The Specter of Funding Stress

October 27, 2025 By Sage Advisory

In a previous Notes prior to the September FOMC meeting, we wrote that the Fed’s balance sheet runoff and increased Treasury bill issuance will continue to expose potential funding stress, especially with the overnight reverse repo facility (RRP) nearly depleted. Incremental Treasury bill issuance now directly reduces bank reserve balances, draining liquidity from the financial system. This means that the Fed could soon slow or stop shrinking its balance sheet, which would serve as an additional tailwind for lower rates in the months to come.

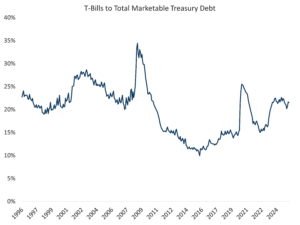

Money market funds (MMFs) parked their cash at the ON RRP facility after the COVID stimulus, which swelled as interest rates rose in 2022. T-bill issuance during that time resulted in MMFs shifting funds parked at the Fed’s RRP into T-bill issuance. As T-bills have taken up a growing share of total Treasury issuance to fund the sizeable fiscal deficit, the ON RRP facility has been largely depleted. Each new round of T-bill issuance will require fresh capital from the market; otherwise, it will begin to pull liquidity directly from the broader financial system, namely bank reserves. T-bill issuance to total US Treasury debt has increased to 22% from as low as 10% in 2015.

Source: Sage, US Treasury

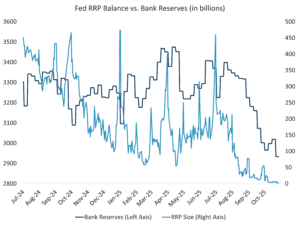

Additionally, the Fed currently allows up to $25 billion in Treasuries and $35 billion in mortgage-backed securities to mature each month without reinvesting the proceeds. By reducing its balance sheet through quantitative tightening (QT), the Fed removes reserves from the financial system as these Treasuries and MBS mature and are not replaced.

As a result, bank reserves have now fallen below $3 trillion, which is under the “ample” level indicated by Fed Chair Jerome Powell in his October 2025 speech.

Source: Sage, Federal Reserve

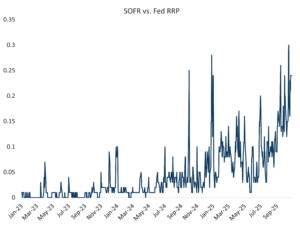

This reduction in reserves tightens financial conditions by increasing competition for liquidity among banks, raising short-term funding costs. The chart below shows the difference between the secured overnight financing rate (SOFR) and the Fed’s RRP rate. The higher the spread indicates higher competition for liquidity among banks, and a sustained rise in this relationship could indicate financial strain.

Source: Sage, Bloomberg, Federal Reserve.

With bank reserves now below the Fed’s “ample” threshold, the central bank may soon be compelled to slow or halt quantitative tightening. This shift would help to stabilize reserve levels and also act as a tailwind for lower interest rates. The risk-reward is increasingly skewed toward an easier Fed.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.