The US economy is increasingly defined by a K-shaped trajectory, where affluent households continue to spend and accumulate wealth while lower-income consumers struggle to keep pace. This divergence is most visible in the credit landscape: auto loans and credit card balances have surged to record highs, but the burden is far from evenly distributed. For prime borrowers, steady income growth and robust asset gains provide a cushion, while subprime and lower-income households face rising interest costs, shrinking savings, and mounting delinquencies. The result is a financial squeeze on lower-income consumers as essential expenses and debt servicing crowd out discretionary spending, creating a two-speed consumer economy.

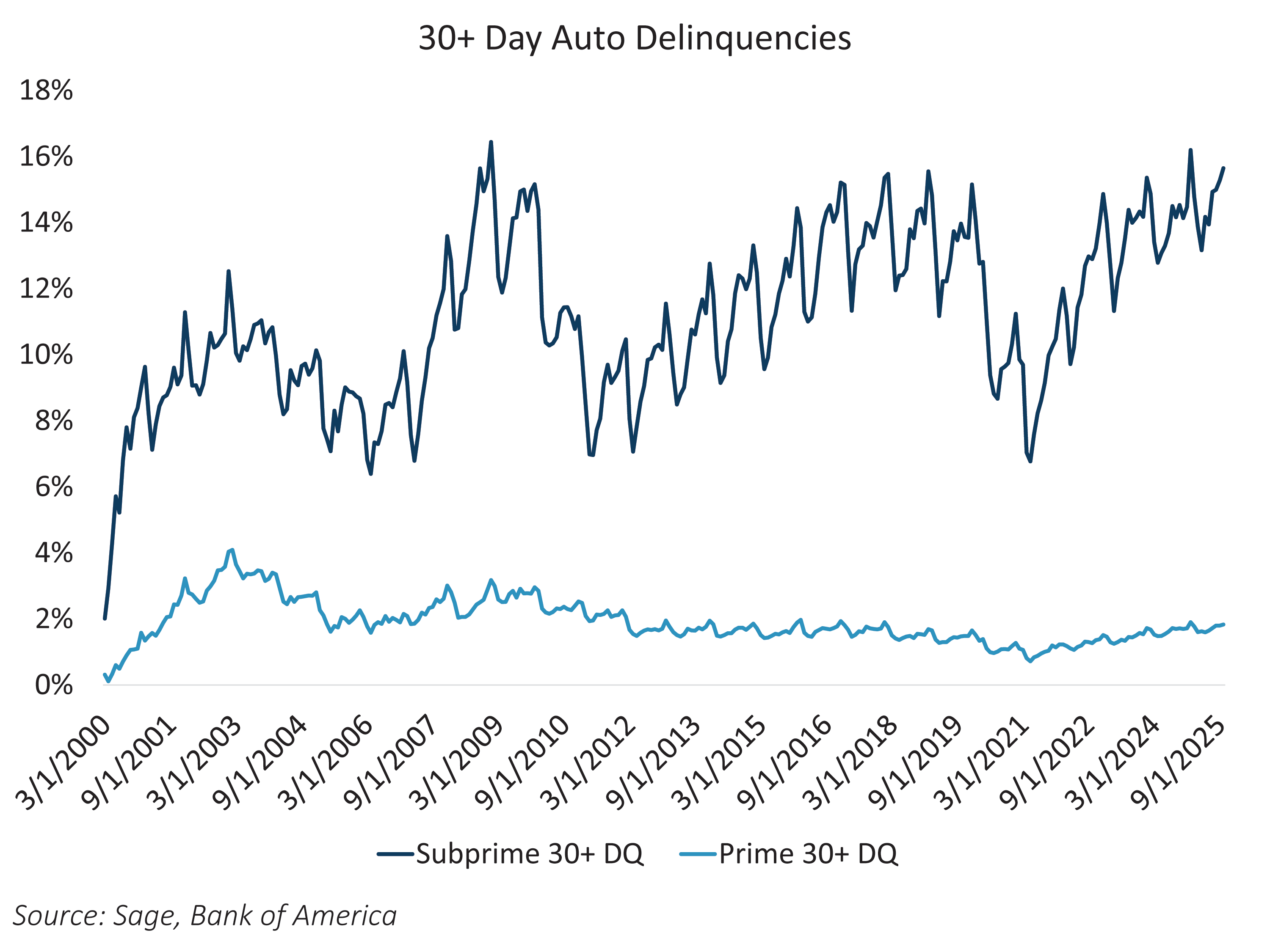

Auto loan delinquencies offer a clear lens into the uneven financial pressures across consumer classes. For prime borrowers, delinquency rates remain relatively low, hovering near 2%. The picture is starkly different for subprime borrowers, where delinquency rates are approaching 16%, signaling acute financial stress. While recent bank earnings suggest overall consumer loan performance is better than feared, pockets of vulnerability, particularly in the subprime segment, pose a risk that could persist if economic momentum slows and unemployment rises. This divergence underscores the structural fragility beneath headline averages and highlights why credit quality trends deserve close attention.

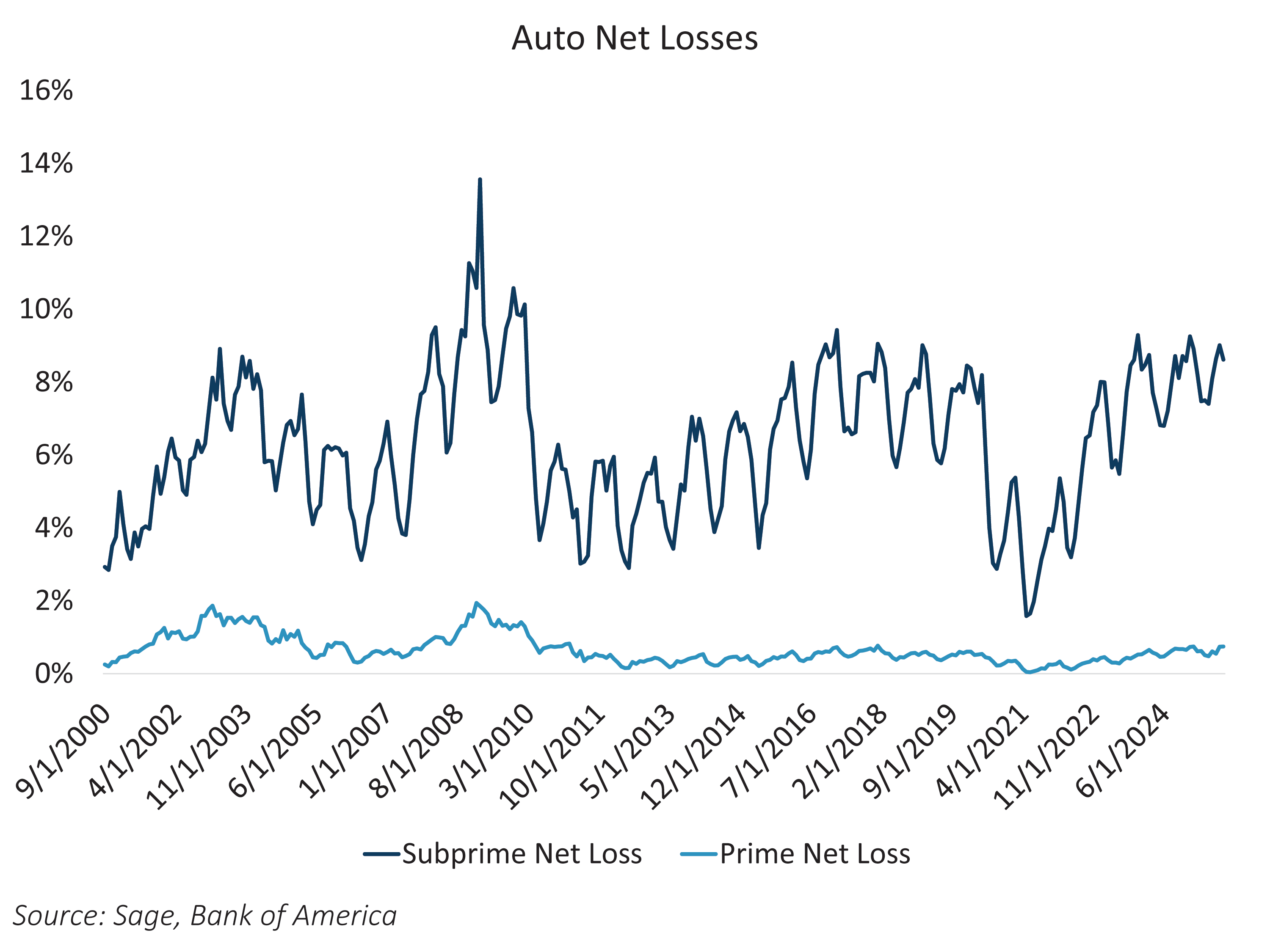

While rising subprime delinquencies grab headlines, it’s important to remember that subprime auto ABS structures are built to absorb far worse performance scenarios. Senior tranches in these deals typically have credit enhancement levels that allow them to withstand up to 35% trust losses without impairment, a buffer far from the current loss rates of 8.5%. In other words, while the uptick in subprime stress warrants monitoring, the impact on the ABS market remains limited. These securitizations are engineered for volatility, and most senior bonds remain well-protected, even under severe stress assumptions. Don’t kill the messenger – the structural resilience of subprime auto ABS means this is more of a credit cycle story than a systemic risk event.