The Edge of the Map

November 3, 2025 By Sage Advisory

Expectations were high for the FOMC to deliver a dovish outcome in last week’s rate decision. As anticipated, the Fed lowered its policy rate by 25 basis points to a range of 3.75% to 4.00% and signaled an end to balance sheet runoff. However, the announcement also included a few hawkish surprises, which injected fresh uncertainty into the outlook for Fed policy — especially in light of the limited federal economic data available due to the ongoing government shutdown.

The decision came with two dissents. Board member Stephen Miran favored a 50-basis-point cut, which was anticipated, but Kansas City Fed President Jeff Schmid’s opposition to any cut at all surprised markets, as it signaled internal disagreement within the FOMC over how to interpret the incoming economic data. The Fed’s balance sheet reinvestment plan added nuance: while maturing Treasuries will be reinvested across the curve, MBS proceeds will go exclusively to the front end. This signals an intent to shorten the average maturity of the Fed’s holdings, meaning less demand for longer-dated coupon bonds.

Perhaps the most striking signal of the Fed’s effort to temper expectations came from Chair Powell’s words. He repeated three times that an additional December cut is “far from a foregone conclusion” — almost as if he had crafted a motto to communicate his stance to the public during the press conference.

In the days following the decision, skepticism about continued rate cuts intensified. Two major Fed regional presidents — Lorie Logan of Dallas and Beth Hammack of Cleveland — publicly stated they would not have supported a cut due to persistent inflation concerns. While neither currently holds a voting seat, both will in 2026, and their candor added weight to doubts about the Fed’s dovish trajectory.

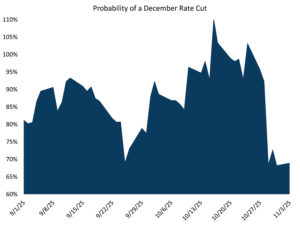

Against this backdrop, market expectations had reached the edge of the map: with so much dovishness already priced in, the Fed had little room to surprise on the dovish side — and ample room to shock with a hawkish tilt. Reflecting this shift, the market-implied probability of a December rate cut dropped sharply from 100% to 69%.

Source: Sage, Bloomberg

Now, as the government shutdown stretches into its sixth week, credit concerns begin to surface, and uncertainty around the Fed’s near-term policy path intensifies, the outlook for rates has become more complicated.

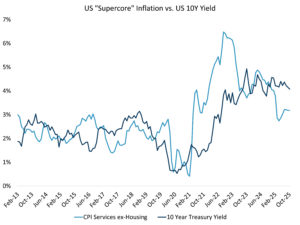

From a big picture perspective, the Fed is still moving toward lower rates, given that current levels remain well above the estimated long-term neutral rate of around 3%. However, this week’s communications suggest that the pace of easing may be slower than markets had anticipated. While the near-term risk/reward profile for rates remains murky, the longer-term trajectory still points toward lower yields — supported by continued Fed easing, the end of balance sheet runoff, and contained inflation, particularly within the Fed’s closely watched services “Supercore” measure.

Source: Sage, BLS, Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.