Rates on the Precipice

September 9, 2025 By Sage Advisory

Last week, the highly anticipated nonfarm payrolls report for August came in softer than expectations, printing just 22k jobs versus the consensus of 75k. Coupled with the downward revisions of -21k to prior months, the three-month average payroll is just under 30k, well below the pace needed to put downward pressure on the unemployment rate. This marks a sharp reversal from the robust labor market seen earlier in the year, which had been buoyed by a string of upside surprises in employment data through late 2024.

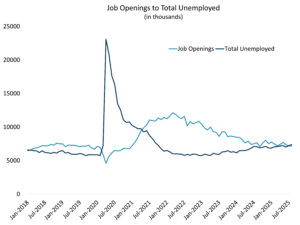

The shift in the health of the labor market is notable, especially as it coincides with other signs of labor market cooling. Job openings continue to decline, with the latest JOLTS data showing 7.2 million openings compared to 7.4 million unemployed — a ratio that has now turned negative after peaking at above 10 million in the post-pandemic recovery.

Source: Sage, BLS

The softening in employment data reinforces a dovish outlook for the FOMC. Interest rate markets are now pricing in a total of six rate cuts through early 2027, a notable shift in expectations compared to just a few weeks ago. Treasury Secretary Scott Bessent’s assertion from less than a month ago that “we should probably be 150 basis points lower” has quickly moved from contrarian to consensus. The market’s embrace of a lower rate trajectory reflects not only the labor data but also broader signs of economic deceleration, and it suggests that the Fed may have more room to ease than previously thought.

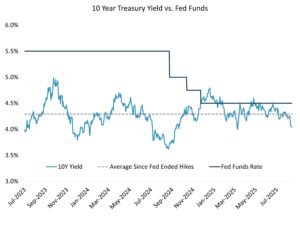

Meanwhile, longer-maturity yields have remained remarkably stable. Since the Fed officially ended its hiking cycle in July 2023, the 10-year Treasury yield has hovered around 4.3%. This range-bound behavior has been more pronounced this year as interest rates have been stuck between two dynamics — on one side, the drag from slowing growth, and on the other, the inflationary risks posed by tariffs. Recent labor market developments have shifted the balance, with the distribution of rate outcomes for the remainder of the year now tilted toward the downside.

Source: Sage, Bloomberg

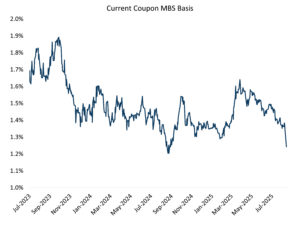

One area that may offer clues about whether we are truly in a regime change is the mortgage-backed securities (MBS) market. MBS spreads have recently tightened, approaching their narrowest levels since 2023. A decisive move lower could signal the onset of a new phase of Fed easing — one that not only supports rates and MBS valuations, but also drives broad-based strength across the entire spectrum of spread sectors.

Source: Sage, Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.