The Two-Faced Economy: Strong Data Amid Shaky Sentiment

May 6, 2025 By Sage Advisory

The current geopolitical climate has injected an extra dose of unpredictability for economic participants, as investment and consumption decisions for everyone have been clouded by trade wars and fiscal policy. Sentiment on the economy is understandably depressed, weighed down by uncertainty; however, real economic data remains expansionary, and should be able to withstand geopolitical stress and tariff concerns over the next few months.

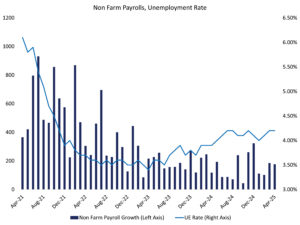

Labor market data last week was solid, with payrolls growing by 177,000 jobs in April, handily beating expectations. The unemployment rate remained near a healthy 4.2% rate, and while it is too early for tariff uncertainty to affect employment, it is clear that the economy is on sound footing.

Source: Sage, Bureau of Labor Statistics

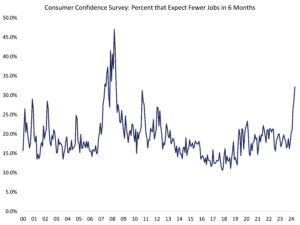

Consumer sentiment on the outlook for jobs, however, is a different story. The most recent Conference Board Consumer Confidence Survey results indicated that 32% of respondents expect there to be fewer jobs in 6 months, which is the highest reading since the Great Financial Crisis.

Source: Sage, The Conference Board

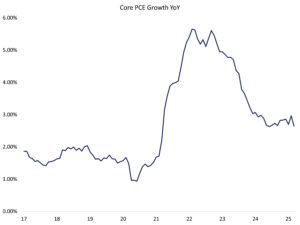

Dynamics around inflation are similar, as the recent core PCE (personal consumption expenditures, excluding food and energy) release continued to show a moderating pace of inflation, with core PCE up 2.6% on an annualized basis.

Source: Sage, The Bureau of Economic Analysis

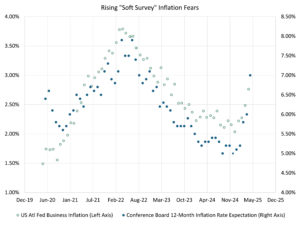

Consumer sentiment, however, reflects a deep concern for the future path of inflation. Survey measures of expected inflation have ticked higher in recent months.

Source: Sage, The Conference Board, FRB Atlanta

It is evident that uncertainty is weighing on sentiment, but the effects on underlying economic activity have yet to be seen. This is natural, as the impact of tariffs, whatever they end up being, will take months to materialize in the hard economic data readings.

How does this affect markets and, in particular, interest rates? We believe the FOMC will continue to display patience in resuming rate cuts until the second half of this year, if inflation and growth continue to decelerate. The variance of outcomes for the economy will be wide, as tariffs, tax cuts, and fiscal deficit developments will all serve as catalysts for the economy and markets through the summertime.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.