Tariff Risk Is Manageable for US Pharma

September 26, 2025 By Sage Advisory

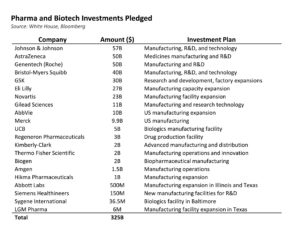

Pharmaceutical tariffs were among the final major trade actions anticipated after Liberation Day in April. The White House had delayed implementation to give drugmakers time to adjust manufacturing plans. On September 25th, President Trump announced a 100% tariff on branded or patented drugs from companies not building manufacturing facilities in the US, effective October 1st. While details remain limited, firms that have broken ground or are actively constructing US plants are expected to be exempt. As a result, most large US pharmaceutical companies are likely to see minimal impact, as the policy has already driven significant investment — industry commitments now total $325 billion.

The tariffs’ impact will depend heavily on whether they apply to individual drugs or to a company’s overall manufacturing footprint – details that remain unclear. International pharmaceutical firms without US investments, such as Novo Nordisk, could face greater disruption. Notably, generic drug makers were excluded from the announcement, which was a positive development for companies like Viatris, Teva, and Amneal Pharmaceuticals.

Announced investments have varied widely depending on the company, with Johnson & Johnson’s investment currently the largest at $57B, followed by AstraZeneca and Roche at $50B each. The tariff announcement also preceded a further $650M investment announced by AMGN on the morning of September 26th. While details could change the ultimate impact, we view this announcement as better than feared as it removes a longstanding overhang for the sector.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.