. In contrast, the most substantial cuts to social spending, which include Medicaid reductions projected to exceed a trillion dollars over ten years and tightened eligibility for SNAP benefits, are deferred until after the 2026 midterm elections. This sequencing is deliberate: voters will see the benefits of lower taxes now, while the costs are delayed or potentially softened in the future.

The fiscal impact could be significant. The Center for a Responsible Financial Budget (CRFB) estimates the legislation will add $4 trillion to the fiscal deficit over the next decade, assuming the delayed spending cuts are implemented in full after future elections. Debt as a share of GDP is projected to climb from about 117% under current policy to over 127% by the mid-2030s, levels that would surpass the prior peaks set during the pandemic and World War II.

While these projections underscore long term sustainability risks, in the near term the large-scale deficit financing effectively acts as another round of fiscal stimulus, bolstering economic growth and, by extension, asset prices.

The legislation arrives against the backdrop of boosting an economy that remains firmly in expansion. Recent labor market readings have underscored continued resilience, with June’s payrolls report showing over 147k jobs added and the unemployment rate holding near historic lows. Higher growth via fiscal expansion could generate additional tax revenue, partially offsetting the deficit impact of the bill’s provisions. However, whether this revenue materializes at the scale necessary to meaningfully narrow the fiscal gap will depend on how long the current expansion endures and if accelerating economic expansion coupled with tariffs would reignite inflation.

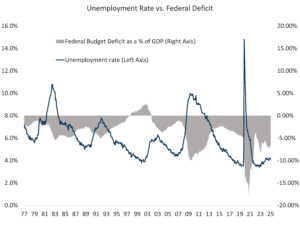

The chart below shows the unemployment rate over time versus the US federal budget balance. Historically, we’ve only seen the current level of deficit relative to GDP when unemployment rates spiked.

Source: Sage, BLS, Treasury

Another factor that could partially mitigate the deficit impact is the administration’s aggressive use of tariffs. New import duties imposed in 2025 are projected by some to raise around $200 billion per year if trade volumes remain steady. However, tariff revenues are notoriously volatile and can be undermined by shifts in global supply chains, retaliatory measures, and aggregate demand. Even if fully realized, these receipts would offset only a portion of the new borrowing required to fund the bill’s provisions.

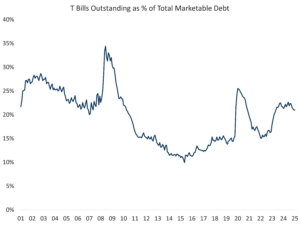

The Treasury Department will face mounting challenges to finance the widening deficits. In recent months, it has increased issuance of short-term Treasury bills to cover cash needs, a trend that is expected to accelerate. Currently, outstanding T-Bills as a percentage of outstanding Treasury debt stands near 21% and has room to increase.

Source: US Treasury, Sage

For markets, the combination of front-loaded tax cuts, large near-term deficits, and the Treasury’s intention to flood the short end of the curve with new bill issuance is especially important. By increasing the supply of T-bills while holding down the issuance of longer-dated Treasuries, the government effectively provides an abundance of collateral to money markets while constraining longer-term bond supply. This combination is likely to keep long-duration yields anchored and liquidity plentiful, conditions that tend to support higher valuations across equities, credit, and other risk assets.

Investors may welcome the stimulus and the relative scarcity of long bonds as a tailwind, even as questions about long-term fiscal sustainability remain unresolved. In many ways, the bill exemplifies the policy trade-off of the moment: short-term economic and market support in exchange for higher structural deficits that will eventually demand attention.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.