US Aluminum Poised for a Comeback – Century’s Bond Is a Signal, Not Just a Deal

July 23, 2025 By Sage Advisory

Century Aluminum is considering development of the first new US aluminum smelter in nearly 50 years — a move that could revitalize the domestic industrial metals landscape. The company recently raised capital in the high-yield market with a $400 million 7NC3 senior secured note at 6.875%, signaling renewed investor interest in US-based metals production.

Source: Sage, Bloomberg

Strategic Supply Gap

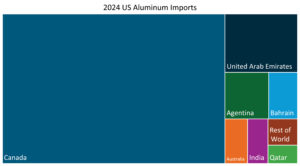

In 2024, the United States imported approximately 3.6 million metric tons of aluminum, while domestic production totaled just 678,000 metric tons. Century already produces about 60% of all US primary aluminum, but with the US facing a 4 million metric ton deficit — and domestic output representing just 1% of global supply — the company has significant room to grow. A new smelter would not only reduce reliance on imports but also enhance supply chain resilience for critical industries like aerospace, defense, and clean energy.

Industrial Revival Meets Fixed Income Opportunity

Century’s bond issuance reflects a broader resurgence in US industrial investment, particularly in sectors aligned with national security and energy transition. For bond investors, this marks a shift from traditional commodity risk toward policy-supported infrastructure plays. The aluminum sector, once considered cyclical and globally oversupplied, is now being reshaped by tariffs, tax credits, and strategic supply concerns.

Policy Tailwinds

Century is benefiting from a confluence of policy support: Section 232 tariffs help level the playing field against subsidized foreign producers, such as China, and a $500 million DOE grant supports the buildout of domestic smelting capacity. IRA tax credits further enhance project economics.

Financial Discipline

Century Aluminum is poised for a breakout year in 2025, with projected EBITDA topping $300 million, more than double its 2023 EBITDA of $133 million. The company is also aiming to reduce net debt to $300 million and maintain leverage below 2.0x — a notable shift for a historically volatile credit.

Century’s recent bond issuance offers attractive relative value compared to other high-yield industrials, especially given its improving fundamentals and strategic backing. While the company’s high-cost structure and commodity exposure remain credit considerations, its partnership with Glencore PLC — a supplier, customer, and partial owner — provides additional stability.

Ripple Effects Across the Supply Chain

This isn’t just a bond deal — it’s a signal that investment in US aluminum is back on the industrial policy map. If Century moves forward with capacity growth, it will mark a turning point in the strategic importance of US smelting capacity — and a potential inflection point for investors looking to align yield with long-term structural themes.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.