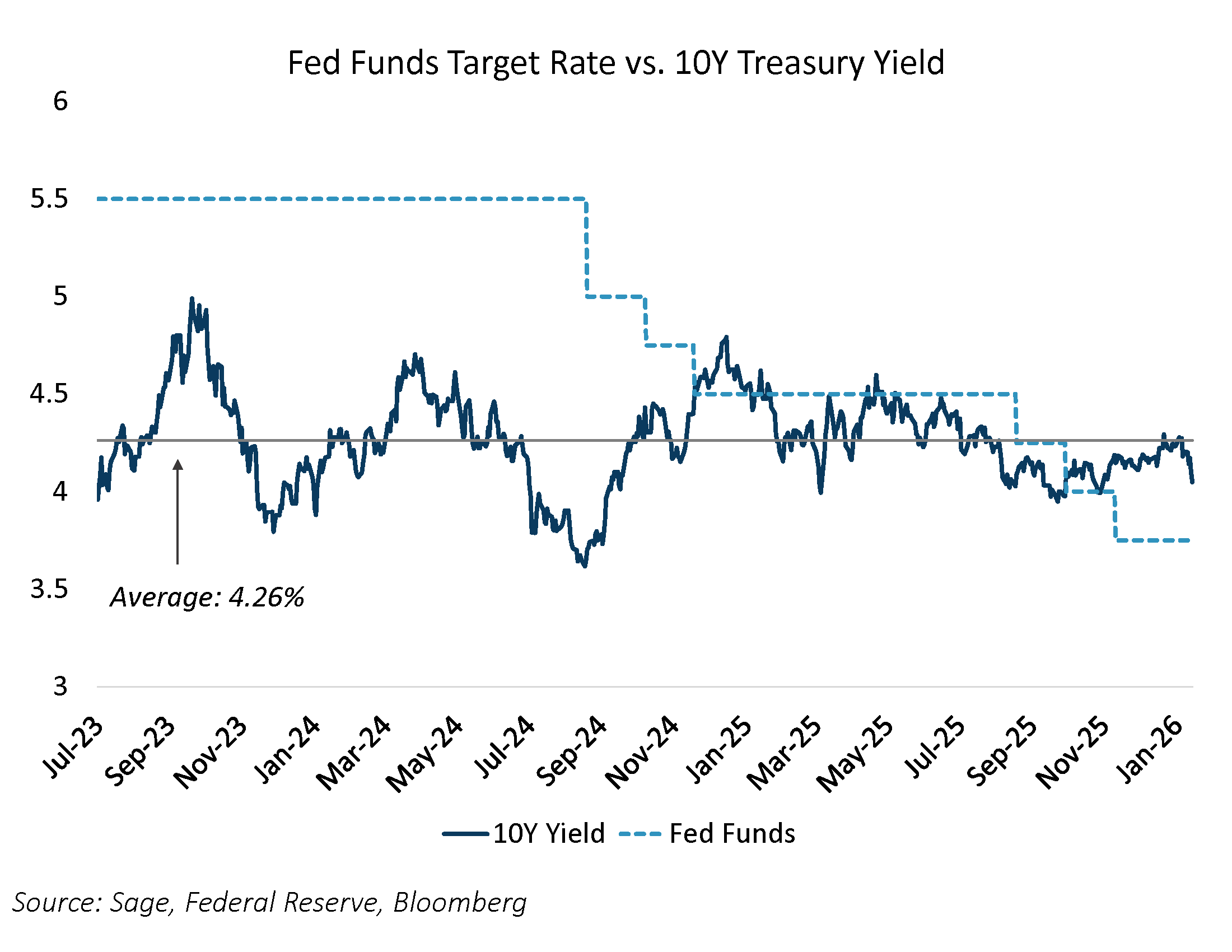

Despite all that has unfolded since the last rate‑hiking cycle ended in July 2023: renewed fiscal sustainability concerns, a US presidential election, rewiring of the global trading order, and geopolitical conflicts — long‑term interest rates have remained remarkably calm. Indeed, the 10Y Treasury yield has been largely rangebound, oscillating around an average level of roughly 4.26%.

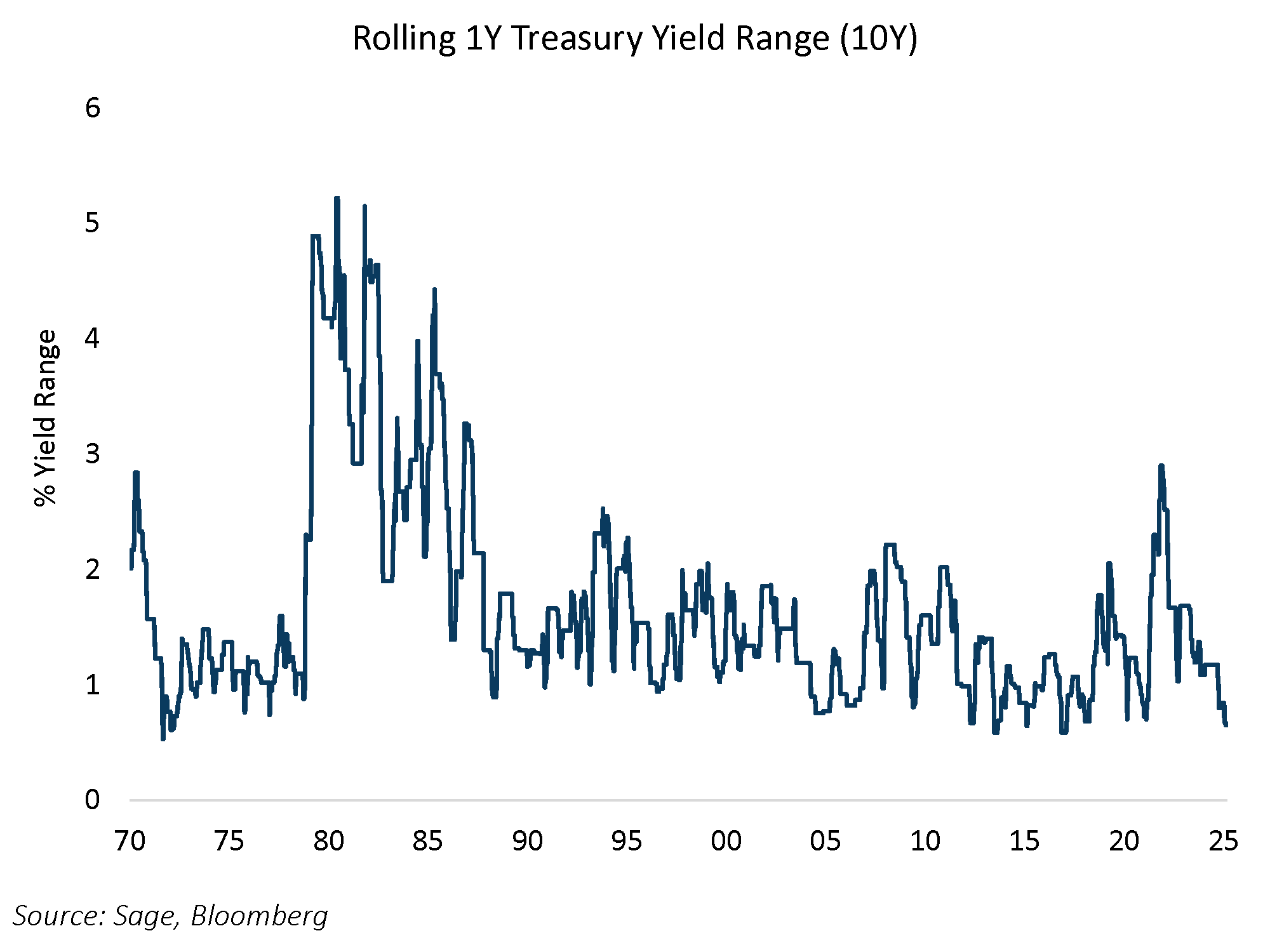

What makes this period especially notable is just how compressed that range has been. Over the past year (252 trading days), the 10‑year Treasury yield has traded within a 64.9 basis‑point range. This places the current environment in the 1st percentile of the tightest trading ranges going back to 1970. The bond market has almost never been this contained over a full year, even during periods of far less uncertainty.

Markets appear to have converged on a working assumption that concerns around fiscal sustainability and central bank credibility are not acute in the near term. The prevailing consensus is that the economy remains in expansion, with expectations centered on two additional rate cuts and limited perceived risk of either left or right tail outcomes. However, the market’s confidence around rate outcomes also raises the risk of an outsized surprise.

What could drive a breakout in yields? On the upside, the primary risks would stem from outsized Treasury supply, a loss of policy credibility, or persistently higher inflation. On the downside, potential catalysts include disappointment in AI related capital expenditures, a materially weaker labor market, or a lower neutral rate driven by higher productivity gains. While our base case remains a continued economic expansion supported by moderately accommodative fiscal and monetary policy, we see risks skewed toward yields ultimately moving lower from current levels. That said, caution remains warranted. In this environment, the risk reward for large duration positions is not yet compelling, though it bears close monitoring as conditions evolve.