Unemployment In Context

August 11, 2025 By Sage Advisory

Given July’s recent payrolls miss and outsized negative revisions, the unemployment rate ticked up to 4.2% from 4.1% — stirring anxiety about whether the labor market is beginning to buckle after a period of extraordinary resilience.

But context matters.

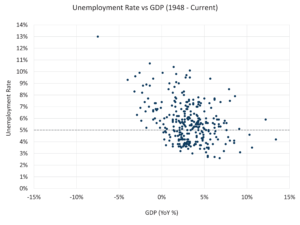

The chart below plots quarterly data from 1948, comparing the unemployment rate to year-over-year real GDP growth. What stands out is that negative GDP prints have historically clustered when unemployment is above 5%. At the current level of 4.2%, we’re still comfortably below that threshold — and still in the territory that has typically coincided with economic expansion.

Source: Sage, BEA, BLS

The current policy stance is restrictive, but it’s not becoming more so. Instead, markets have shifted their focus to how quickly the Fed will normalize. Currently, the pendulum of expectations has swung hard toward accommodation. Cuts in September, November, and December are nearly fully priced in. The easing path looks fully valued, leaving little room for any sign of stabilization in the labor market or upside inflation surprises. While yields remain asymmetrically biased lower — especially in a downturn or hard-landing scenario — they could push the pendulum back and reprice the front end higher.

Still, history suggests we’re not in dangerous territory yet. With unemployment below 5%, the backdrop leans toward expansion, not recession. But when the market is leaning this far in one direction, it takes little for the momentum to shift. With cuts fully priced in and yields already reflecting a dovish tilt, the near-term risk/reward around adding duration here warrants caution.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.