On Friday, President Trump announced his pick for FOMC chair after a closely watched series of interviews with candidates. In a prior piece, we identified Kevin Warsh as the most likely choice due to his experience serving on the FOMC and the market’s perception that he would provide the most credibility in terms of promoting independence. Given the views Warsh expressed leading up to his selection, we expect him to support additional modest rate cuts in the near term. However, his emphasis on controlling inflation and his preference for limited Fed intervention in markets suggest that a Warsh‑led FOMC may be more inclined to tighten financial conditions if inflation runs above trend.

Warsh’s career includes significant experience in both the private and public sectors. Most notably, he served as a Fed governor from 2006–2011, a pivotal period in which the Fed shifted from relying mainly on policy rate adjustments with a relatively small balance sheet to deploying large‑scale unconventional tools that expanded the balance sheet by orders of magnitude. Warsh’s monetary views are grounded in monetarist principles: he sees money supply as the primary driver of inflation, rather than rising wages or consumer demand. Consistent with that, he has criticized bond‑buying programs outside of periods of severe financial stress, even as he has recently supported near‑term rate cuts to help spur economic growth and a productive expansion. As a result, interest rate market pricing barely moved after the announcement and still reflects expectations for two additional 25‑basis‑point cuts this year, starting in June or July.

Given his experience with the FOMC and the nature of being a “known quantity” for markets, Warsh’s selection should dampen fears around Fed credibility and independence. He has consistently emphasized the importance of an independent central bank, and his reputation as a clear communicator should aid in building consensus and encouraging constructive debate within the FOMC. The next important step will be during the confirmation hearing, where Warsh will need to convince senators of both parties that he can operate an FOMC that is free from political influence.

As far as a full scale deconstruction and change in the Fed’s operating procedures? Highly unlikely in the short term. The Fed’s balance sheet and reserve balances will remain around current levels for a long time given the transformation of the economy, regulatory environment, and policy functioning since the Great Financial Crisis. Nonetheless, we expect Warsh to err toward the side of less Fed involvement in markets over his term, which on balance should result in potential opportunities due to higher interest rate volatility and a more patient Fed during equity drawdowns.

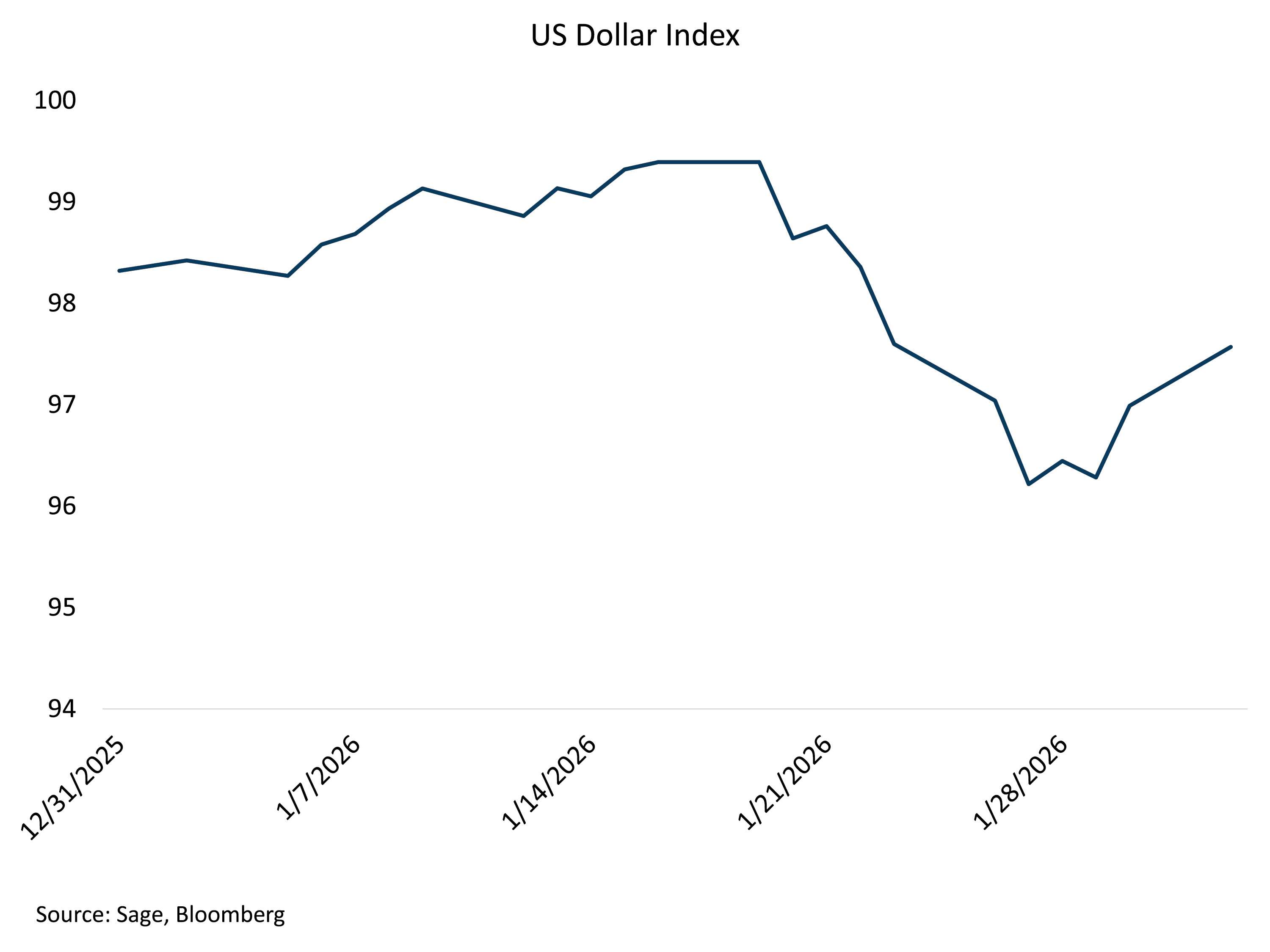

The markets have responded accordingly to the Warsh announcement, with bond yields lower in the front end and a sharply stronger dollar, which we believe is reflective of Warsh’s monetarist approach to addressing inflation as well as his belief in an independent Fed. The Senate confirmation hearing will serve as an important milestone for a leadership change at the Fed and shed light on what a Warsh Fed will look like in the near term.