2025 marked a standout year for “High Quality High Yield,” defined by a sharp divide between the market’s haves and have-nots. Investors who prioritized higher-quality credits were rewarded handsomely, while those venturing into the riskiest segments lagged. This trend persisted despite default rates running 110 basis points below the post-GFC average and generally favorable credit fundamentals, with Single-B and CCC leverage metrics improving year-over-year through 3Q25. Against a backdrop of geopolitical uncertainty and macro headwinds such as tariffs, investors priced greater credit risk into the most levered companies, reinforcing the premium on quality.

2025 Performance Tells the Story

- BB-rated bonds led the charge with total returns of 8.92%, outpacing their lower-rated peers.

- Single-B bonds delivered 8.32%, respectable but notably behind BBs.

- CCC-rated bonds, the traditional high-octane segment, managed only 8.08%, marking a year where risk did not pay as handsomely as before. (This was only 12bps better than all of IG returns at 7.96%!)

Why Did Quality Win?

Two forces shaped this outcome:

- Solid Carry from Higher-Quality Issuers

BB-rated companies offered attractive yields without the tail risk of distressed credits. In a year marked by macro uncertainty and selective growth, investors favored stability. - Risk-Adjusted Returns Trumped Raw Yield

While CCCs dangled higher nominal yields, volatility and idiosyncratic risk eroded their appeal. The market rewarded prudence, not bravado.

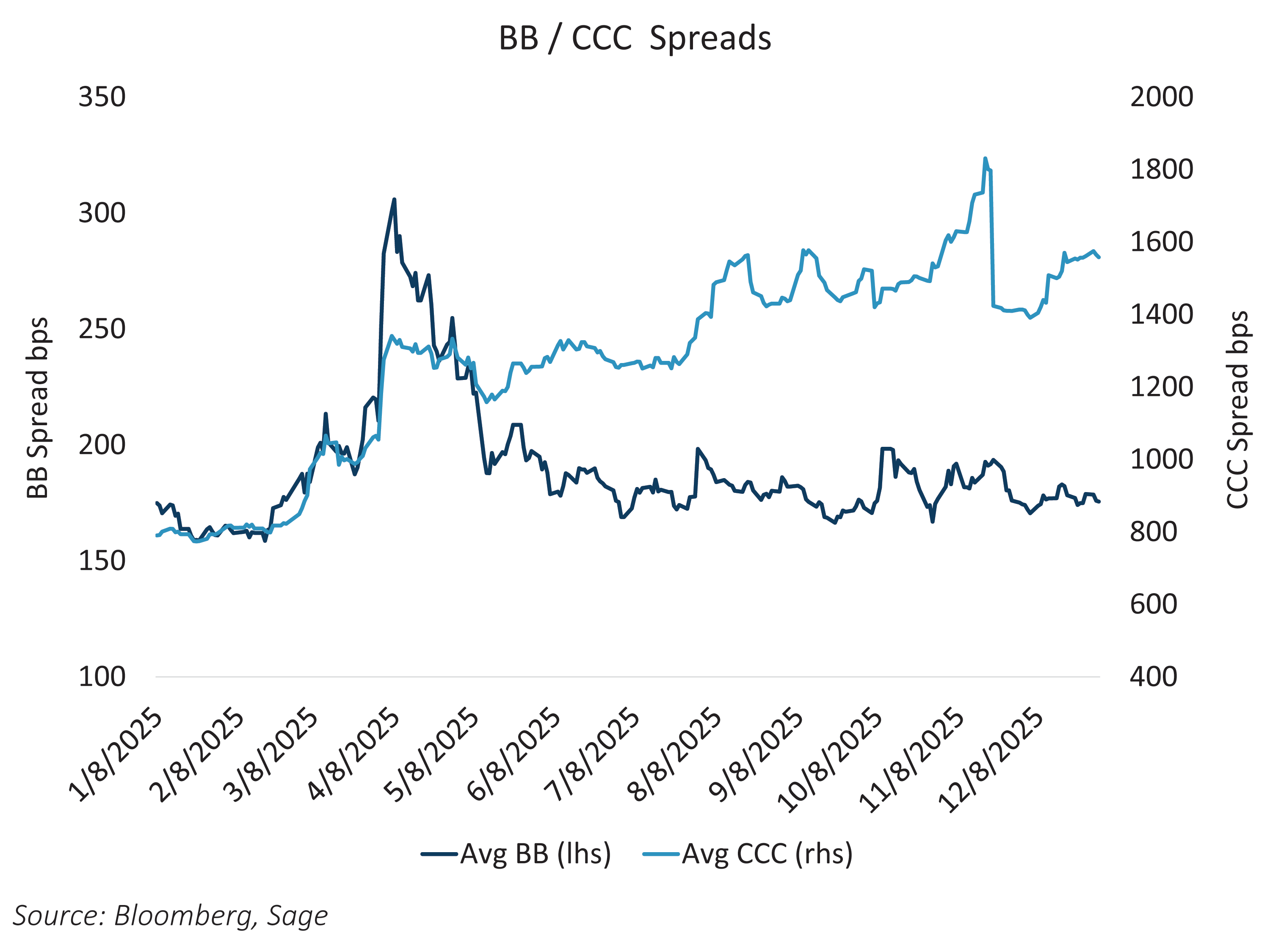

From Tariffs to Cockroaches: CCC’s Rough Ride in 2025

In 2025, BB-rated high-yield bonds significantly outperformed CCC-rated credits, highlighting a stark quality divide. Both segments were hit during the spring tariff tantrum, as trade tensions drove spreads wider and risk assets lower. However, BB bonds rebounded quickly as investors sought stability in higher-quality issuers, supported by solid fundamentals and low default rates. CCC-rated bonds, by contrast, never regained momentum. Their weakness deepened in the second half of the year as credit risk fears spilled over from private credit markets following the “cockroach” defaults in Q3. These failures amplified concerns about highly levered companies, leaving CCC issuers under pressure through year-end. The result: a year where quality dominated, and the riskiest credits bore the brunt of persistent volatility.

The Big Picture

2025 was a year of earning steady, risk-adjusted returns rather than chasing the highest coupon. The “haves” (BBs and upper-tier Bs) delivered consistency, while the “have-nots” (lower-tier Bs and CCCs) struggled under the weight of decompression and selective risk appetite.

As we turn the page to 2026, the lesson is clear: quality matters, especially in high yield. In a market where spreads tell a story and carry drives performance, the winners were those who embraced discipline over daring.