Call the Engine Room, We Need More Power

AI and data centers are driving structural shifts, with forecasts showing data centers consuming more than 600 TWh by 2030, roughly 12% of total US electricity. As utilities ramp up capital expenditures to modernize grids and expand generation capacity, they will increasingly turn to the investment grade bond market for funding. Large scale projects such as new generation capacity, transmission upgrades, and grid digitalization require billions in upfront capital, which operating cash flow alone cannot cover. With interest rates stabilizing and credit spreads near historical tights, utilities will tap the bond market for capital. This dynamic suggests a steady pipeline of investment grade utility bonds over the next several years.

PJM Auctions Signal Surging US Energy Demand

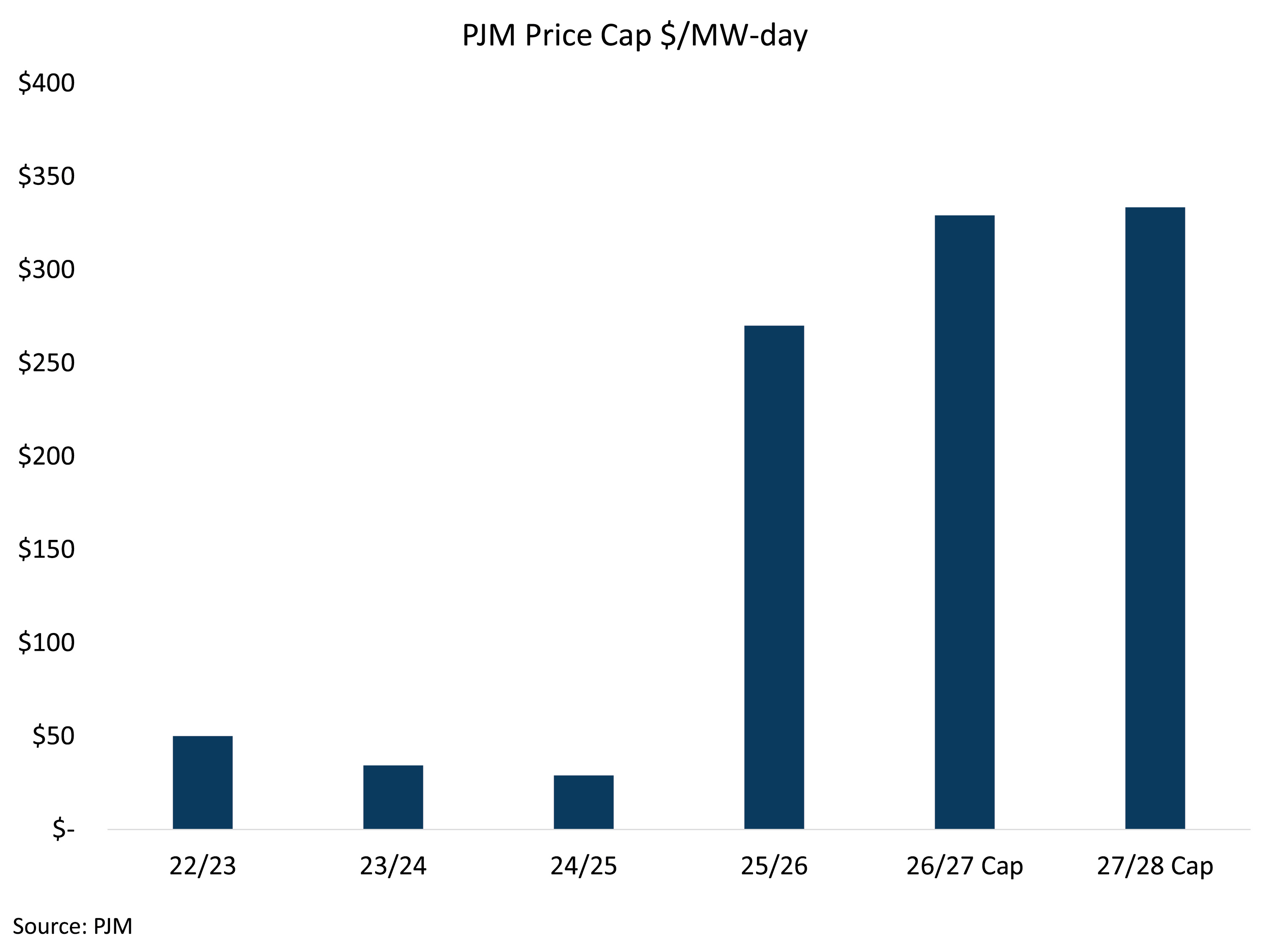

The PJM Interconnection, which oversees the largest competitive wholesale electricity market in the United States, has become a bellwether for the nation’s energy reliability and pricing trends. Its annual Base Residual Auction (BRA) is designed to secure enough generation capacity to meet peak demand three years in advance. Recent auctions have revealed a striking trend: clearing prices have consistently hit the Federal Energy Regulatory Commission (FERC) approved cap, underscoring the intensity of demand growth and the tightening supply landscape.

Energy demand within PJM’s footprint, spanning 13 states and Washington, D.C., is being driven by structural shifts in the economy. The proliferation of data centers, artificial intelligence workloads, and electrification initiatives has sharply increased peak load forecasts. These factors, combined with retirements of older thermal plants and slower-than-expected renewable integration, have created a supply/demand imbalance. As a result, capacity prices have surged from historical norms of under $100/MW-day to capped levels exceeding $329/MW-day for the 2026/27 and 2027/28 delivery years.

The fact that auctions are clearing energy cost at their maximum allowable price is not merely a pricing anomaly, it is a clear signal of scarcity and strong forward demand for reliable energy. Without the cap, analysts estimate prices could have exceeded $500/MW-day, reflecting the urgency for new investment in generation and grid infrastructure. These elevated prices provide a powerful incentive for developers to bring new resources online, but they also highlight the challenges of meeting reliability standards.

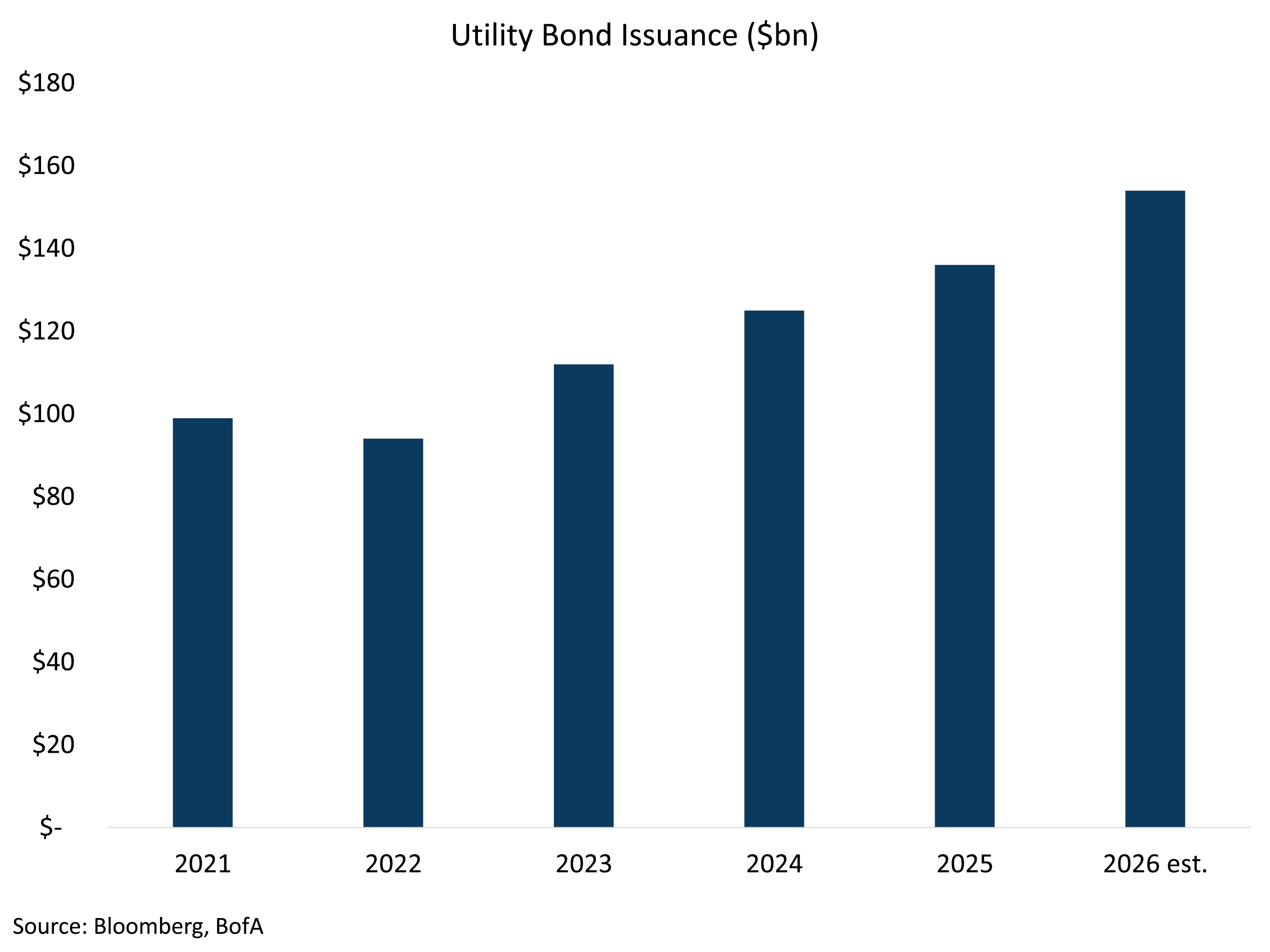

Debt Markets Provide the Capital

PJM’s capped auctions highlight mounting pressure on the US energy system and the challenge of balancing surging power demand and reliability with affordability. This backdrop is driving major capital expenditure across US investment grade utilities, with utility capex closing 2025 near $215 billion, up 24% from 2024. With capex expected to grow again in 2026, analysts are anticipating debt issuance in the Utility sector to grow north of $150 billion this year. The coming wave of economic and technological growth hinges not only on utility planning but also on the confidence and liquidity of capital markets to underwrite billions in upfront investment.