The Quiet Force Behind Economic Growth: Federal Spending’s Shifting Role

August 18, 2025 By Sage Advisory

One of the most important but often overlooked macroeconomic shifts in recent years is the changing role of federal government spending in driving the real economy. While headlines tend to spotlight deficits and debt ceilings, the bigger story lies in how much the government spends relative to the size of the economy. This ratio, known as federal outlays-to-GDP, plays a critical role in shaping growth and increasingly shifts the responsibility for sustaining expansion onto the private sector.

As federal spending slows, the economy faces a headwind — unless consumer demand, corporate investment, and productivity gains, especially from AI and automation, step in to fill the gap.

Tracking the Government’s Footprint

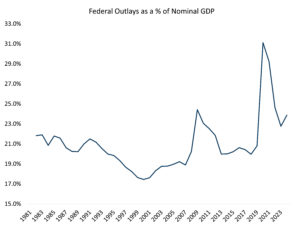

Federal outlays as a share of nominal GDP offer a clear view of the government’s fiscal footprint. This ratio has ranged from a low of 17.3% in FY 2000 (during the late-1990s budget surplus era) to a high of 31.1% in FY 2020, averaging 20.9% since 1981.

A notable shift occurred after the 2008 financial crisis. From 1981 to 2007, federal spending averaged 19.8% of GDP. Post-2008, that average rose to 23.1%, reflecting structural changes in how the government allocates funds. Entitlement programs, like Social Security and Medicare, have grown significantly, driven by demographic trends and expanded benefits. These programs now account for over 60% of total spending, up from 45% in 1981.

Meanwhile, discretionary spending has shrunk from 50% to just 25%, and interest payments have climbed to around 14% of the budget, up from a historical range of 8%-10%, due to rising debt and higher interest rates. Compared to the post-WWII average of 19.5% (1947-1980), today’s spending levels reflect a larger welfare state and more active countercyclical fiscal policy.

Source: Sage, US Treasury, BEA

The Slowdown and Its Implications

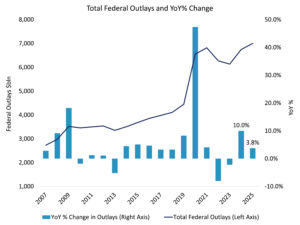

Federal spending growth is now decelerating. In FY 2024, total outlays rose 9.98% year-over-year, reaching approximately $6.75 trillion — up from $6.13 trillion in FY 2023. This increase was driven largely by mandatory programs and surging interest payments. But in FY 2025, growth is expected to slow to just 3.75%, with outlays projected at $7.0 trillion, according to the CBO’s January 2025 baseline.

This slowdown — more than a 6% drop in spending growth — places greater pressure on the private sector to sustain economic momentum. Returning the outlays-to-GDP ratio to its long-term average of 20.9% would require cuts of 2 to 3 percentage points of GDP, or roughly $600-$900 billion annually, based on projected FY 2025 GDP of $29-$30 trillion.

The impact of such cuts depends on fiscal multipliers, which the CBO estimates range from 0.5x to 2.5x depending on the type of spending. In other words, every $1 reduction in spending could reduce GDP by $0.50 to $2.50. Historical examples include the 2013 sequestration, which shaved 0.5%-1.0% off GDP growth, and Europe’s 2010-2012 austerity measures, which prolonged economic stagnation.

Source: Sage, US Treasury

Private Sector: Time to Step Up

With federal spending growth slowing, the private sector will need to take the lead in driving expansion. That means stronger consumer spending, increased business investment, and productivity gains, particularly from AI and automation, will be essential to offset the fiscal drag.

In the near term, the strength of the labor market and consumer spending will be key indicators of whether the private sector can carry that weight. If these areas hold up, they could help sustain growth even as the government pulls back.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.