Understanding the Hidden Risks in High-Yield Municipal Bonds

June 26, 2025 By Sage Advisory

Fixed income investors are often caught in a balancing act: the pursuit of higher yields versus the need to manage risk. In today’s environment, where investment grade municipal bonds offer modest returns, many investors are drawn to high-yield municipal bonds for their significantly higher income potential. Historically, this strategy has paid off — especially when investments are made through diversified, commingled funds that offer liquidity buffers.

However, this approach can mask a critical vulnerability: the underlying illiquidity of many high-yield municipal securities. These bonds, often tied to niche or speculative projects, can be difficult to price and even harder to sell in stressed markets.

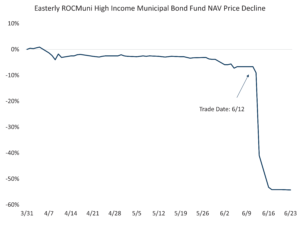

A recent and dramatic example underscores this risk. The Easterly ROCMuni High Income Municipal Bond Fund experienced a nearly 50% drop in net asset value (NAV) in just one day — falling from $6.15 on June 12 to $3.16 on June 13.

Source: Bloomberg

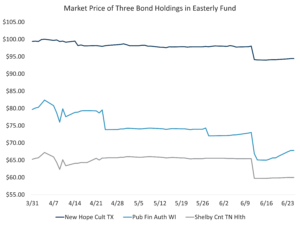

This sharp decline was triggered by the fund’s forced liquidation of illiquid holdings, including debt from biofuel ventures, recycling plants, and retirement facilities — sectors known for their limited trading activity and opaque pricing.

Source: Bloomberg

Because municipal bonds are typically priced using models rather than actual market transactions, the gap between theoretical value and real-world sale prices can be vast — especially during periods of forced selling. This event highlights the potential for significant losses, even in a market segment that has delivered strong returns over the past decade.

At Sage, we’ve long emphasized the importance of liquidity and credit quality. Our commitment to investment-grade municipal bonds ensures that our clients benefit from transparency, stability, and real market pricing. While high-yield bonds can play a role in a diversified portfolio, investors must remain vigilant about the hidden risks — particularly those tied to liquidity and price discovery.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.