Rate Relief and Mortgage Spread Compression

September 22, 2025 By Sage Advisory

As expected, the Fed cut rates at its September FOMC meeting, lowering the funds target range by 25 basis points – at 4.00% to 4.25% – after holding steady since December. The decision reflected recent weakness in labor markets, sparking concern over a growth slowdown even as inflation remains above target. The Committee’s updated projections point to additional cuts through 2025 and a steady glide path lower through 2027. In his remarks, Fed Chair Powell framed the move as a step toward neutrality — acknowledging that the balance of risks has shifted from inflation toward employment. This shift makes the MBS market’s continued strength especially noteworthy, reinforcing themes we’ve been tracking and suggesting further room for relative outperformance.

Agency mortgage-backed securities (MBS) are bonds backed by the cash flows of residential mortgages, most often issued through government-sponsored entities such as Fannie Mae and Freddie Mac. These securities carry minimal credit risk due to implicit government backing, but they are subject to interest rate risk, which alters prepayment speeds and cash flow timing.

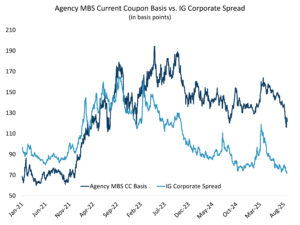

One of the key measures of MBS relative value is the “mortgage basis” — the spread between agency MBS and comparable Treasuries. This spread compensates investors for prepayment and sector risks, and it typically widens when volatility rises. After blowing out to multi-year highs in 2022, the basis has steadily retraced. Today it is approaching the narrow levels last seen in 2023, after labor market weakness emerged as a key concern for the economy, and it now sits on the cusp of breaking below levels observed post-Fed hike.

Source: Sage, Bloomberg

At present, the current-coupon MBS basis is nearly 120 bps over Treasuries — a spread that still offers meaningful value. Investors can earn a greater yield pickup from owning AAA-rated MBS than from many lower-rated corporate bonds that carry credit risk. This dynamic underscores how much the sector continues to compensate investors for rate and prepayment uncertainty, even as spreads compress.

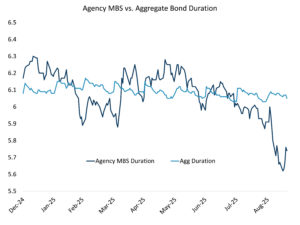

When interest rates fall, the duration of agency MBS shortens because borrowers are more likely to refinance early, which accelerates principal repayments and reduces a bond’s sensitivity to future rate changes. This creates a duration gap for benchmarked investors, prompting many to shift into longer-duration assets like Treasuries to stay aligned. At the same time, the need to hedge against convexity risk diminishes — shorter MBS duration means fewer Treasury sales for hedging purposes. These shifts in positioning and hedging can add momentum to the rate rally, supporting lower yields and reinforcing the relative strength of MBS.

Source: Sage, Bloomberg

Looking ahead, the backdrop for MBS continues to improve. The Fed’s pivot toward easing should help lower rate volatility, removing one of the sector’s largest headwinds. Banks — historically, the largest buyers of mortgages — are on stronger footing and may step back in as demand returns. At the same time, the contraction in MBS duration and the resulting hedging dynamics are already reinforcing the rally in Treasuries, creating a virtuous cycle that supports valuations. Layered on top is the political wildcard: the administration’s focus on driving long-term yields and mortgage rates lower. With policymakers ultimately setting the rules of the game, that “unknown unknown” adds another tailwind, leaving agency MBS well-positioned for the next stage of the cycle.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.