Refreshing the Fed’s Policy Framework

May 19, 2025 By Sage Advisory

Federal Reserve Chair Jerome Powell delivered the opening remarks at last week’s Thomas Laubach Research Conference, focusing on the Federal Open Market Committee’s (FOMC) review of its Monetary Policy Framework. The Fed is committed to conducting a public review every five years to ensure the framework remains responsive to changing economic conditions. The last assessment was in 2020, during the Covid-19 pandemic, and the review that is taking place now is expected to result in updates that could shift how the Fed responds to economic and financial developments.

The Consensus Statement

The Federal Reserve’s dual mandate — promoting maximum employment and maintaining stable prices — was established by Congress in 1977 in response to the economic challenges of the 1970s. While the mandate guided monetary policy, it lacked specific metrics for evaluating progress. In 2012, the Fed introduced the Statement on Longer-Run Goals and Monetary Policy Strategy, known as the “consensus statement,” to clarify how it would pursue its objectives.

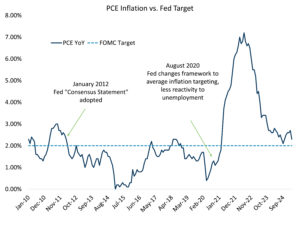

In response to low interest rates, low inflation, and low unemployment post-Great Financial Crisis (GFC), the Fed began a review of its policy framework in 2019, which ended in 2020. A key outcome was the adoption of flexible average inflation targeting (FAIT), which allowed inflation to exceed the 2% target after periods of undershooting, to better anchor expectations.

The 2020 review also changed how the Fed evaluates labor market conditions. Instead of responding to both upward and downward movements from maximum employment, the Fed began focusing on “shortfalls” from full employment — signaling a more patient stance.

As the chief concern at the time was persistent disinflation, the modifications in 2020 resulted in less reactive policy shifts that were asymmetrically dovish. The economic environment changed soon after these adjustments. The Covid-19 pandemic triggered a surge in inflation, and while the Fed responded, it underestimated the persistence of inflationary pressures.

From the GFC to the Post-Pandemic Era

Today, the Fed faces different challenges. Real interest rates are higher, inflation volatility has increased, and supply-side disruptions are more frequent. Powell recently addressed this shift:

“Higher real rates may also reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the 2010s. We may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks.”

Source: Sage, Federal Reserve, BEA

The Fed appears ready to revise its framework again. According to Powell, FOMC participants have shown interest in reexamining the language around employment shortfalls and reassessing average inflation targeting. The Fed is also considering changes to how it communicates forecasts and uncertainty.

Refreshing the Policy Framework and Communications

As the Fed reviews its policy framework, several areas may change. The experience of the past few years — marked by a pandemic, inflation, and a delayed tightening cycle — has highlighted the need for a framework better suited to managing supply shocks and inflation volatility. One likely adjustment is to how the Fed approaches average inflation targeting. While FAIT was designed to address inflation undershooting, its application during a period of rising inflation revealed limitations. The language around employment shortfalls may also be reconsidered. The 2019 focus on shortfalls was appropriate in a low-inflation environment, but in today’s context, a more balanced approach may be necessary to avoid the perception of excessive tolerance for inflation in pursuit of labor market goals.

Future iterations of the framework may place less emphasis on past deviations from inflation or employment targets and instead prioritize a more responsive stance. This could lead to quicker policy adjustments and, as a result, greater variability in interest rate outcomes — introducing more volatility into rate markets.

The Fed is also evaluating how it communicates policy. As outlined in Ben Bernanke’s recent Brookings proposal, clearer and more structured messaging could enhance policy effectiveness. One suggestion is a quarterly “Monetary Policy Report Summary,” which would provide a plain-language explanation of the FOMC’s outlook, policy rationale, and associated risks. Importantly, it would also include alternative scenarios to help the public understand how the Fed might respond if its base case proves incorrect. Additionally, given the market’s focus on the “dot plot” as a signal of future rate paths, the Fed may consider revising how it presents its projections for the federal funds rate.

A shift toward a more flexible and less formulaic policy approach could increase uncertainty around the timing and magnitude of rate changes. This may lead to more frequent repricing across financial markets, particularly in interest rates and risk-sensitive assets. While this could present challenges, it also creates opportunities for investors who can interpret evolving policy signals and adjust their positioning accordingly.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.