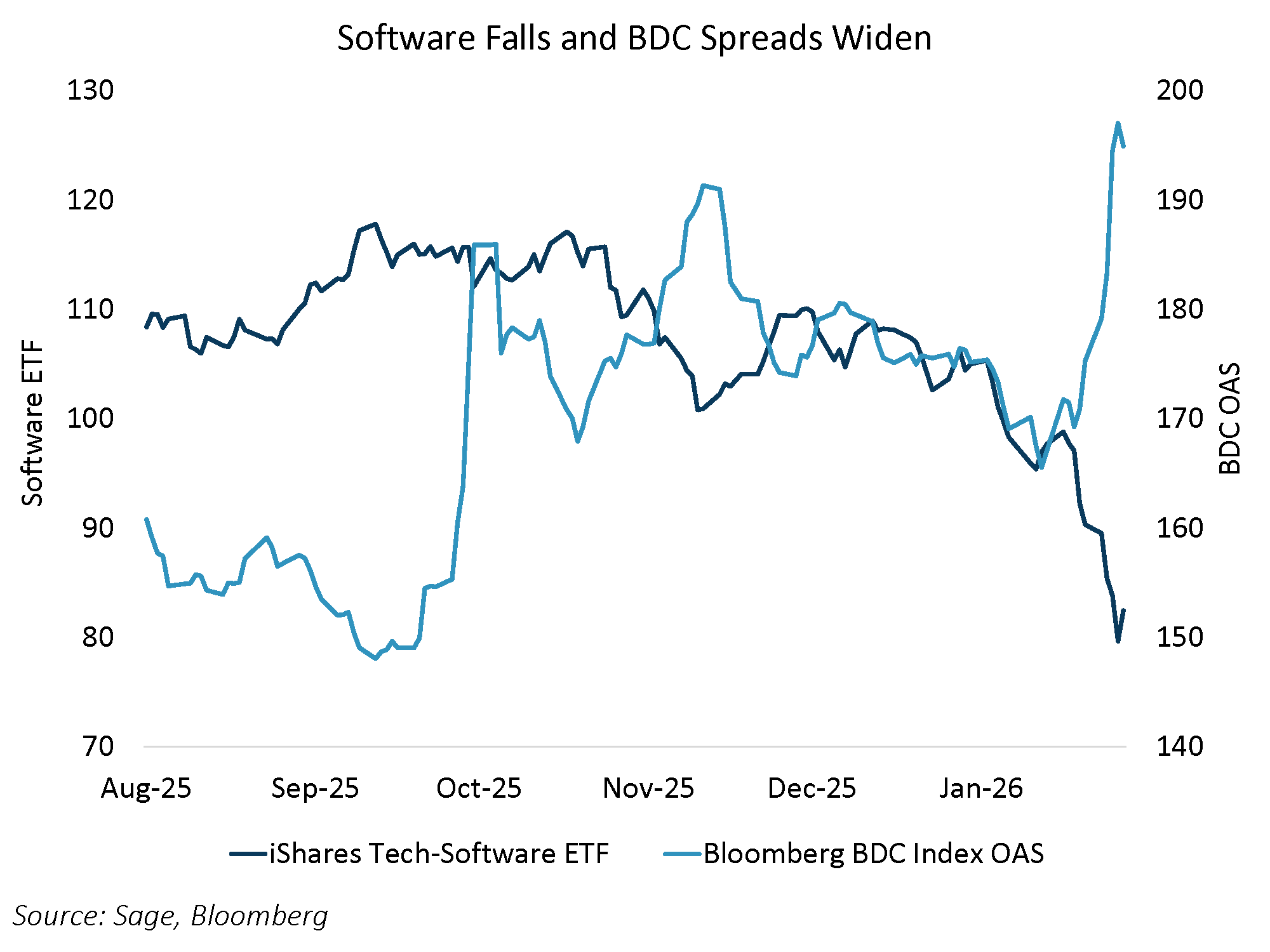

For years, software was the darling of the BDC world — stable, high-margin, and seemingly immune to economic gravity. But that “bulletproof” narrative is shifting fast. What started as a valuation correction in public equities is now tearing through the debt and loan markets, and the spillover into business development companies (BDCs) is no longer just noise. Widening spreads show that the capital structures of levered software companies are being tested by a new reality: the AI disruption.

The Stats: From Equity Bear Market to Credit Contagion

The carnage in software equities has been violent. IGV, a popular software ETF, has plunged roughly 20% year-to-date, officially entering a technical bear market. But while equity investors talk about multiples, credit investors are looking at solvency.

- BDC Spreads Widening: On February 4th alone, BDC spreads widened by 10–35 basis points. Compare that to the broader investment grade index, which remains stubbornly resilient near 73bps. BDCs are decoupling from the pack.

- The Technology Concentration: Public BDCs currently hold a massive 20% average combined allocation to tech and software. As AI threatens to commoditize legacy SaaS moats, the “infinite margins” that supported high leverage are evaporating.

- Headline Red Flags: These underscore how rapidly credit pressure is building in key BDC portfolios.

- BlackRock TCP Capital (TCPC) reported a staggering 19% sequential decline in net asset value (NAV).

- Blue Owl Tech (OTF) saw industry-high redemptions of 15.4% as investors rushed for the exit.

- Affordable Care (a significant holding across FS KKR Capital and other BDC portfolios) hired restructuring advisors, showing that idiosyncratic credit stress is mounting.

The Debt Dilemma: High Leverage, Low Recovery?

The real risk lies in the loan and bond markets. Unlike investment grade corporate bonds, BDC portfolio companies are typically levered in line with single-B borrowers. In the loan market, where software exposure is significantly higher than in high-yield bonds, the “bid” is disappearing. We’ve seen bond prices for “AI losers” in the credit space drop as much as 10 points in a single week. If a software company’s fundamental business model is disrupted by AI, the recovery outcomes in a bankruptcy scenario are likely to be dismal. A defunct software moat can’t be liquidated for much more than pennies on the dollar.

The Lingering Question for 2026

As BDCs prepare to mark their opaque private portfolios in upcoming earnings, we have to ask: Are these loan portfolios built on “mission-critical” software that will survive the AI transition, or are we looking at a generation of levered zombies whose business models have already been disrupted? Spread widening is the market’s way of saying it doesn’t know the answer yet.