The Federal Reserve delivered a widely anticipated rate cut in December, signaling caution about growth risks while maintaining a “wait and see” stance. In the press conference following the decision, Chair Powell struck a more dovish tone than markets expected, emphasizing the risks of a weak labor market beyond what the underlying data indicated. Powell’s remarks, as well as the surprise announcement of Treasury bill purchases — a move seen as dovish despite its technical purpose — fueled a bull steepening in yields and a rally in risk assets.

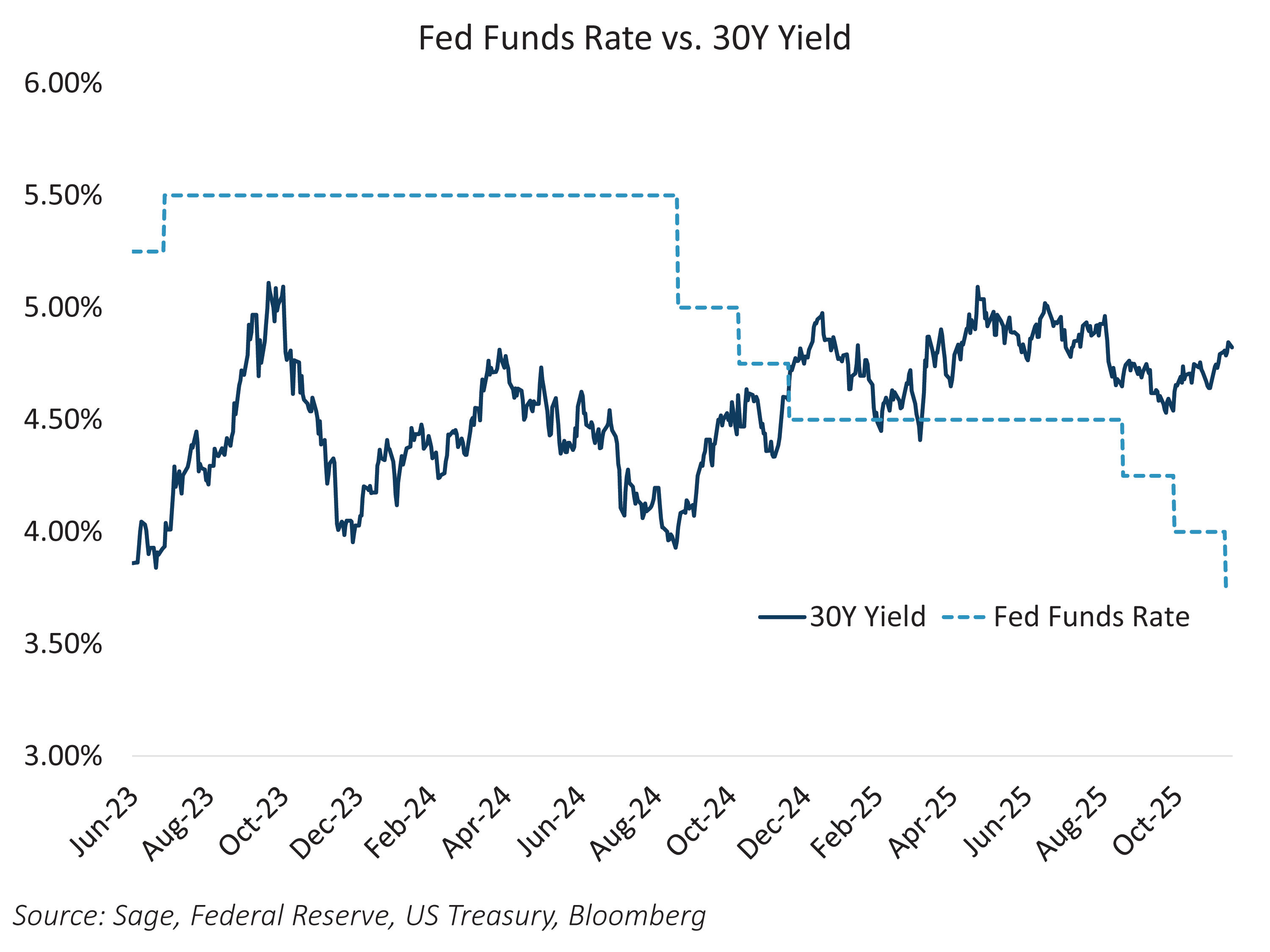

Despite the market’s dovish interpretation of the FOMC meeting, the global easing cycle is nearing its end. The Fed has cut rates by 175 basis points since September 2024, and with growth projected at 2.3% next year, policy now sits near neutral. Powell reinforced this shift, noting the fed funds rate is “within a broad range of estimates of neutral,” a clear departure from earlier guidance that it was merely “moving toward neutral.”

Most major central banks are in a similar position: the ECB, RBA, and Bank of Canada are signaling that their next moves are likely hikes, not cuts. After a period of aggressive easing despite the absence of recession, further rate reductions — combined with ongoing fiscal deficit spending — could overheat the economy and force a faster-than-expected return to tightening.

The long end of the curve reflects the reality of a solidly expanding economy. Thirty-year Treasury yields have risen 35 basis points from October lows to 4.86%, mirroring similar moves in global long-maturity bonds. Investors are pricing in sustained growth and a strong fiscal impulse in 2026. A global trend of government deficits continues to support expansion, and the steepening at the long end signals confidence that this cycle can persist without additional aggressive easing.

The inflation portion of the Fed’s mandate has also seen progress. Powell noted that most of the remaining overshoot stems from tariff-driven goods categories rather than domestic overheating. Excluding tariff-affected goods, inflation is already in the low 2% range, while services inflation and wage pressures are easing. Goods inflation is expected to peak in early 2026, as import levies create a one-time price adjustment rather than ongoing year-over-year increases.

The era of aggressive rate cuts is likely over. While some additional easing remains possible, the bar for further action is high given steady growth and cooling inflation. Meanwhile, the long end of the curve should be rangebound at these levels as it faces the push and pull from lower policy rates while contending with structural forces. Tax cuts are expected to boost an already expanding US economy, and most major economies are deploying fiscal programs to support growth. On balance, the curve is biased toward steepening as markets reconcile stable short rates with a fundamentally constructive growth outlook.