Two perspectives emerge when analyzing the state of US consumers. Sentiment surveys paint a picture of economic weakness, yet behavioral data tells a different story — spending remains in line with historical expansion trends. We believe hard data offers the most accurate reflection of reality, and by that measure, the economy appears resilient, even as labor markets show signs of stagnation.

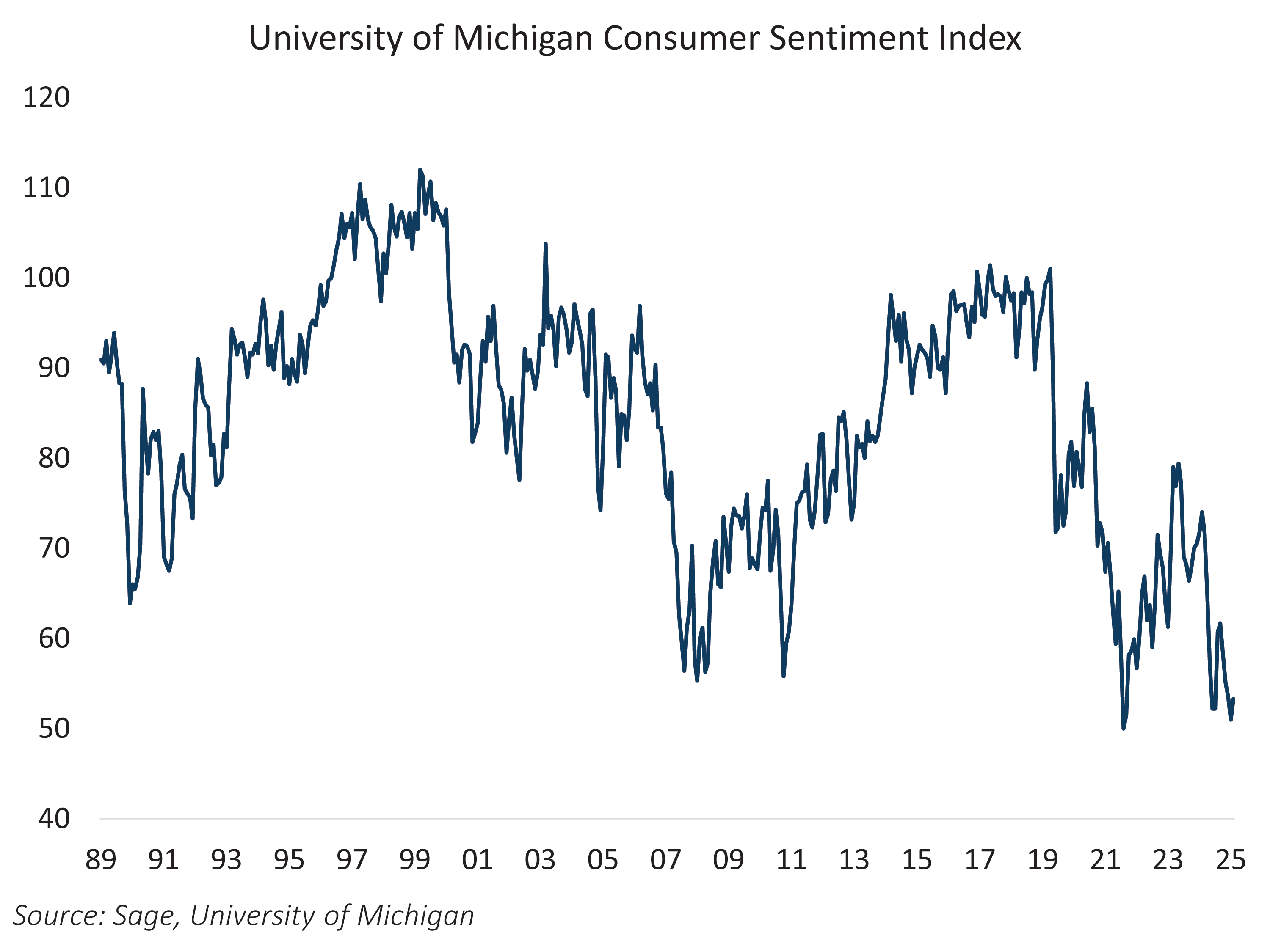

Survey-based sentiment indicators point to rising concerns about the economy and future spending. The latest University of Michigan Consumer Sentiment Survey remains near its post-pandemic lows, while the Conference Board’s Confidence Index fell in November to levels approaching those same lows.

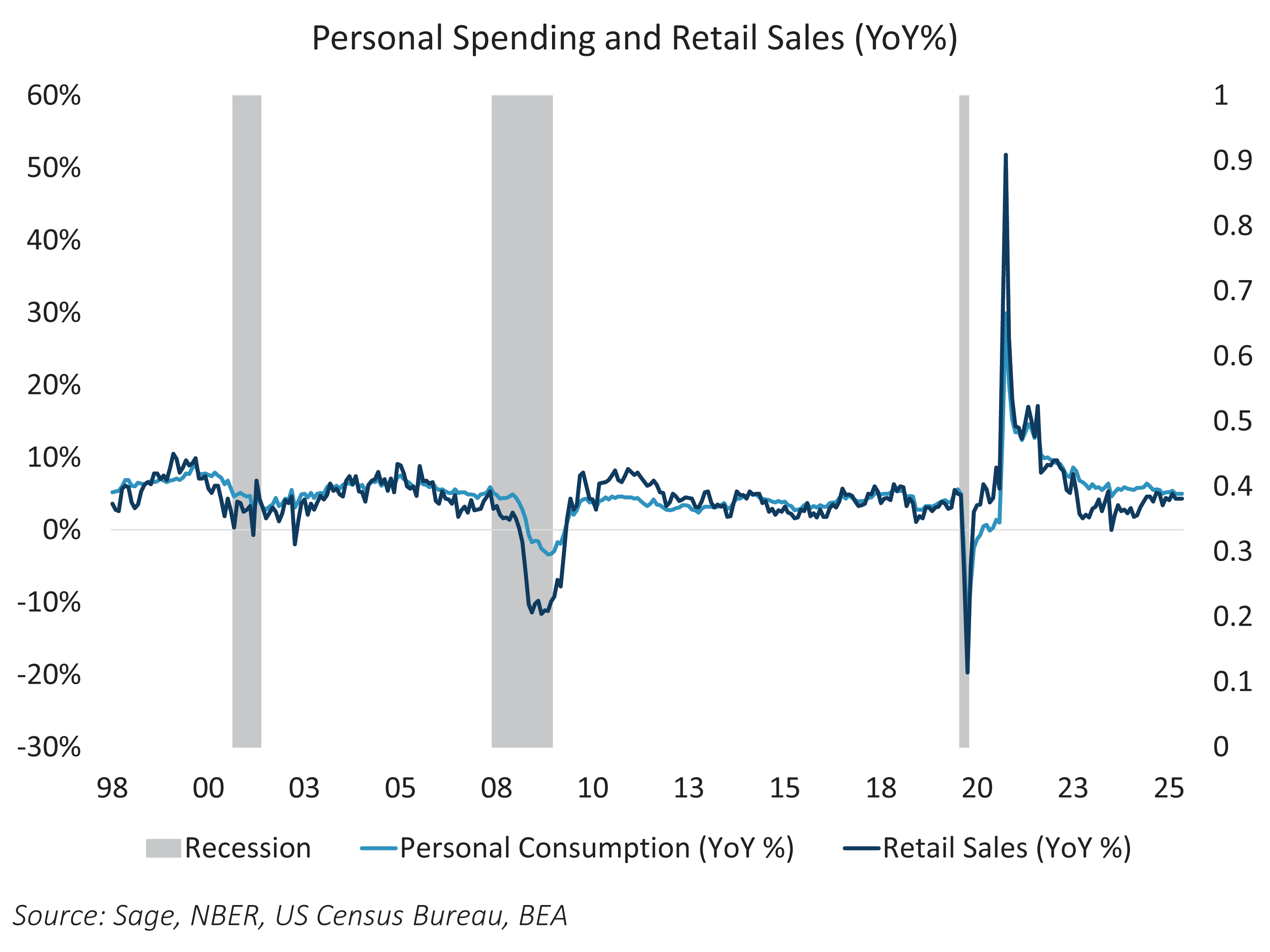

This pessimism is understandable given inflationary shocks, political polarization, and a stagnant labor market. However, sentiment has not translated into weaker spending, as hard data continues to align with levels seen during economic expansions. Recently released lagged data, delayed by the government shutdown, shows personal consumption and retail sales are growing at 5% and 4.3%, respectively.

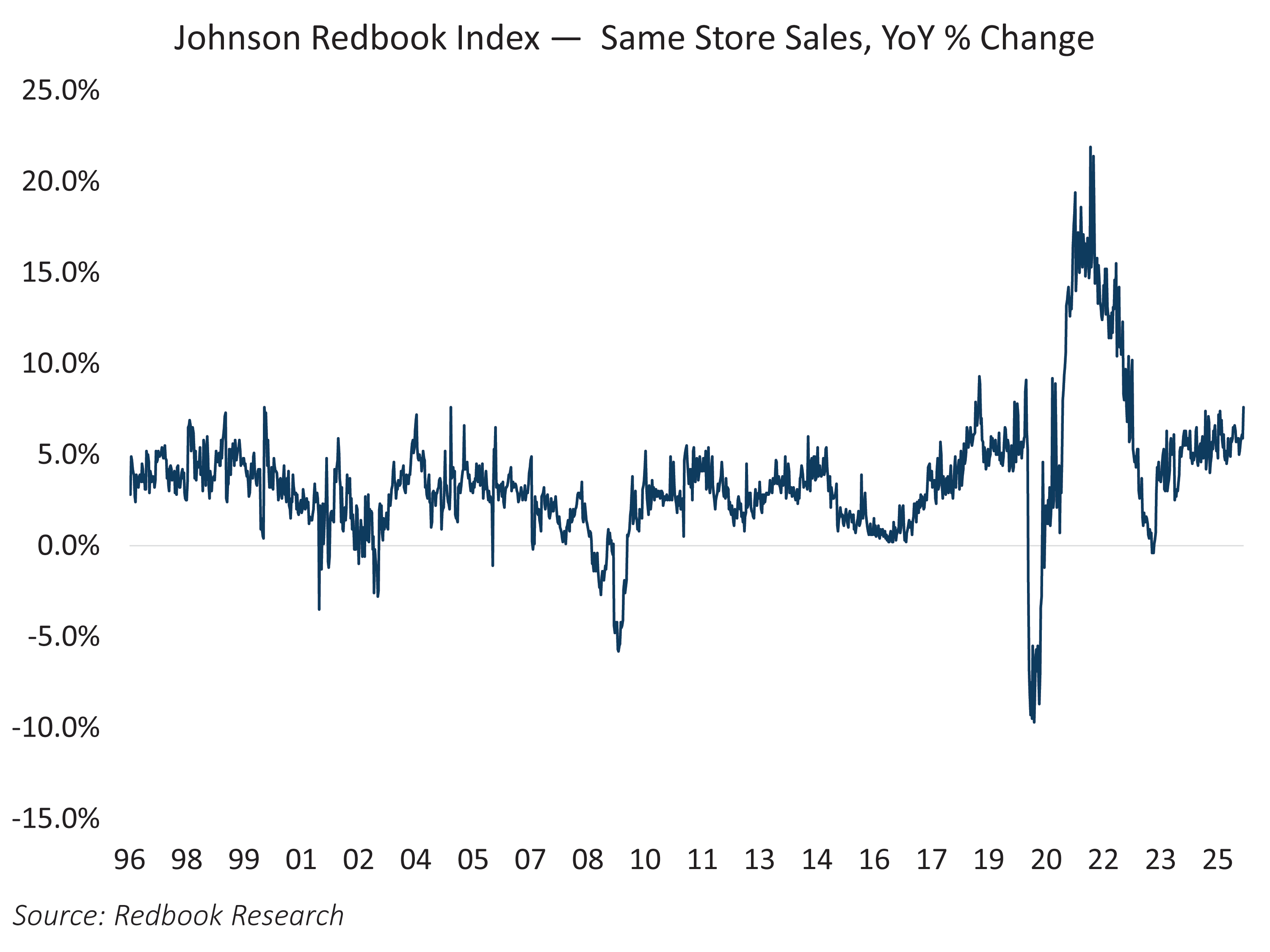

Real-time, private data reinforce the story of strong consumption despite poor sentiment. The Johnson Redbook Index is a privately published measure of same-store sales growth at large US general merchandise retailers. Compiled by Redbook Research, a division of LSEG (London Stock Exchange Group), the index tracks year-over-year changes in sales at stores that have been open for at least a year. Because it reflects actual retail activity rather than survey-based sentiment, the index provides a timely gauge of consumer spending behavior. As of November, same-store sales were up 7.6% year-over-year.

Additionally, results from the most recent Black Friday shopping period were robust, signaling healthy retail activity and resilient consumer demand. Over the five-day Thanksgiving weekend, a record 203 million consumers shopped in-store or online, surpassing last year’s 197 million. Mastercard SpendingPulse reported Black Friday retail sales (excluding autos) rose 4.1% year-over-year, an acceleration from last year’s 3.4% gain and above Mastercard’s holiday forecast of 3.6%. In-store sales increased 1.7%, while online sales surged 10.4%, with notable strength in apparel (+5.7%) and jewelry (+2.3%). Adobe Analytics reported online spending on Black Friday grew 9.1%, following a strong 10.2% gain in 2024 and exceeding initial forecasts. Salesforce added that global online sales reached $79 billion, up 6%, with US sales at $18 billion, up 3% — though price increases drove much of the growth. Combined, these figures underscore a consumer base that remains highly engaged and willing to spend, even amid economic uncertainty.

The economy continues to expand, supported by strong consumer spending and resilient growth. At the same time, the labor market is stagnant, with job gains expected to be about 50k per month and little evidence of either hiring or firing momentum. This mix of healthy demand and weak employment complicates the Fed’s path forward: aggressive rate cuts could risk reigniting inflation (both via the real economy or asset bubbles), while a cautious approach may leave financial conditions tighter than needed. While the Fed is widely expected to lower rates at this week’s meeting, the bigger question is how much room do policymakers have to cut in 2026?