Looking Beyond Yield in a Multi-Asset Income Strategy

February 28, 2019 By Sage Advisory

Multi-asset income (MAI) strategies can be an excellent fit for investors who need higher levels of income and have a more moderate risk budget as compared to what a traditional fixed income portfolio may allow. Unfortunately, we are now in the part of the economic cycle where some investors will reach too far for yield without considering the risk of those higher-income markets. Investors seeking income through multi-asset strategies should consider the volatility and correlation to equities of many of these strategies.

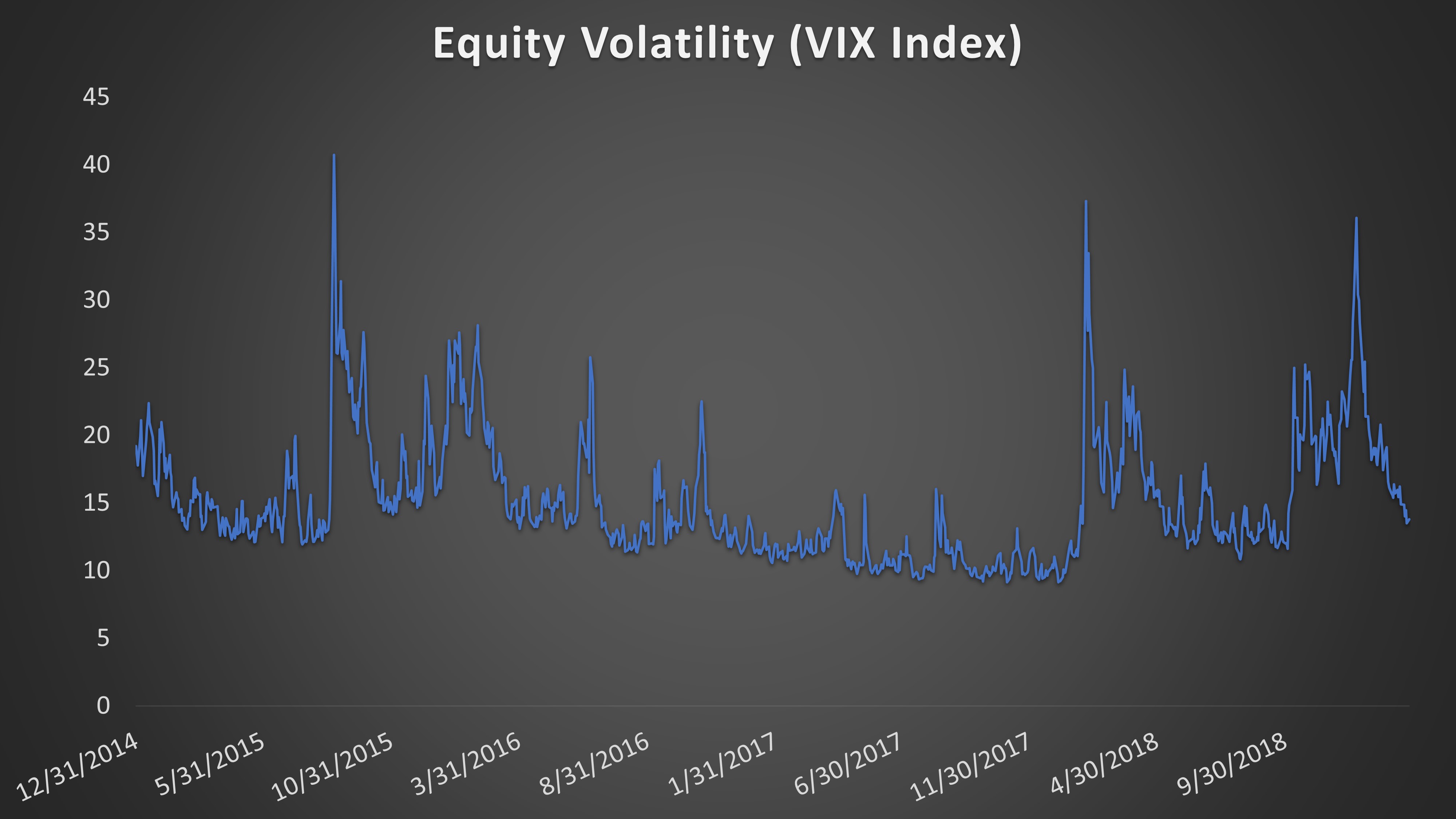

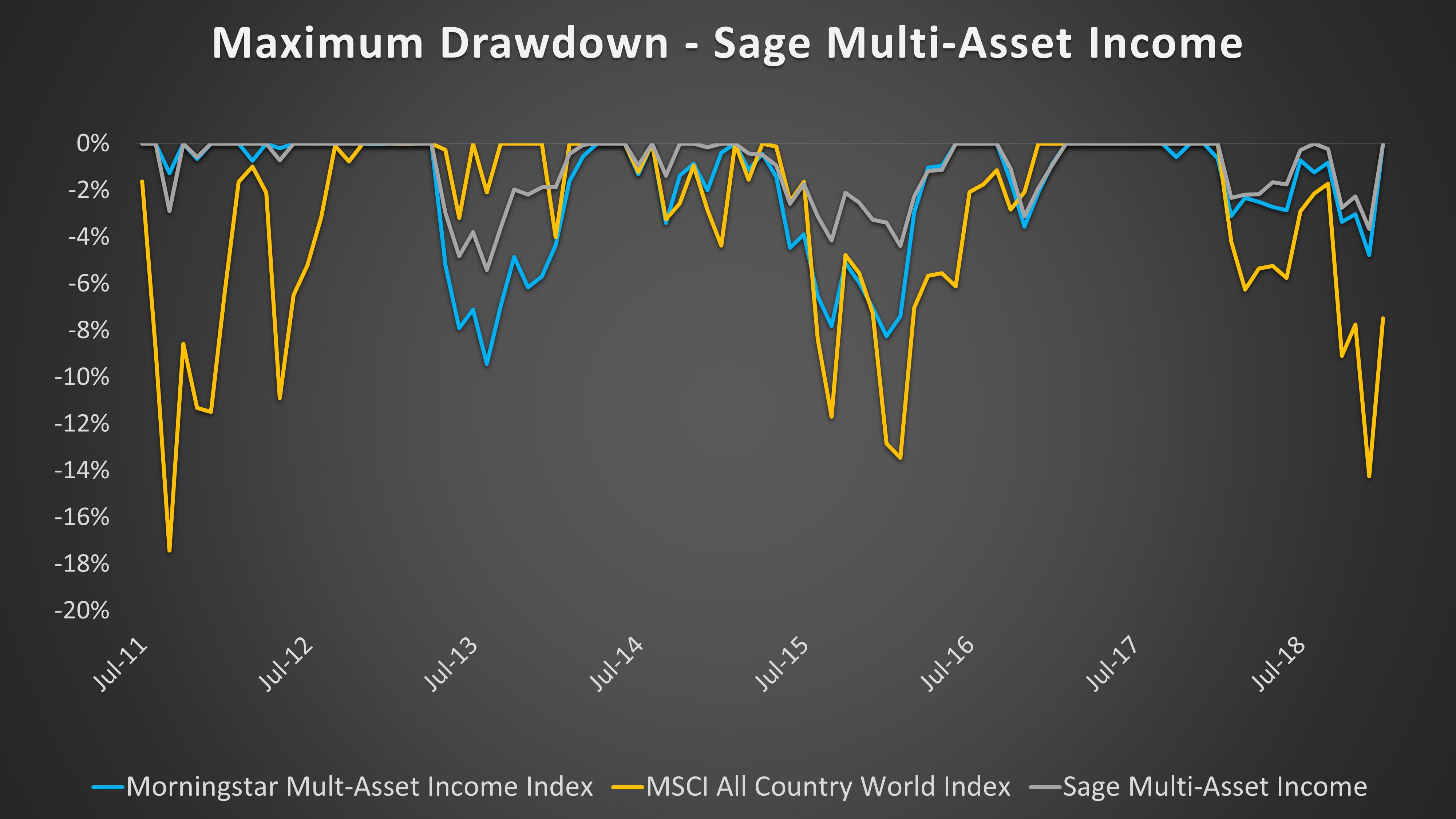

While many MAI strategies have boasted equity-like returns during the recovery, they have also come with equity-like volatility. This was evidenced in 2018, as most MAI funds experienced negative returns, similar to equities. Before 2018, the last year there was a spike in volatility was 2015; MAI funds also struggled that year. The reason is that most MAI strategies rely heavily on high-dividend equities and equity-like markets, such as preferred stocks, high-yield, and alternative fixed income (such as MLPs). This is appropriate to generate higher yields, but if it’s not balanced with an allocation to core high-quality fixed income and managed with overall risk level and volatility in mind, it will lead to a large drawdown in risk-off markets and a high correlation to equities.

We believe that for income-focused investors, large drawdowns and high correlations to equities are unacceptable. Sage’s MAI strategy is managed on a yield-to-volatility concept, where we measure the attractiveness of an income-generating market not by yield alone, but also by its ratio of yield-to-volatility. This ensures we are not gravitating too strongly toward high-income markets with rising volatility or “reaching for yield” in an environment of increasing risks.

At Sage we manage the portfolio with a “risk budget,” so our portfolio’s volatility is closer to a fixed income index than an equity index. This ensures that our portfolios are always well diversified, have a core allocation to high-quality fixed income, and act more like a fixed income portfolio in volatile markets than an equity portfolio. While this approach puts us on the more conservative side of the typical MAI strategy, we will gladly sacrifice modest levels of income and return in bull markets for a more soundly constructed income allocation. In the long run, it’s Sage’s MAI strategy is about 1) generating consistent income without the risk of giving years’ worth of that income back in one drawdown, and 2) providing clients a smooth ride along the way.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.