Watch for These 6 ESG Trends in 2020

January 30, 2020 By Sage Advisory

by the Sage ESG Team

1. A greater adoption of ESG.

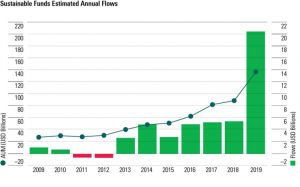

Growth in ESG funds continues to climb. According to Morningstar, net flows to sustainable funds in the U.S. were $20.6 billion in 2019, almost four times the amount of net flows from 2018 of $5.5 billion. There are now 300 ESG open-ended funds and ETFs, up 27% YOY from 236 funds in 2018.

Source: MorningStar Direct, Data as of 12/31/2019

2. Greater results.

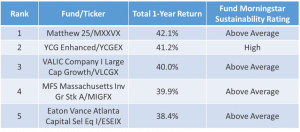

Gone are the days of sacrificing performance to invest in the causes and themes we care about. More people are investing in ESG portfolios because the performance of ESG strategies are competitive with conventional investment products and align to individuals’ values. We call it a double-bottom line. This month, Barron’s reported that in 2019 big-cap equity mutual funds that received a Morningstar sustainability rating of “above average” or “high” outperformed comparable funds with lower sustainability ratings.

Source: Barron’s Morningstar

We are seeing similar results. In 2019, Sage fixed income and equity ESG strategies also outperformed their respective market benchmarks.

3. An increase in products.

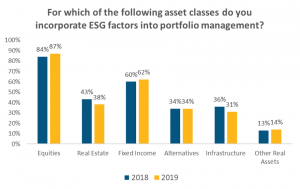

We are seeing new ESG products emerge across the asset allocation spectrum, from 401(k) plans to real estate and alternatives portfolios. Specialty funds on ESG themes have also risen in popularity, such as strategies with increased focus on diversity, with gender emphasis, and a breakout of climate change issues, including fossil-fuel-free funds.

Source: RBC Global Asset Management

At Sage, we expect an increase in the number and types of our product offerings in 2020. Last year, Sage ESG portfolios made their way into cash management and 401(k) plans, providing ESG investment opportunities to plans where there is growing demand but few ESG options.

4. Increased competition.

As more ESG products make their debut, we expect 2020 will be a year of separation in the quality of performance and ESG integration process. There will be heightened scrutiny from SEC, as ESG consideration is increasingly viewed as part of an investor’s fiduciary duty to clients, and institutional consultants will become clearer on their ESG investment requirements. It will be important for each asset manager and each ETF provider to have clear processes in place for how they choose ESG investments. Investors will want to know 1) What is the framework? 2) What is the source of the data? 3) How does it reflect the culture of the firm? 4) what is the client reporting process? 5) how has the strategy performed? Third-party validation from data providers, such as MSCI and Sustainalytics, will matter; the industry will need a referee to say what is truly ESG.

Sage ESG has portfolios that are audited by Sustainalytics semi-annually, because we believe it’s important to our clients to have third-party verification. We also conduct annual stewardship surveys to engage with ETF providers and determine which have practices and policies in place to select the best ESG companies to include in an ETF.

5. Internal ESG policies will matter.

When it comes to choosing an ESG investment manager, internal policies and the “ESG-ness” of the firm will be just as important as its ESG investment holdings. Increasingly, public companies and ESG investment managers are producing annual sustainability reports to measure how their product, services, and people adhere to ESG standards.

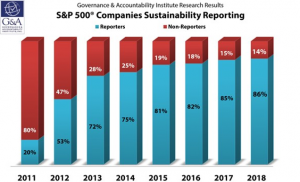

In 2018, 86% of the companies in the S&P500 Index published sustainability or corporate responsibility reports.

Source: Governance & Accountability Institute, Inc. 2018 Research – www.ga-institute.com

Additionally, it will be increasingly important for ESG investment managers to affiliate with and support ESG research and reporting organizations, such as MSCI, Sustainalytics, and the Sustainability Accounting Standards Board (SASB), and to seek and hold key certifications, such as the B Corporation designation.

Sage is a member or supporter of all the sustainable organizations that we believe are making the strongest advances in ESG research and reporting. These include Principles for Responsible Investing (PRI), Climate Action 100, The Forum for Sustainable and Responsible Investment (US SIF), Task Force on Climate-Related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and The Green Bond Principles. We also produce and update annually our Sage Responsible Investment Policy in order to provide investors with transparency about how we incorporate ESG factors into our investment process.

6. Clearer reporting.

An emphasis on clear, concise, and consistent reporting will be higher than ever. An increase in the number and types of products will cause confusion in two dimensions: 1) What third-party sources should I pay attention to, and 2) Who is (actually) doing ESG and how do they do it?

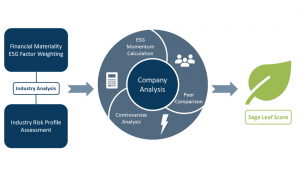

At Sage, we are pragmatic in our ESG investing. Our client reporting includes consistent communication about measurable outcomes. For us, financial materiality and the “G” in ESG will be the focus. Governance will be followed by an emphasis on social and environmental factors, because we believe change starts within the company. This year we will introduce more broadly our Sage ESG Leaf Score, enabling investors to quickly assess ESG performance across companies and industries.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.