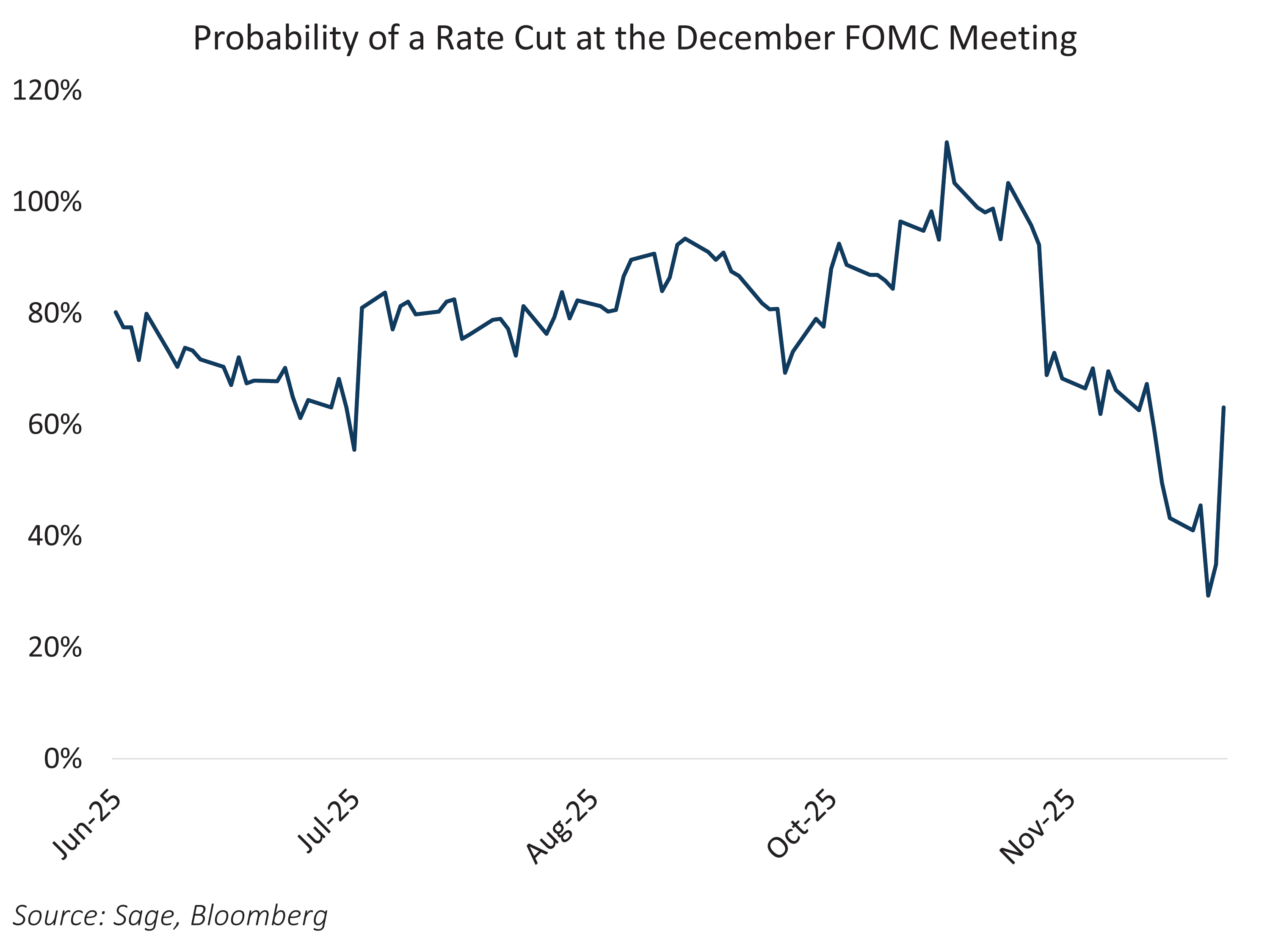

The reopening of the US government and the release of delayed economic data did little to calm markets. The long-awaited September jobs report finally arrived last week, showing job gains of 119,000, surpassing expectations but accompanied by downward revisions to previous months and a rise in the unemployment rate. This mixed picture reinforces the prevailing trend of a labor market that remains resilient but is losing momentum. Wage growth also softened, signaling incremental progress on inflation, yet the absence of October data leaves policymakers flying partially blind. Adding to the uncertainty, the latest FOMC minutes revealed a deeply divided committee: some members favor holding rates steady given sticky inflation, while others see room for a cut if labor softens further. With the Fed’s December meeting approaching, the lack of a complete labor and inflation picture has turned the next move into a coin toss, with futures markets pricing roughly even odds of a cut.

Renewed doubt on the pace of the “AI trade” in markets adds another layer of complexity. Last week, Nvidia delivered a blowout quarter, surprising to the upside with record data center revenue and strong forward guidance. Yet the stock sold off the next day — not because of earnings, but due to questions about the sustainability of hyperscaler AI spending and competitive pressure from Google’s Gemini 3.0 launch. Gemini’s reliance on Google’s own TPUs rather than Nvidia GPUs signals a potential shift in the economics of AI infrastructure, raising concerns for investors about the durability of current capex cycles and the refinancing burden tied to AI-driven debt issuance. With the recent deluge of bonds issued to fund AI infrastructure, the risk is not immediate default but the long tail of refinancing in a world where ROI timelines stretch years beyond traditional investment cycles. For credit markets, this introduces a structural question: how much of today’s leverage is predicated on assumptions that may not hold?

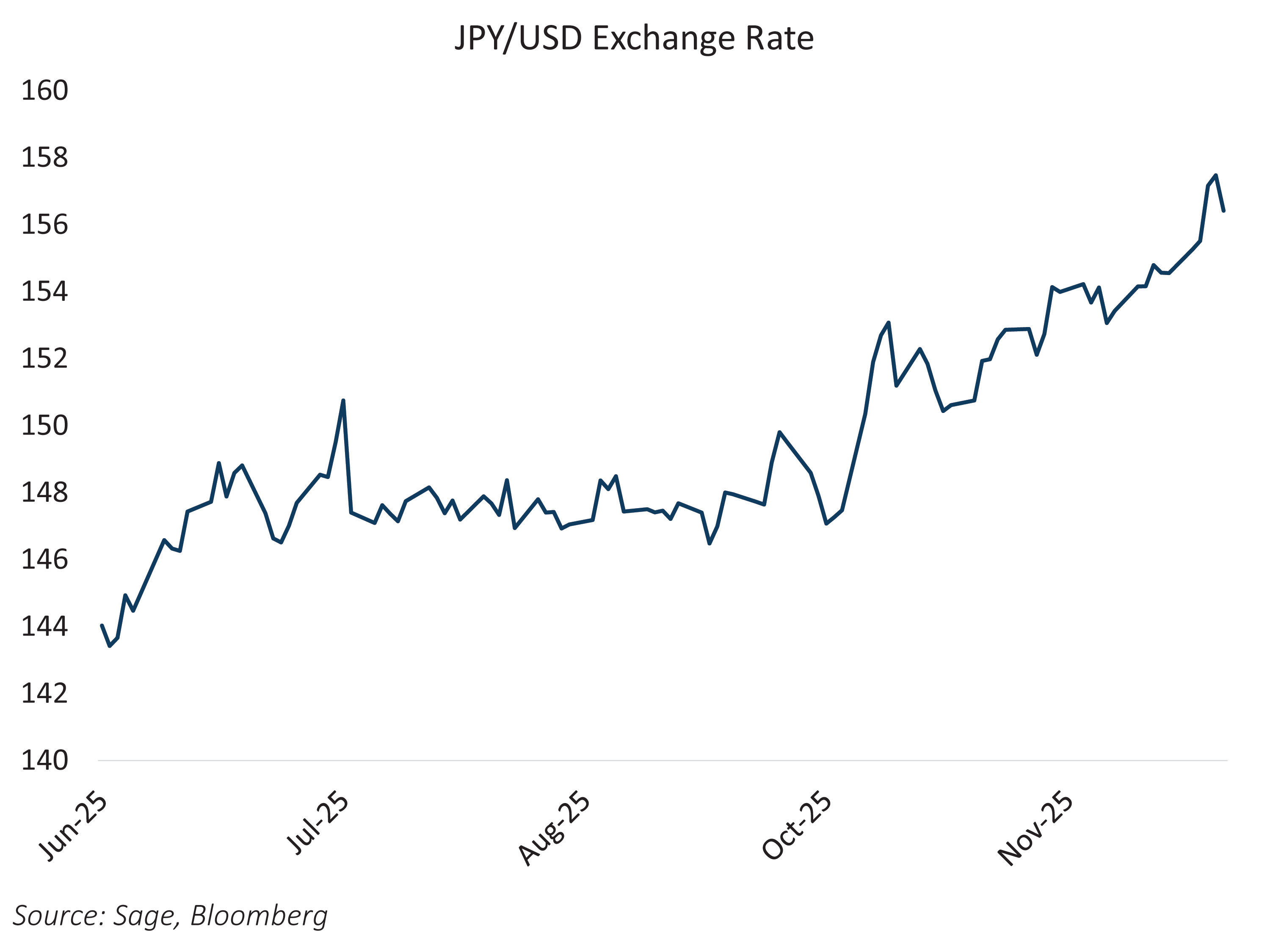

Global developments have compounded the uncertainty. Japan announced a sweeping fiscal stimulus package exceeding ¥21 trillion ($135 billion), combining near-term household relief with structural and defense spending. While this is supportive for immediate growth, the scale of borrowing pushed Japanese Government Bond (JGB) yields to multi-decade highs and weakened the yen, underscoring fiscal risks that could ripple through global rates markets. The BOJ’s challenge is acute: balancing stimulus-driven growth against bond market stability in an environment where global investors are increasingly sensitive to sovereign debt sustainability.

The coming months present a complex backdrop for markets. The Fed’s December meeting looms large, with uncertainty amplified by incomplete labor and inflation data. A rate cut could steepen curves and compress front-end yields, while a hold would keep pressure on duration as markets reassess the timing of easing. Meanwhile, questions around the sustainability of AI-driven capital expenditure introduce a structural layer of credit risk: the surge in debt issuance tied to long-horizon projects may reshape refinancing dynamics and widen spreads if growth assumptions falter. Globally, Japan’s aggressive fiscal stance and rising JGB yields highlight a broader theme — sovereign debt trajectories are becoming a key driver of global rate volatility. Together, these factors suggest that bond markets are entering a phase where policy divergence, refinancing risk, and liquidity stress could dominate pricing, making the next leg of the cycle less about incremental data and more about structural shifts in AI and fiscal regimes.