What the Decline in ON RRP Means for Markets

September 15, 2025 By Sage Advisory

All eyes are on the FOMC this week, with markets broadly anticipating a rate cut. Market participants will be closely analyzing the dot plot, the Summary of Economic Projections, and Fed Chair Powell’s press conference for signals on the future policy trajectory. Meanwhile, a quieter but significant shift is unfolding beneath the surface. With the overnight reverse repo facility (RRP) nearly depleted, Treasury bill issuance now directly reduces bank reserve balances, draining liquidity from the financial system. This change elevates the importance of money market dynamics, as tightening liquidity conditions could amplify financial stress.

In the aftermath of the Global Financial Crisis, the Federal Reserve began paying interest on reserves as a tool to maintain control over short-term interest rates. However, this mechanism was limited to large depository institutions, leaving smaller entities — including government-sponsored enterprises (GSEs), regional banks, and money market funds (MMFs) — unable to earn interest directly from the Fed. These institutions sought alternative short-term investments, which became problematic when the Fed attempted to raise rates. Excess liquidity kept overnight rates low despite policy changes, prompting the Fed to introduce the ON RRP. This allowed smaller players to lend to the Fed overnight, effectively establishing a floor under short-term rates and improving the Fed’s ability to transmit monetary policy.

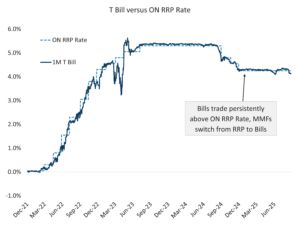

In the wake of Covid, the Fed injected trillions of dollars into the economy through asset purchases, much of which flowed into MMFs. With Treasury bill yields suppressed due to limited issuance and regulatory constraints, MMFs parked their cash at the ON RRP facility, which ballooned to $2.5 trillion as interest rates rose in 2022. Since that time, increased Treasury bill issuance pushed yields above the ON RRP rate, prompting MMFs to shift funds from the Fed to T-bills.

Source: Sage, Bloomberg

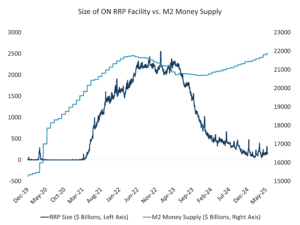

This reallocation offset the liquidity drain from bond issuance, keeping the overall money supply stable. As T-bills have taken up a growing share of total Treasury issuance to fund the sizeable fiscal deficit, the ON RRP facility has been largely depleted. Going forward, each new round of T-bill issuance will require fresh capital from the market; otherwise, it will begin to pull liquidity directly from the broader financial system.

Source: Sage, Federal Reserve

As the ON RRP facility nears depletion, money markets are likely to become more sensitive to shifts in Treasury issuance and fluctuations in the Treasury’s cash balance. For the Fed, continued balance sheet runoff will intensify pressure on market liquidity, potentially complicating the effective transmission of monetary policy.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy, or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis, and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.