Rising Taxes and Out-Migration Trends: A Bad Budgetary Combo

April 1, 2019 By Sage Advisory

by Jeffrey Timlin

Numerous major metropolitan cities have experienced an economic boom over the past decade as the technology, energy, health care, and financial industries have flourished. Although their fiscal outlook has improved dramatically since the Great Recession, municipalities face several challenges. An influx of highly paid employees has been a double-edged sword. Tax revenue has increased but so has the cost of living, which has decreased affordability for public service workers. Raising taxes to pay higher salaries for public service workers is only a short-term solution, as municipalities will eventually have to grapple with their main source of revenue – wealthy taxpayers – moving to less-taxing states.

Politicians have been talking about the wealth gap for decades yet have done little to fix the real issue. In this case, the benefits of economic success are being offset by the challenges associated with providing enough public services. That may seem counterintuitive since with more revenue generated comes greater funding ability. However, public services are often the largest municipal expenditure, and the public employees providing these services – teachers, firefighters, police – require an adequate salary to afford to live in the areas they serve. The additional revenue received from high-income tax payers has not been enough to support necessary salary and benefit increases to support the increased cost of living for public service employees. (It is important to note that salaries and benefits for public employees are fixed and don’t fluctuate in-line with tax revenue.) Just look at the defaults of Puerto Rico, Detroit, and Vallejo.

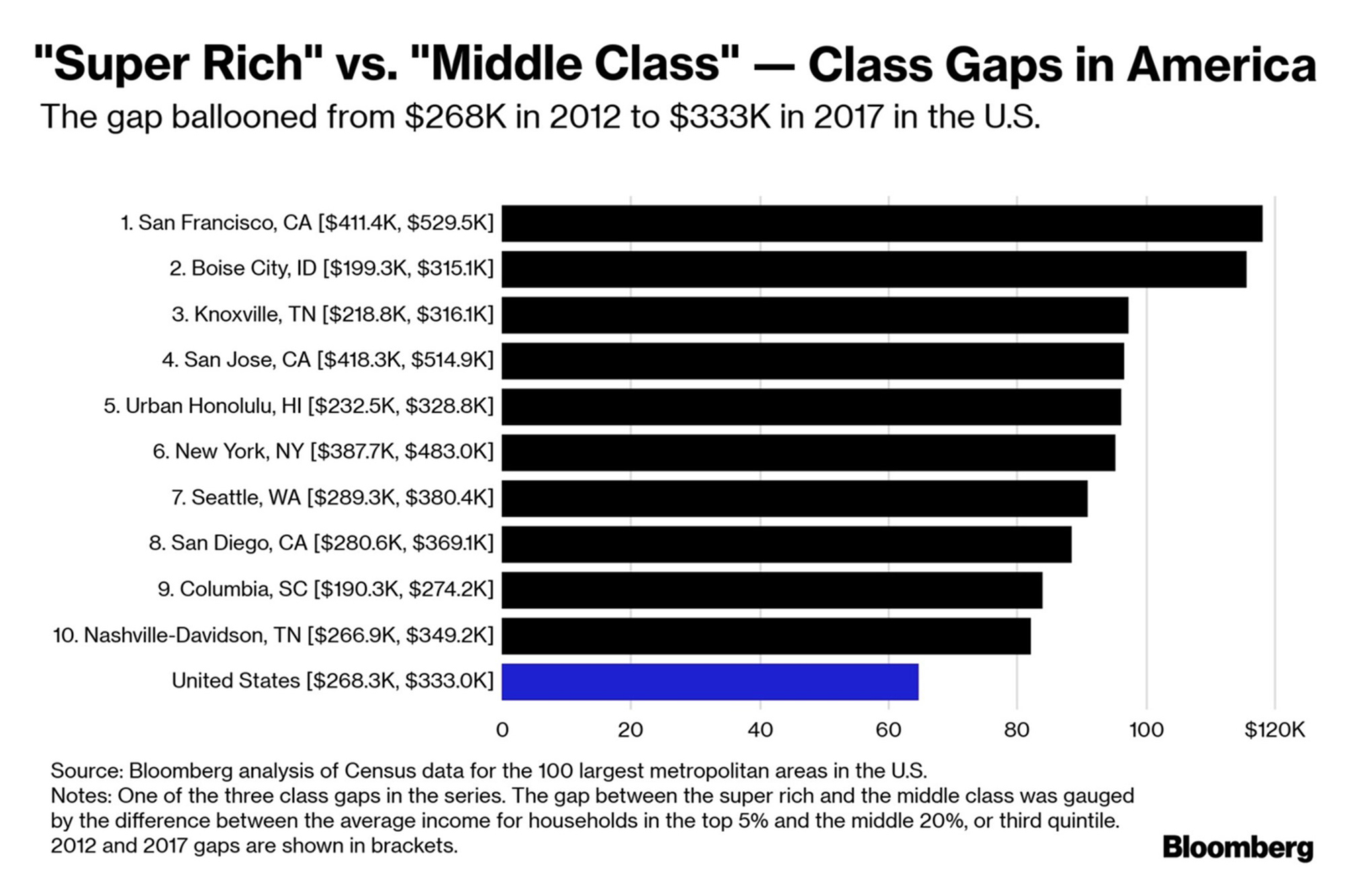

Although the top 10 cities listed above are currently rated AA or better, the growing economic strain associated with the need for additional public services remains unsustainable and will eventually bring greater downward pressure on their respective credit ratings.

A good example of this challenge is found in not only New York City but, more importantly, in New York State, which recently announced a projected $2.3 billion budget deficit. According to New York State officials, this is the most serious revenue shock the state has faced in many years and it is expected to worsen before it gets better. Fiscal imbalances of this nature and magnitude are becoming more common among those cities and states with exceedingly high tax burdens. Indeed, according to a recent WalletHub survey that looked at the combined state income, property and sales tax burdens paid by citizens, New York came in first, at 13.04%; with Illinois, New Jersey, and California close behind.

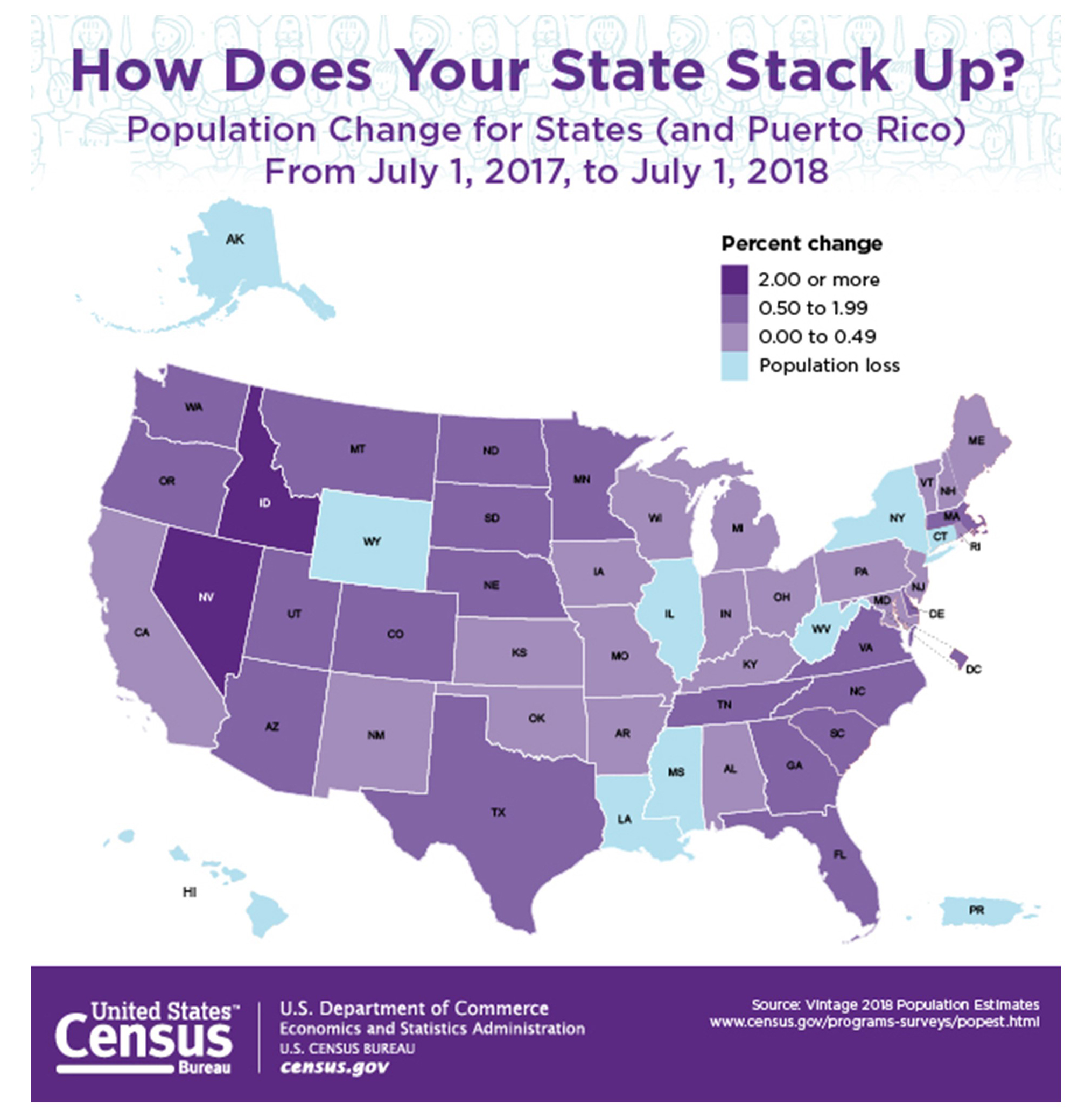

Ongoing political pressure to resolve these challenges will undoubtedly lead to an increase in tax rates, primarily on the wealthy. Although this may initially seem appropriate and prudent, the high reliance on high-net-worth residents can be fickle. Unfortunately, voters and politicians severely discount the ability of wealthy individuals to relocate to friendlier tax environments. For example, growing tax burdens have become a force for significant out-migration from the Northeast and California to places like Florida and Texas. According the 42nd Annual National Movers study by United Van Lines, last year 61.5% of New York residents left the state, while just 38.5% moved there. More importantly, of those who left, 41% earned $150,000 or more and only 8.4% earned less than $50,000. It is also worth noting that New York City, a traditional magnet for the young and talented, saw the biggest loss of millennials last year compared to other large cities, with more than 29,000 residents moving elsewhere.

Although no major municipality has experienced a sudden outflow of wealthy residents, a slow but steady outflow has a cumulative effect on budgets. This is showing up in places like New York, which from 2010 to 2017 suffered a net out-migration of over 1 million taxpayers, a level that was more than any other state, including California, which lost just under 1 million taxpayers over the same period. This apparent secular out-migration trend is particularly troubling because the top 1% of New York State earners pay 46% of all the income taxes collected by the state.

As states like New York, New Jersey, Connecticut, Illinois, California, and the major cities within them, become more dependent on an increasingly smaller number of high-income taxpayers to fund their growing fiscal deficits, the ongoing leakage of these outbound taxpayers can and will cause significant budget disruptions for the municipalities and their respective creditors.

We believe that these trends, if left unresolved through significant budget expense adjustments, will become increasingly difficult for creditors and credit ratings agencies to ignore. An eroding tax base is difficult for most municipal governments to curtail once trends such as those cited above get firmly underway. Adding to our concern about these trends is the recognition that the U.S. economy continues to enjoy a robust level of economic activity. Until now this has allowed many state and city governments to defer any meaningful spending adjustments, and they have preferred to raise income taxes to punitive levels in order to close short-run funding gaps. At some point, the current favorable environment will dissipate and disappoint. That is the day of reckoning that creditors should be concerned about in the months ahead.

As always, the determining factor for investors looking to make allocations to municipal bonds remains valuations. In the current environment, our view is that many of these tax burdensome issuers do not provide enough yield reward relative to municipal issuers from other regions or possibly taxable corporate bonds with similar credit profiles, unless you are a resident of the high tax rate state. Fortunately for our clients and investors in general, the municipal market provides numerous beneficial alternatives to enhance yield reward and maintain a stable credit profile while avoiding some of the potentially harmful secular demographic trends presented above.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.